The bulls are in control of today’s session, as seen from the increase in the global market cap. The total cap stood at $2.28T as of press time, representing a 0.44% increase over the last 24 hours, while the trading volume dropped by 56.15% over the same period to stand at $45.07B as of press time.

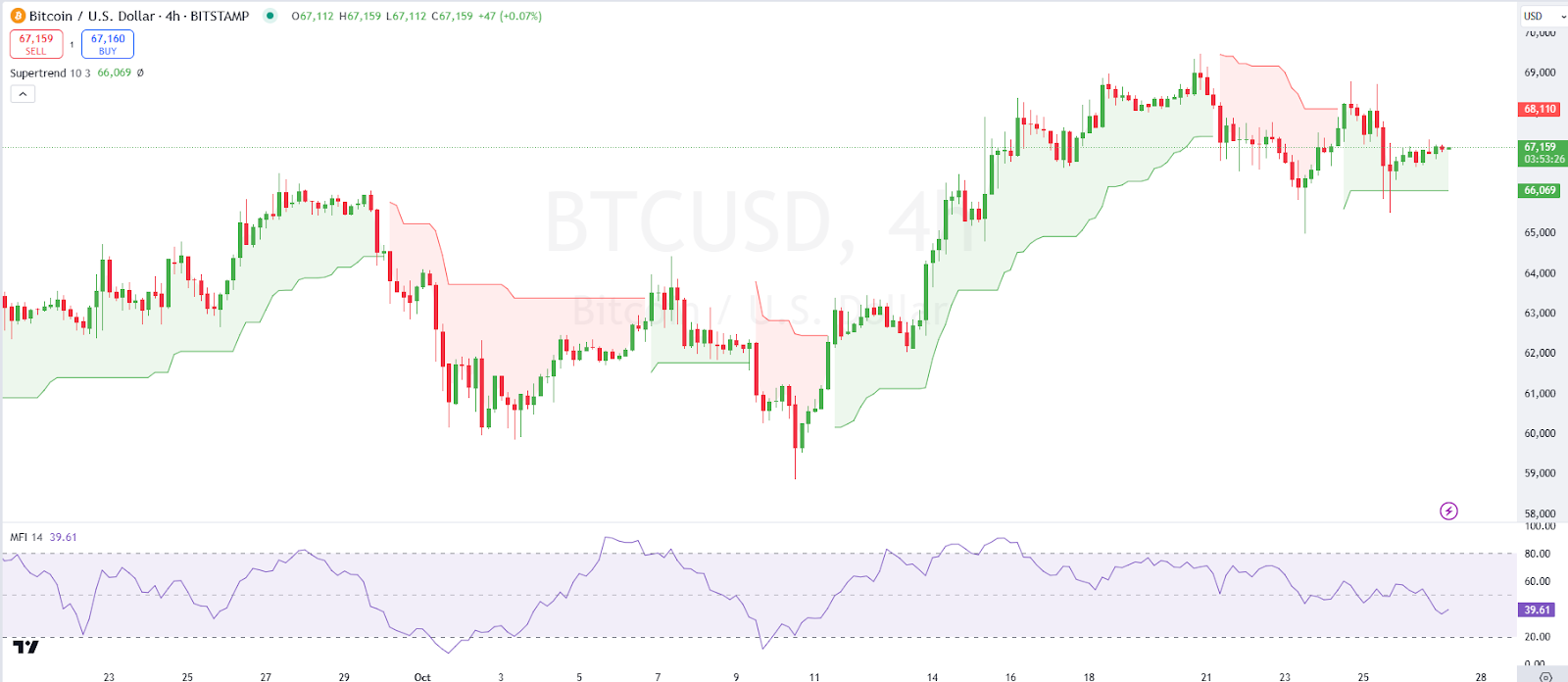

Bitcoin Price Review

Bitcoin, $BTC, has posted minor gains in today’s session, as seen from its price movements. Looking at an in-depth analysis, we see that the chart displays Bitcoin moving within the bounds of the Supertrend indicator, highlighting shifts between bullish and bearish zones. The price is currently testing the support zone around 66,069 while maintaining a slight upward trend. If this support holds, BTC may push higher. However, a break below could indicate further downside.

On the other hand, the MFI is around 39.61, indicating that BTC is not yet in the oversold or overbought zones, providing room for potential movement in either direction. Traders may watch for a reversal in the MFI to anticipate a shift in trend direction. Bitcoin traded at $67,154 as of press time, representing a 0.23% increase over the last 24 hours.

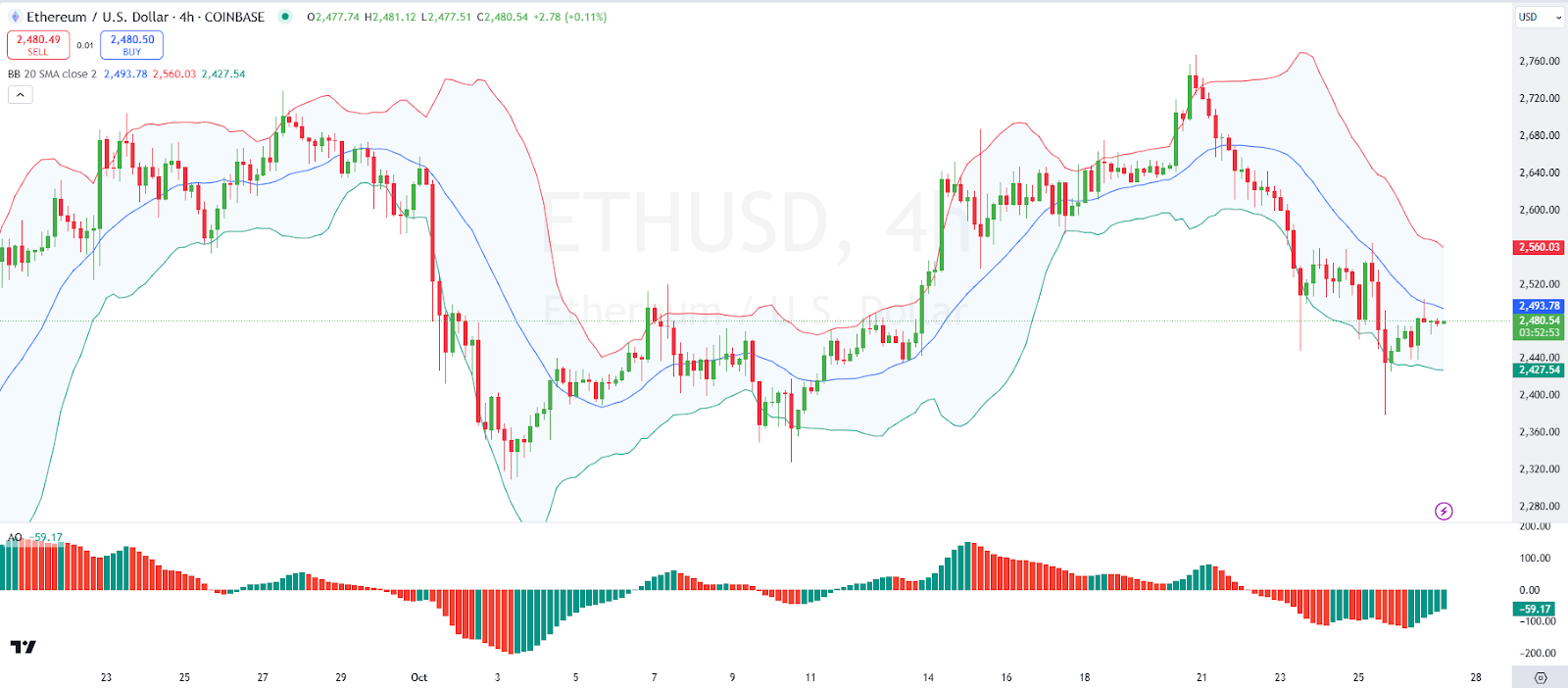

Ethereum Price Review

Ethereum, $ETH, is also among the gainers today as also seen from its price movements. Looking at an in-depth analysis, we see that the chart displays Ethereum trading near the midline of the Bollinger Bands, suggesting a neutral stance. The price has been reacting to the upper and lower bands, indicating volatility. A breakout above the upper band may signal bullish momentum, while a drop below the lower band would suggest bearish pressure.

On the flip side, we see that the Awesome Oscillator shows decreasing momentum with histogram bars nearing the zero line. A shift to green could signal bullish divergence and a potential buy signal. Ethereum traded at $2,478 as of press time, representing a 0.5% increase over the last 24 hours.

Aerodrome Price Review

Aerodrome, $AERO, is among the top gainers in today’s session as seen from its price movements. Looking at an in-depth analysis, we see that the Aerodrome price has recently bounced off the 200-period SMA, indicating it as a strong support level. A cross above the 100-period SMA (yellow) could provide bullish confirmation. The 50-period SMA remains above the current price, acting as immediate resistance.

On the other hand, we see that the RSI is at 60.84, suggesting a bullish momentum but still within neutral territory. An RSI reading above 70 would indicate overbought conditions, while a drop below 50 could indicate weakness. Aerodrome traded at $1.19 as of press time, representing a 12.19% increase over the last 24 hours.

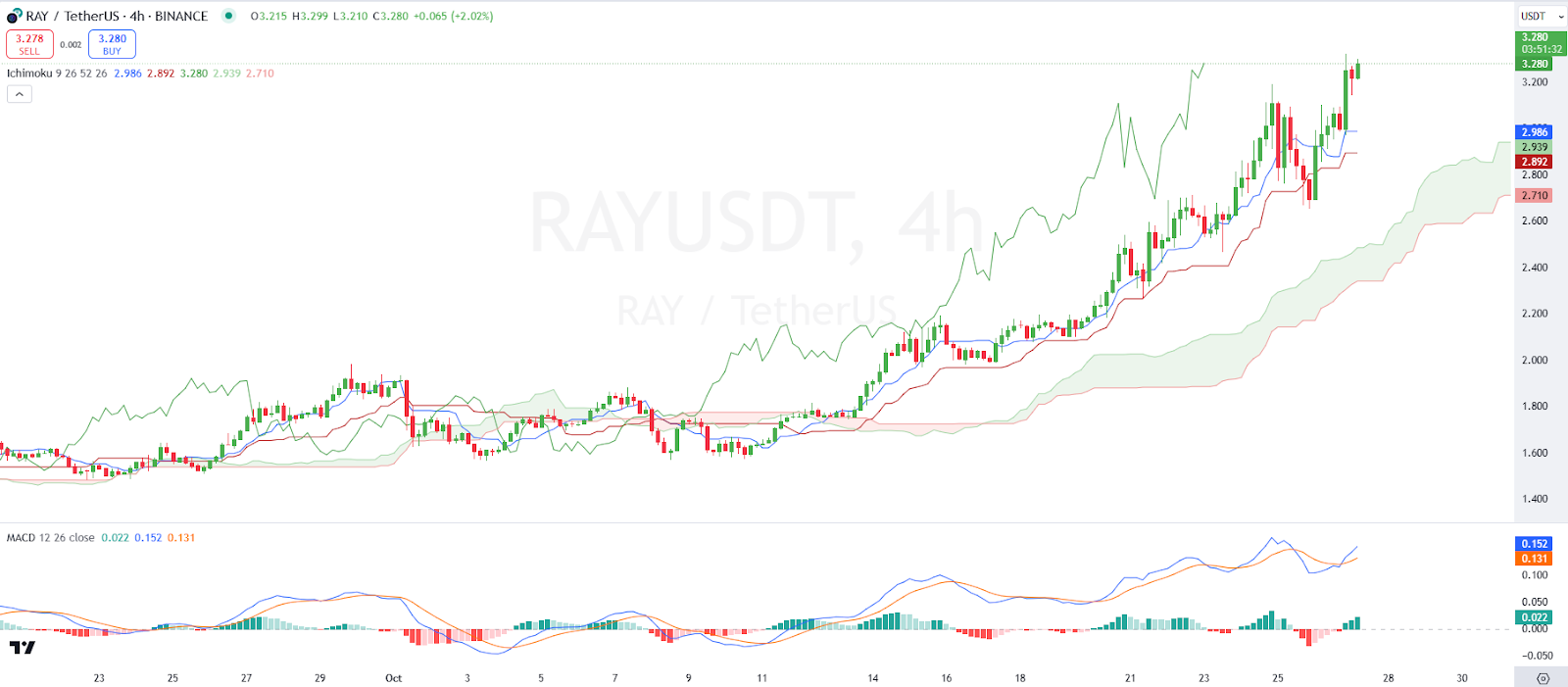

Raydium Price Review

Raydium, $RAY, is also among the top gainers today as also seen from its price movements. Looking at an in-depth analysis, we see that Raydium’s price is currently above the Ichimoku Cloud, indicating a bullish trend. The price being above the cloud suggests potential support levels around the upper cloud boundary. Traders should watch if the price can maintain this position above the cloud to confirm the continuation of the bullish trend.

Looking at other indicators, we see that the MACD shows positive momentum with the MACD line crossing above the signal line, suggesting a bullish crossover. If the histogram bars continue growing, it could confirm a buying opportunity. Raydium traded at $3.27 as of press time, representing a 12.49% increase over the last 24 hours.

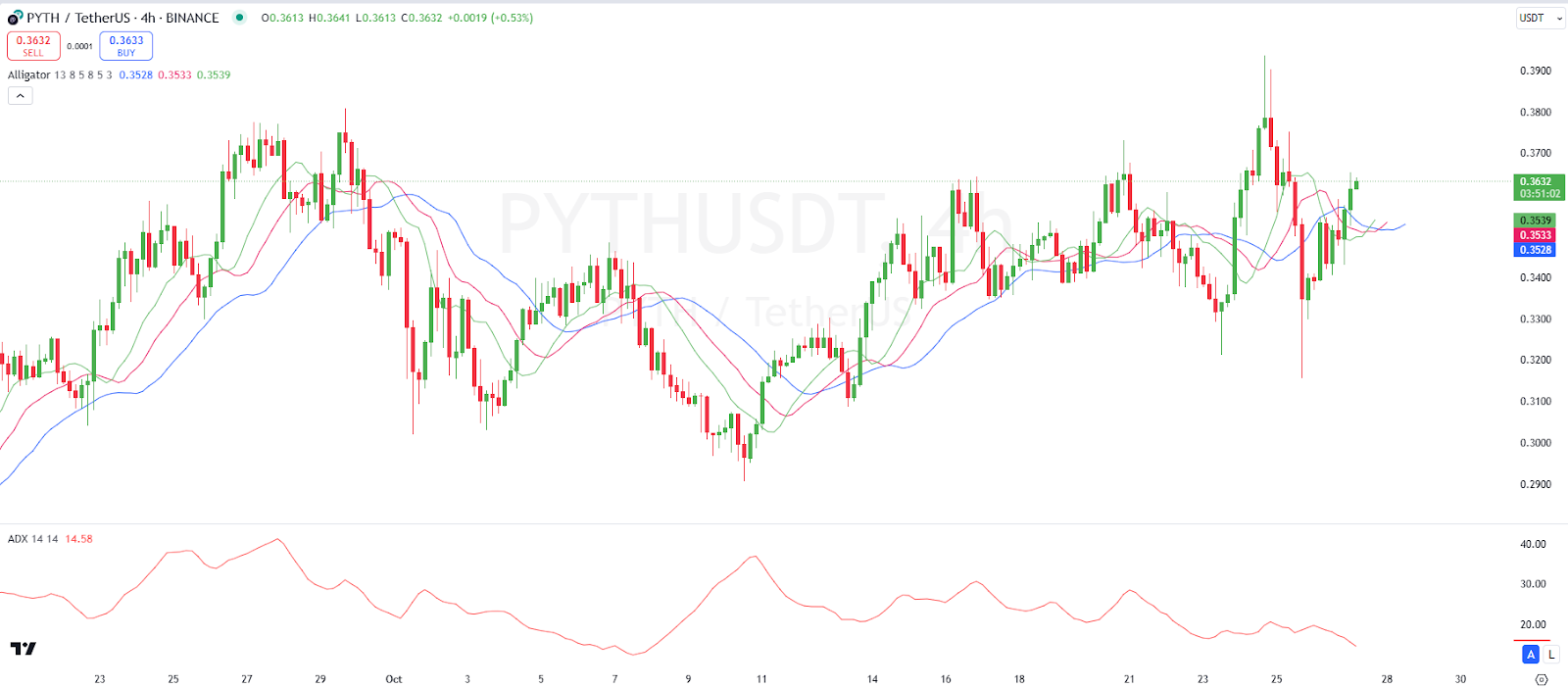

Pyth Price Review

Pyth, $PYTH, is also among the top gainers today as also seen from its price movements. Looking at an in-depth analysis, we see that the Alligator indicator shows its lines converging, suggesting a potential pause in trend direction. If the lines begin to diverge with the green line above the red, it may indicate a bullish trend forming. Conversely, a downward divergence could signal further bearish movement.

On the other hand, we see that the ADX is at 14.58, indicating a weak trend currently. Traders should watch for a rise above 20 on the ADX to confirm the strength of a developing trend, either bullish or bearish. Pyth traded at $0.3617 as of press time, representing a 5.12% increase over the last 24 hours.