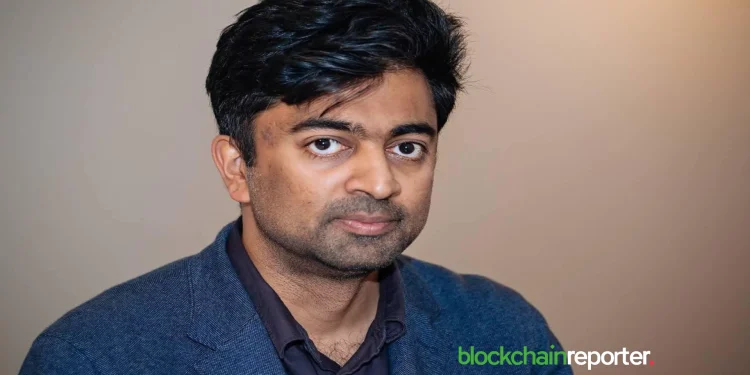

Q1. Could you briefly introduce yourself and the vision behind Panther Protocol?

I’m Dr. Anish Mohammed, Co-Founder of Panther Protocol, with over two decades of experience as a cryptographer and security advocate. Panther was founded to address a critical gap in decentralized finance (DeFi): confidentiality. Our vision is to create a financial ecosystem where users can confidently engage in DeFi while maintaining their data privacy and adhering to global compliance standards. Panther will bridge the gap between confidentiality and traceability by leveraging advanced technologies like Zero-Knowledge proofs (ZKPs), empowering institutions and individuals to unlock DeFi’s full potential.

Q2. What inspired you to focus on privacy-preserving technologies within the decentralized finance (DeFi) space?

The ethos of blockchain is rooted in decentralization and autonomy, yet the public nature of most blockchains compromises privacy. This leaves users vulnerable to risks such as front-running, strategy theft, and data exploitation. Over a decade ago, I co-authored The NewSecret, which explored the interplay between transparency and privacy—concepts that are more relevant now than ever. Those ideas have shaped my work at Panther, where we aim to solve the challenges we foresaw: preserving confidentiality in financial systems while maintaining traceability and regulatory compliance.

Q3. As AI becomes more integrated into financial systems, what do you see as the most pressing privacy risks for individuals and institutions?

AI’s integration into financial systems offers transformative benefits but raises significant privacy concerns. In crypto and DeFi, AI’s ability to analyze blockchain data at scale can expose user behaviors, leading to strategy theft, front-running, and reputational risks.

Institutions face threats like data breaches and compliance failures.

The most critical issue is AI linking pseudonymous blockchain transactions to real identities, enabling fraud and undermining trust in DeFi. Privacy-preserving technologies like Zero-Knowledge proofs are essential to mitigate these risks, ensuring secure transactions while meeting regulatory requirements. Having both confidentiality and compliance is key to fostering trust and innovation in AI-driven finance.

Q4. How does AI’s access to sensitive financial data challenge traditional notions of privacy and security?

Traditional security models are designed for limited, static datasets. However, AI thrives on analyzing vast and varied data sources to identify patterns, which increases the risk of inadvertently exposing sensitive financial information. For instance, when combined with other public records, blockchain transaction data can reveal private user identities and financial behaviors. This can have unintended consequences both in public and private spheres—what is deemed private and very personal could easily be inferred by AI, given its ability to synthesize insights from different sources.

Privacy-enhancing technologies (PETs) such as Zero-Knowledge proofs offer robust solutions to address this. PETs enable systems to validate and process transactions without revealing sensitive underlying details, ensuring that AI-driven insights are privacy-preserving. If those PETs are capable of maintaining confidentiality while adhering to regulatory requirements, they can uphold trust and compliance in financial ecosystems.

Q5. What are some real-world examples of privacy breaches or risks stemming from AI’s involvement in financial systems?

AI offers immense potential for innovation but can also amplify risks when misused, particularly by making data breaches more impactful. In the Flagstar Bank breach of 2022, which exposed sensitive financial data of 1.5 million customers, AI could analyze the stolen information to predict behaviors and create highly targeted phishing campaigns. Similarly, in the Block (formerly Square) breach of 2021, where data from over 8 million users was leaked, AI could be used to cross-reference the stolen records with public data to develop detailed victim profiles, enabling precise fraud. These examples illustrate how AI not only intensifies the damage of breaches but also introduces new avenues for exploitation, underscoring the urgent need for privacy-preserving technologies like Panther to secure sensitive financial data and limit its misuse.

Q6. Could you explain in simple terms how Zero-Knowledge proofs (ZKPs) work and their relevance to financial privacy?

Zero-Knowledge proofs enable one party to prove they possess certain information without disclosing the information itself. For example, you can prove you have sufficient funds for a transaction without revealing your account balance. This ensures that sensitive data remains confidential, even during verification processes.

In DeFi, ZKPs play a critical role by ensuring that transactions remain private, while also proving facts that are important to regulatory requirements, like transaction details. This dual capability is vital in protecting users from data exposure, manipulation, and risks like front-running.

What makes Panther unique is how we leverage ZKPs to create privacy-enhancing tools, such as zAssets—fully collateralized, shielded tokens that provide confidentiality within Panther’s Shielded Pool without sacrificing usability within DeFi ecosystems. These innovations not only address existing privacy challenges but also pave the way for broader institutional adoption of DeFi, where privacy and compliance are equally essential.

Q7. How can ZKPs enable AI to analyze financial data without exposing sensitive details? Could you share specific use cases or implementations?

AI can be made to rely on ZKPs to indicate whether a certain criterion or set of criteria are met as part of its analysis, minimizing the number of people and systems who have access to that information and thereby reducing the exposure of sensitive data.

For more complex analyses, for example, those involving patterns or trends, ZKPs can be combined with privacy-preserving technologies like homomorphic encryption, which allows direct computation on encrypted datasets. This synergy ensures AI remains functional and privacy-preserving, enabling financial institutions to safely integrate AI into sensitive tasks like fraud detection, transaction monitoring, and credit scoring, driving innovation in DeFi.

Q8. What are the limitations or challenges in implementing ZKP solutions in financial systems influenced by AI?

Implementing ZKPs in AI-influenced financial systems presents several challenges.

Computational complexity remains a key concern, as ZKPs can be resource-intensive, making real-time AI applications difficult to execute efficiently. Scalability is another issue; ZKP frameworks must handle growing data volumes without compromising performance. Additionally, interoperability is a challenge, as adapting ZKPs to function seamlessly across diverse AI models and financial platforms requires standardized protocols.

At Panther, we will address these challenges by leveraging zkSNARKs, an advanced ZKP technology optimized for efficiency and scalability. More importantly, we focus on mitigating risks posed by AI-driven organizations, such as Nansen and Chainalysis, that map and analyze wallet activity on public blockchains. Without privacy-preserving solutions, Web3 risks becoming a surveillance economy where financial behaviors are exposed to scrutiny. By enabling private, compliant interactions in DeFi, Panther will help protect user data while ensuring transparency where needed, supporting a more equitable and privacy-centric decentralized ecosystem.

Q9. How does Panther Protocol leverage ZKP and other privacy technologies to safeguard financial data?

Panther will safeguard financial data using advanced privacy technologies.

Zero-Knowledge proofs (ZKPs) will be used to create privacy-enhanced assets (zAssets) that enable secure DeFi interactions within Panther’s Shielded Pool without exposing sensitive information. Complementing this, Panther will employ differential privacy, homomorphic encryption, and Secure Multi-Party Computation (SMPC) to protect data during analysis and computation. Selective disclosure mechanisms will further allow users and market operators to share only the specific information required, ensuring robust privacy and trust.

Q10. Could you provide insights into Panther Protocol’s approach to balancing transparency and privacy in DeFi?

Panther’s approach to balancing transparency and privacy in DeFi is built on selective disclosure, allowing users to demonstrate compliance (e.g., AML/KYC) without revealing unnecessary details, such as their full transaction history. Within Panther’s Shielded Pool will be logical partitions called Zones. Zones are dedicated, logically partitioned environments within Panther’s Shielded Pool, empowering users to engage with decentralized applications, allowlisted assets, and verified counterparties under compliance frameworks configured by Zone Managers. Zone Managers will also configure their Zones to automatically disclose specific information based on preset rules, ensuring alignment with regulatory requirements. Additionally, Panther will be capable of issuing Zero-Knowledge reveals, enabling granular proof of compliance or other conditions while safeguarding user confidentiality by enabling privacy-respecting compliance.

Q11. What are some specific applications or partnerships where Panther Protocol is addressing AI-related privacy concerns?

While Panther is not explicitly focused on AI-related privacy concerns, its privacy-preserving design ensures transaction details remain confidential and shielded from public view. What sets Panther apart is its commitment to empowering users and market operators with control over their data. Panther will put them in the driver’s seat, allowing them to decide when, how, and with whom they disclose their information. This contrasts starkly with systems where data can be accessed or used without consent, including by AI agents like LLMs. Panther will mitigate risks of unauthorized exploitation, fostering a more user-centric and privacy-focused DeFi ecosystem.

Q12. Why is protecting financial privacy crucial as AI reshapes the financial landscape?

Financial privacy is a cornerstone of autonomy and security. As AI becomes increasingly integrated into financial systems, it gains access to larger datasets through the growing adoption of blockchain technology and crypto, where transaction data is often publicly accessible. Additionally, AI can aggregate this data with other publicly available or leaked information, creating detailed profiles of users. Protecting privacy ensures individuals retain control over their financial data, fosters trust in digital ecosystems, and mitigates risks like fraud, exploitation, and discrimination.

Q13. How do you foresee the regulatory landscape evolving to address AI and financial privacy issues?

Regulators worldwide are increasingly focusing on AI ethics and data privacy. Initiatives such as the UK’s pro-innovation AI regulation framework and similar efforts in other countries exemplify this trend. These frameworks aim to balance innovation with safety through principles like accountability, transparency, and fairness. Investments in regulatory capacity building, such as the establishment of AI-focused institutes, highlight the global push to address AI risks while fostering innovation. These models are likely to inspire coordinated international efforts to manage AI’s impact on financial privacy and other sectors .

Q14. What advice would you give to institutions and individuals to better protect their financial privacy in the age of AI?

To better protect financial privacy in the age of AI, institutions should adopt a multi-faceted approach. Investing in privacy-preserving technologies is essential, but so is implementing robust internal data policies. These policies should prioritize secure storage, limit access to sensitive information, and establish clear protocols to protect client data from misuse. Strong cybersecurity measures like encryption and regular audits can further safeguard against breaches. For individuals, selecting platforms with rigorous privacy standards and being mindful of the data they share is key. Additionally, educating employees, customers, and other key stakeholders on how AI interacts with financial systems will help empower institutions and individuals to mitigate risks effectively.

Q15. Where do you see the intersection of privacy, DeFi, and AI heading in the next 5–10 years?

The future will likely bring closer integration of privacy, DeFi, and AI, with privacy-preserving technologies playing an increasingly important role in financial systems. DeFi will increasingly integrate advanced AI tools to enhance efficiency, such as personalized financial planning, fraud detection, and automated portfolio management. At the same time, technologies like Zero-Knowledge proofs ensure sensitive user data remains protected. As quantum computing becomes more practical, its potential to impact encryption and data security will likely drive new innovations in privacy technologies. This evolution could drive mainstream adoption of decentralized technologies, offering individuals greater control over their finances, reducing reliance on intermediaries, and fostering inclusivity in global markets. Panther envisions being at the forefront of this transformation, enabling a financial ecosystem that is both innovative and secure.

Dr. Anish Mohammed’s Bio:

Dr. Anish Mohammed is a co-founder of Panther Protocol. With a robust background spanning over 20 years in security and cryptography, Anish has made significant contributions to the design and audit of various blockchain protocols.

He also co-founded the United Kingdom Digital Currency Association and played a crucial role as a reviewer for the Ethereum network’s foundational documents.

In addition to his technical roles, Anish holds positions on several advisory boards, including those for Ripple Labs and Hyperloop Transportation Technologies, showcasing his broad influence across multiple technology sectors.

Anish is a sought-after speaker on topics such as blockchain technology, cryptocurrency, fintech, cybersecurity, and artificial intelligence. He has delivered lectures at leading educational institutions worldwide, including the Massachusetts Institute of Technology (MIT), Carnegie Mellon University, University College London, Imperial College London, and Coventry University. His contributions help shape the future of these rapidly evolving industries.