- VeThor (VTHO): A Quick Overview

- VeThor (VTHO): Uniqueness

- VTHO Price Prediction: Price History And Technical Analysis

- VTHO Price Prediction: From Industry Experts

- Is VTHO A Good Investment? When Should You Buy?

- Final Thoughts

The price of VeThor has been relatively stable for the last few months. Let’s find out its future prices from our VTHO price prediction.

VeThor had a price rise in 2021, and since then, the token has been bearish. Most crypto enthusiasts consider VeThor an offshoot coin to the widely successful VeChain network. Let’s know more about VeThor, its development, and future price from our VTHO price prediction.

VeThor (VTHO): A Quick Overview

Like VeThor, every cryptocurrency tries to make a place in the market in terms of utility and innovative use cases. However, the asset’s price remains one of the strongest determinants, and it does not matter how vital the token is. VeThor Token (VTHO) is one of the two native tokens launched on the VeChainThor blockchain network. Like its partner cryptocurrency, the VET coin, VTHO can also be stored in hot and cold wallets, allowing ERC-20 tokens, including Ethereum (ETH). VTHO was introduced to the market in 2018.

The VeChain crypto is primarily aimed at upgrading the performance of several processes. It boosts the supply chain management process on the network by ensuring that each level of the supply chain is in sync with the quality parameters and compliance standards.

Now, the VeChainThor public blockchain acts as a host to the VeChain ecosystem. The VeChain Explorer service contains all history of crypto transactions made on the network. After the rebranding, VET is the primary value-transfer token of VeChain; in contrast, the newly introduced token, the VeThor Token (VTHO), was applied as a token for paying to use the VehainThor blockchain by accelerating transactions and processes and the use of smart contract deployment. Let’s take a look at VTHO’s current details to clarify our VTHO price prediction better.

| Cryptocurrency | VeThor Token |

| Ticker Symbol | VTHO |

| Price | $0.001 |

| Price Change 24H | -0.22% |

| Price Change 7D | -21.60% |

| Market Cap | $72,556,409 |

| Circulating Supply | 45,630,180,356 VTHO |

| Trading Volume | $1,892,216 |

| All Time High | $0.04201 |

| All Time Low | $0.0001526 |

| VeThor Token ROI | -95.83% |

VeThor (VTHO): Uniqueness

The VeChainThor blockchain works on a proof-of-authority (PoA) consensus mechanism, and it depends on VeChainThor’s authority controller nodes to authenticate transactions and add blocks to the blockchain network. After the node network confirms a transaction, 30% of the transaction’s value is returned, while the other 70% is burned from the supply to keep VTHO’s price sustainable. Users can directly purchase VTHO tokens from the market or holding VET will help users to earn VTHO tokens. So, the VTHO token can be maintained by a third party; however, they still offer services and solutions utilizing the fee delegation feature.

The two token system of the VeChain network makes the network faster and more efficient when compared with other networks. The VET token is the primary way of transferring value on the blockchain network. The VTHO, which is the native token of the VeThor Blockchain, allows users to diversify their involvement in the network and separate the market speculation activities from the cost of using the VeChainThor Blockchain. The PoA mechanism facilitates VeChainThor’s transaction process at record processing speeds. The blockchain also has an open-source structure that allows blockchain technology developers to deploy their efforts to upgrade it. Recently, VeChainThor has also included VIP-220 to its public testnet.

VTHO Price Prediction: Price History And Technical Analysis

VTHO has had a tremendous price graph since its launch. The price history looks promising as it can lead this coin to new highs in the future. However, our VTHO price prediction says its price history does not guarantee its future prices.

VeChain was rebranded to VeChainThor in July 2018, and the VeThor Token (VTHO) was introduced in the market. The bulls of the crypto market went ahead to impose a price movement to hit the highest Vethor token price of $0.04201 on August 1 of the same year. However, the trend was of a short span, and the price quickly became a bearish trend the day after.

The bearish trend continued until October 2018. The Token’s market price stabilized at about $0.0005 until January this year, when some considerable bullish market movement led the token’s price to $0.0246 on April 16. On March 15 2021, VeChainThor launched a testnet of its decentralized exchange (DEX) Vexchange 2. Vexchange is the Uniswap for VeChain, allowing users to swap, send, pool and farm tokens. The VeThor community welcomed the update, and VTHO broke past the $0.01 barrier the following day for the first time since its launch. Due to the recent pandemic hitting the market and leading to a crash, VTHO is on the bottom line in the price graph.

VTHO is currently trading near $0.001 with a market cap of $72,556,409. According to our VTHO price prediction, the Bollinger band’s upper limit is $0.002. If this resistance level breaks, the price can break $0.0035. Conversely, the Bollinger band’s lower limit is $0.00085. Below this level, VTHO can trade near $0.0006. However, our VTHO price prediction says that VTHO is currently in a recovery phase as it is building momentum to spike soon. RSI and MACD indicate a positive signal for VTHO price prediction.

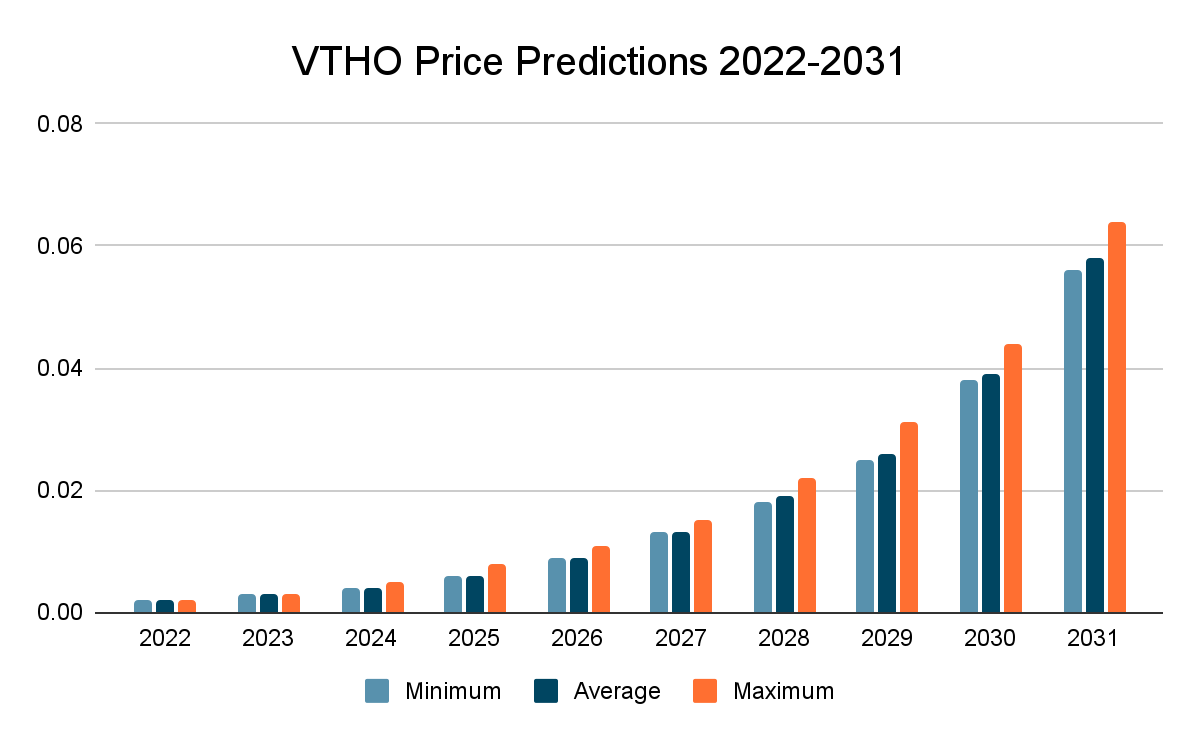

By the end of 2022, the VTHO price may reach a maximum value of $0.002. According to our VTHO price prediction, VTHO’s price will follow its developments and the market’s ecosystem, and in 2025 VTHO may reach a high of $0.008, with an average price of $0.006. In 2030, VTHO has the potential to get a maximum price of $0.044.

VTHO Price Prediction: From Industry Experts

According to Wallet Investor’s VTHO price prediction, the VTHO token’s maximum price might reach $0.0474 by the beginning of the year 2025, while its price by the end of December 2025 is anticipated to be $0.06027 (589%).

DigitalCoinPrice’s VTHO price prediction says that VTHO has a promising future ahead. By the year 2025, VTHO price could be worth $0.0263100075 per coin (+200%).

Is VTHO A Good Investment? When Should You Buy?

In the past, VeThor proved to be one of the most talked about coins in crypto space. With this in mind, our VTHO price prediction says VTHO is a good investment choice. It can give incredible returns in the long term. According to our VTHO price prediction, a price of $0.0005 can be a good entry point for an excellent return on investment (ROI).

Final Thoughts

VTHO is a versatile token that solves one of the most significant issues faced in physical product management: duplication. It establishes a road to reduce counterfeits in many sectors and also provides a faster supply chain function. VTHO token is showing potential, and it can quickly climb highs. However, our VTHO price prediction suggests investing in the market after researching the coin.