The bear are still holding firm on to the markets, as seen from the continous decrease in the global market cap. The total cap stood at $2.25T as of press time, representing a 2.25% decrease over the last 24 hours, while the trading volume also dropped by 18.91% over the same period to stand at $95.06B as of press time.

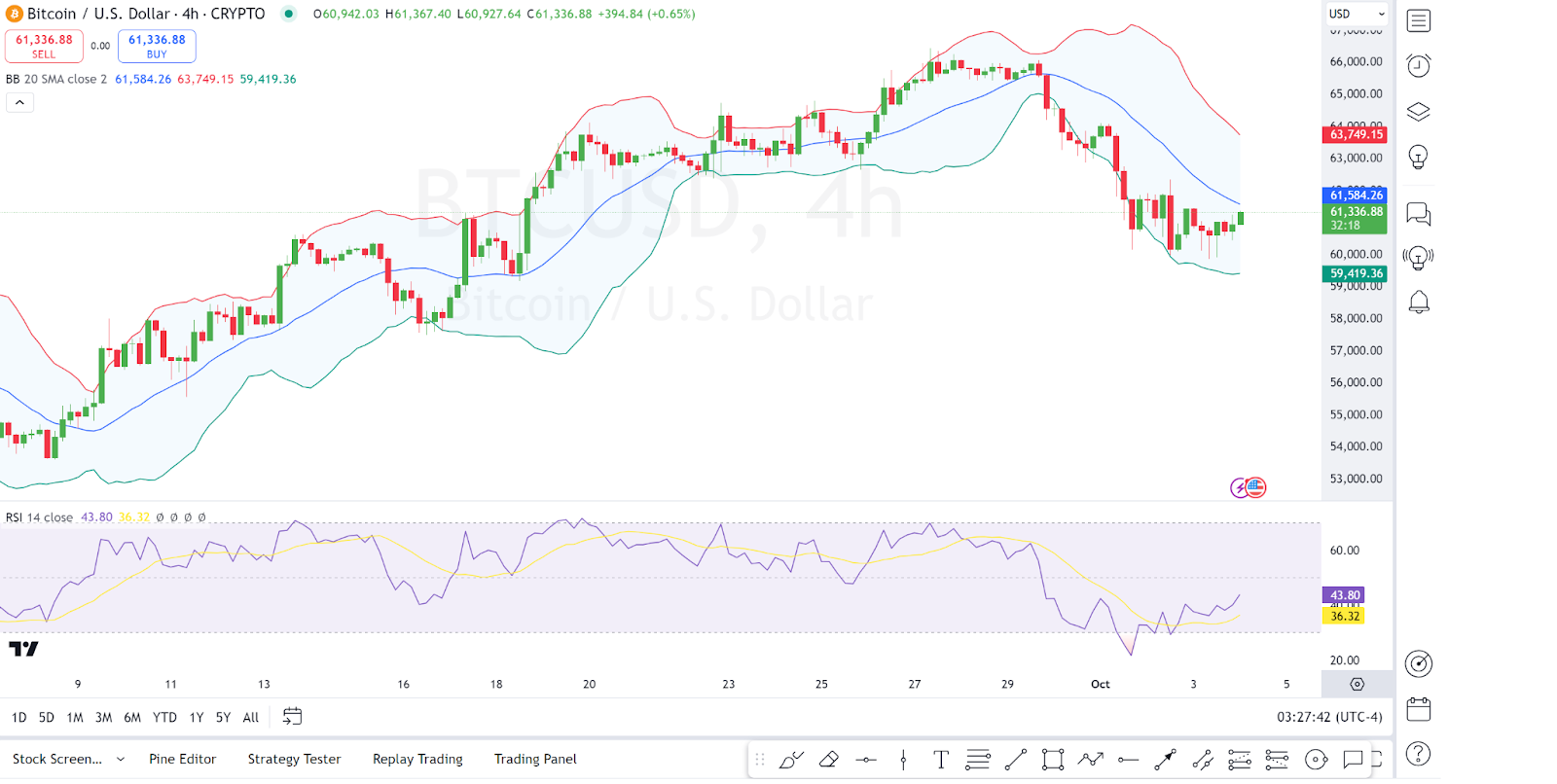

Bitcoin Price Review

Bitcoin, $BTC, has posted minor gains in today’s session, as seen from its price movements. Looking at an in-depth analysis, we see that the Bitcoin price is trading near the lower Bollinger Band, which suggests that Bitcoin may be oversold in the short term and could experience a bounce back. The narrowing of the bands indicates a reduction in volatility, hinting that a breakout (up or down) could be imminent.

On the other hand, we see that RSI (Relative Strength Index): Currently, RSI is around 43, which leans toward a slightly oversold condition but not extreme. There’s potential for a bullish recovery if RSI rises toward the neutral level of 50. Bitcoin traded at $61,395 as of press time, representing a 0.49% increase over the last 24 hours.

Ethereum Price Review

Ethereum, $ETH, is also among the gainers in today’s sesion as also seen from its price movements. Looking at an in-depth analysis, we see that the Alligator lines (green, red, blue) are showing a clear separation, with the green line (lips) crossing below the red (teeth) and blue (jaw) lines. This indicates that Ethereum is currently in a downtrend, as the bearish formation of the Alligator suggests a sleeping phase (trend developing).

The AO is in negative territory at -175.08, showing that the momentum is bearish. However, the bars are beginning to decrease in size, which may signal weakening bearish momentum. A potential bullish reversal could be forming if the histogram starts printing green bars above zero, confirming a shift in momentum. Ethereum traded at $2,384 as of press time, representing a 0.53% increase over the last 24 hours.

FTX Token Price Review

FTX Token, $FTT, is also among the gainers in today’s session as seen from its price movements. we see that the FTT price the Supertrend indicator is signaling a bullish setup with the current price trading above the buy level of $1.7611. This suggests that the market sentiment is positive, and FTX Token is in an uptrend.

On the other hand, we see that the ADX is at 41.89, indicating that the current trend is strong. An ADX reading above 25 generally signifies a strong trend, so the bullish momentum is confirmed. FTX traded at $2.57 as of press time, representing a 30.19% increase over the last 24 hours.

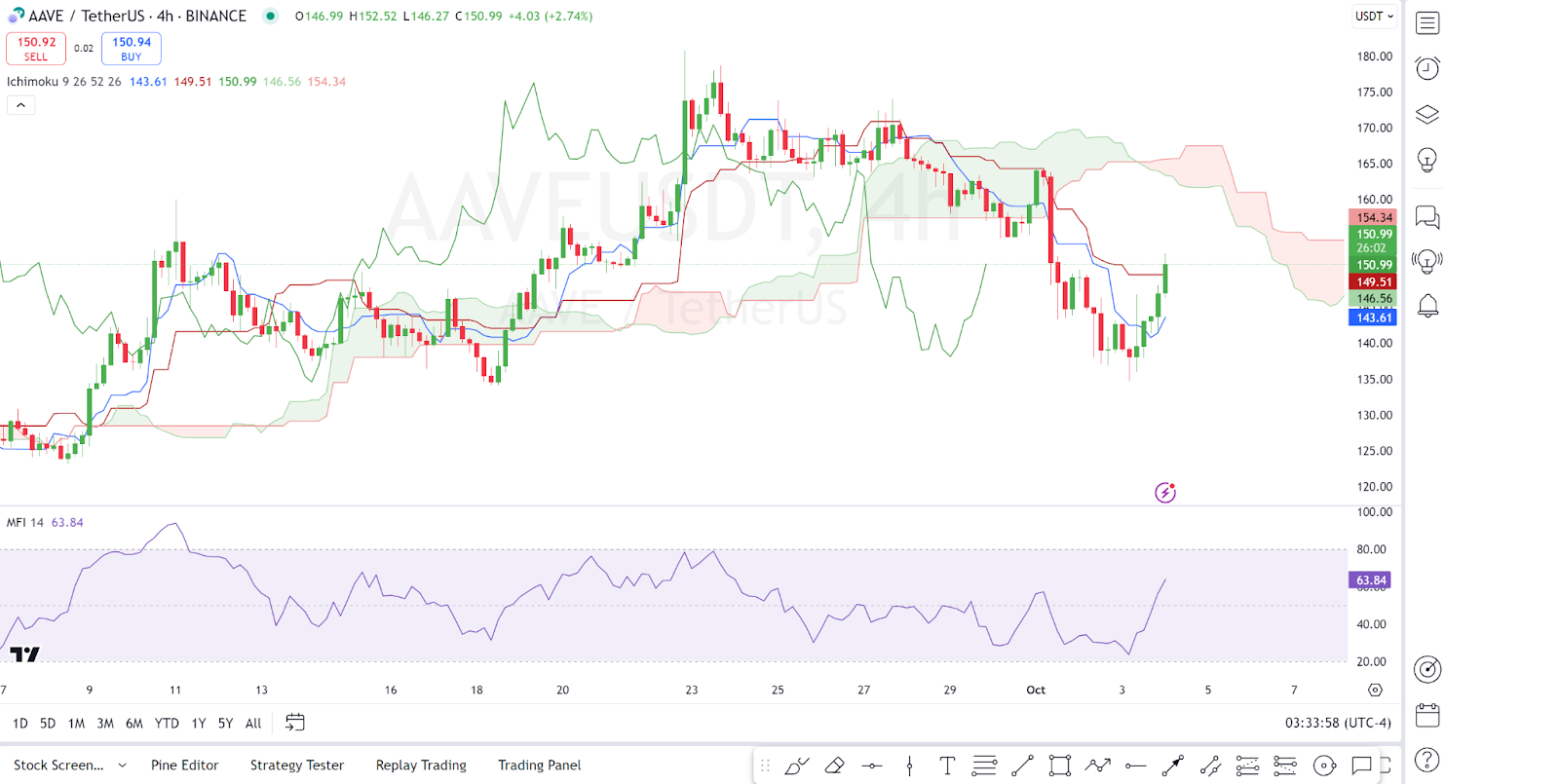

Aave Price Review

Aave, $AAVE, is also among the gainers in today’s session as also seen from its price movements. Looking at an in-depth analysis, we see that AAVE is trading within the cloud, signaling indecision in the market. The price is testing the bottom of the cloud, indicating a potential support level. If the price breaks below the cloud, this would signal a bearish continuation. Conversely, a break above the cloud would signal a bullish trend.

On the other hand, we see that the Money Flow Index is at 63.84, which is near the overbought zone (70). This suggests buying pressure is still strong but may be nearing exhaustion. Aave traded at $150.14 as of press time, representing a 7.99% increase over the last 24 hours.

Monero Price Review

Monero, $XRM, is also among the gainers in today’s session as also seen from its price movements. Looking at an in-depth analysis, we see that Monero is in a descending trend channel, indicating a clear bearish movement. However, the price is currently testing the upper boundary of the channel, which could signify a potential breakout and reversal if the price manages to close above the channel.

On the other hand, we see that the Volume Oscillator is at -10.16%, showing decreasing trading volumes. This is a potential signal of weakening bearish momentum, especially as the price approaches a key resistance level. Monero traded at $146.67 as of press time, representing a 5% increase over the last 24 hours.