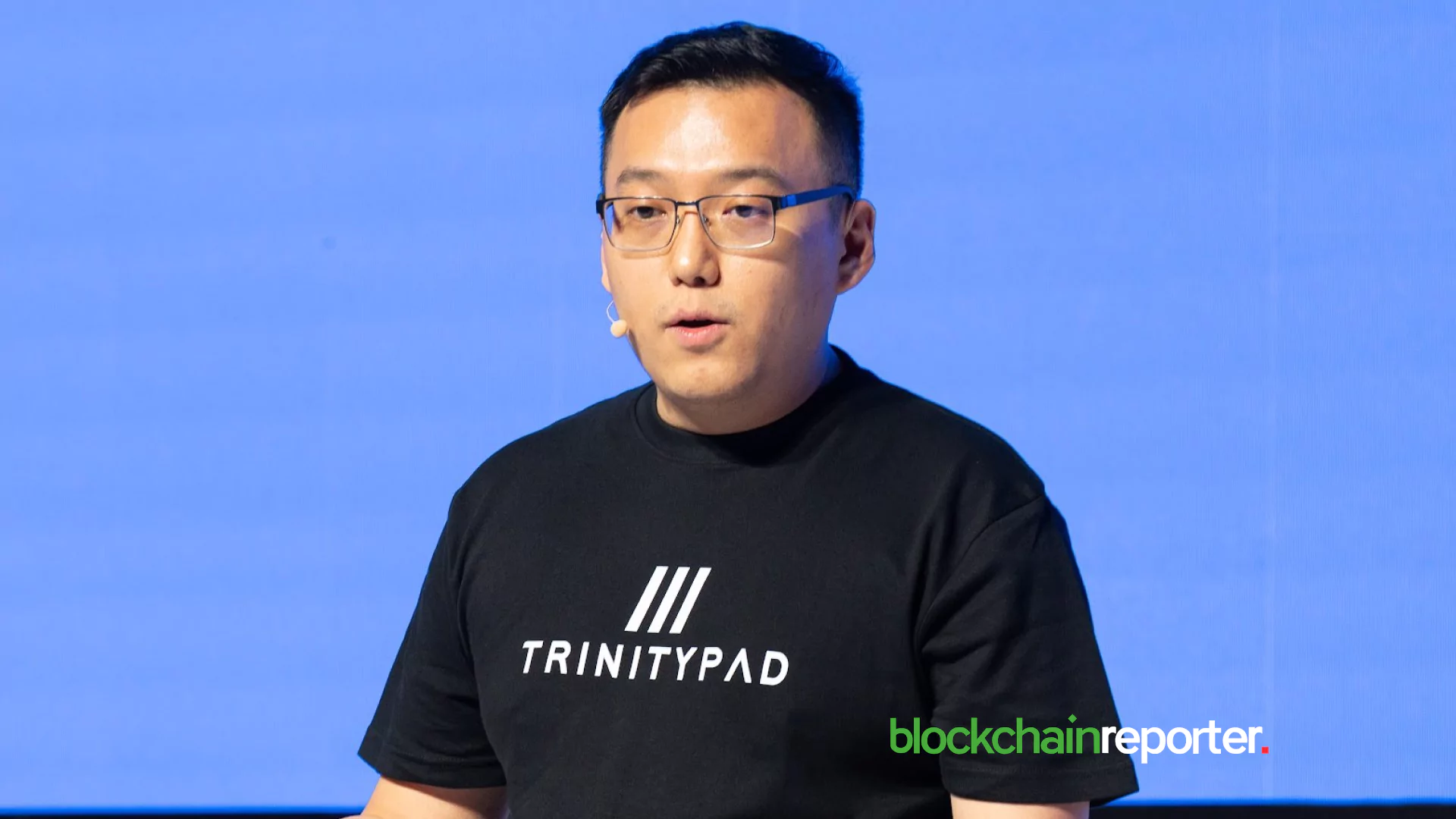

Victor Tan, the visionary founder and CEO of TrinityPad, is at the forefront of revolutionizing decentralized finance. With a strong background in Web3 innovation, Tan has developed a platform that simplifies investing, integrates cutting-edge AI technologies, and prioritizes trust and transparency. TrinityPad offers investors and entrepreneurs the tools they need to thrive in the ever-evolving crypto landscape.

Q1. As a thoroughly experienced entrepreneur, what inspired you to develop TrinityPad, and what sets it apart in the Web3 ecosystem?

The inspiration behind TrinityPad was to create a platform that simplifies decentralized investments, making them accessible to a broader audience. Our focus on leveraging AI to automate and optimize investment processes ensures that users can confidently navigate the complexities of Web3. TrinityPad is built to empower both investors and developers by combining cutting-edge technology with a user-first approach. In addition to this, our platform was developed to provide a safe and almost entirely autonomous experience, for both the lazy and veteran investors alike.

Q2. In your perspective, how does the Auto Invest & Exit Feature operate, and how does it ensure consistent results for users?

The Auto-Invest and Auto-Exit features are designed to provide a seamless investment experience by analyzing real-time market data and adjusting portfolios dynamically. These tools rely on AI-driven insights to identify opportunities and optimize performance, reducing the need for constant manual monitoring. While market outcomes are inherently unpredictable, these features help mitigate risks and enhance decision-making.

Q3. How does the AI-driven asset management mechanism of TrinityPad balance automation with human oversight for portfolio optimization?

TrinityPad’s AI tools act as a sophisticated assistant, processing vast amounts of data to identify trends and execute strategies. Human oversight ensures that these automated processes align with broader market conditions and user preferences. This balance between AI efficiency and human intuition creates a robust framework for portfolio management.

Q4. What security issues does TrinityPad address in the DeFi ecosystem by integrating quantum-proof backend engines?

Security is at the forefront of TrinityPad’s design. By integrating quantum-proof encryption, we proactively address emerging risks posed by advanced computing technologies. Additionally, all transactions are recorded transparently on-chain, and we employ reputable secure third-party treasury solutions to safeguard user funds and maintain trust.

Q5. What is TrinityPad’s role in advancing NFT, GameFi, and DeFi innovation via AI technology?

TrinityPad leverages AI to streamline the investment journey for these sectors, helping users discover high-potential projects and automate portfolio management. By offering tools that provide actionable insights and reduce complexity, TrinityPad supports the growth of innovative projects in NFT, GameFi, and DeFi, driving adoption and innovation across the ecosystem.

Q6. According to you, how has your former experience in driving prominent Web3 projects impacted your approach to establishing TrinityPad?

My experience with GameGPT and Rainmaker Games, which collectively achieved a peak market cap of $1.41 billion, underscored the importance of scalability and user engagement. These lessons have deeply influenced TrinityPad’s development, ensuring that we prioritize security, accessibility, and innovation to meet the evolving needs of the Web3 community.

Q7. What measures does TrinityPad take to ensure trust and transparency in automated investment processes?

Transparency is a cornerstone of TrinityPad. Every activity is visible on-chain, ensuring users can track their investments in real time. Additionally, our quantum-proof backend and secure treasury systems provide robust protection for user assets, fostering confidence in the platform’s reliability.

Q8. How does TrinityPad benefit entrepreneurs in launching projects?

TrinityPad simplifies the investment landscape for entrepreneurs by providing access to a global network of investors and offering AI-driven tools to enhance decision-making. Our platform reduces the complexities of fundraising, allowing founders to focus on building and scaling their projects while benefiting from advanced analytics and streamlined processes.

Q9. In your point of view, how do AI-led investment platforms advance a decentralized economy, and what is TrinityPad’s contribution to it?

AI-led platforms remove barriers to entry by simplifying complex investment systems, fostering inclusivity in decentralized finance. TrinityPad contributes by offering real-time insights, predictive analytics, and automation, enabling smarter and more efficient investment practices that align with the principles of decentralization. This enables a different type of opportunity – an opportunity that creates a new meaning to the potential of wealth creation and distribution to a larger and broader audience demographic.

Q10. What are the ways in which TrinityPad can support wider Web3 adoption and DeFi innovation in the future?

TrinityPad is committed to driving Web3 adoption by expanding its suite of AI-driven tools and collaborating with ecosystem partners. Initiatives like on-chain AI agents are designed to simplify user onboarding and enhance investment automation, making Web3 more accessible and fostering the next wave of DeFi innovation.