- 1. Crypto staking

- 2. What is Staking?

- 3. Start it with the One of Leading Platform - OkayCoin

- 4. How to Choose the Best Crypto Staking Platform

- 5. How to get started on OkayCoin

- 6. Staking plans in OkayCoin

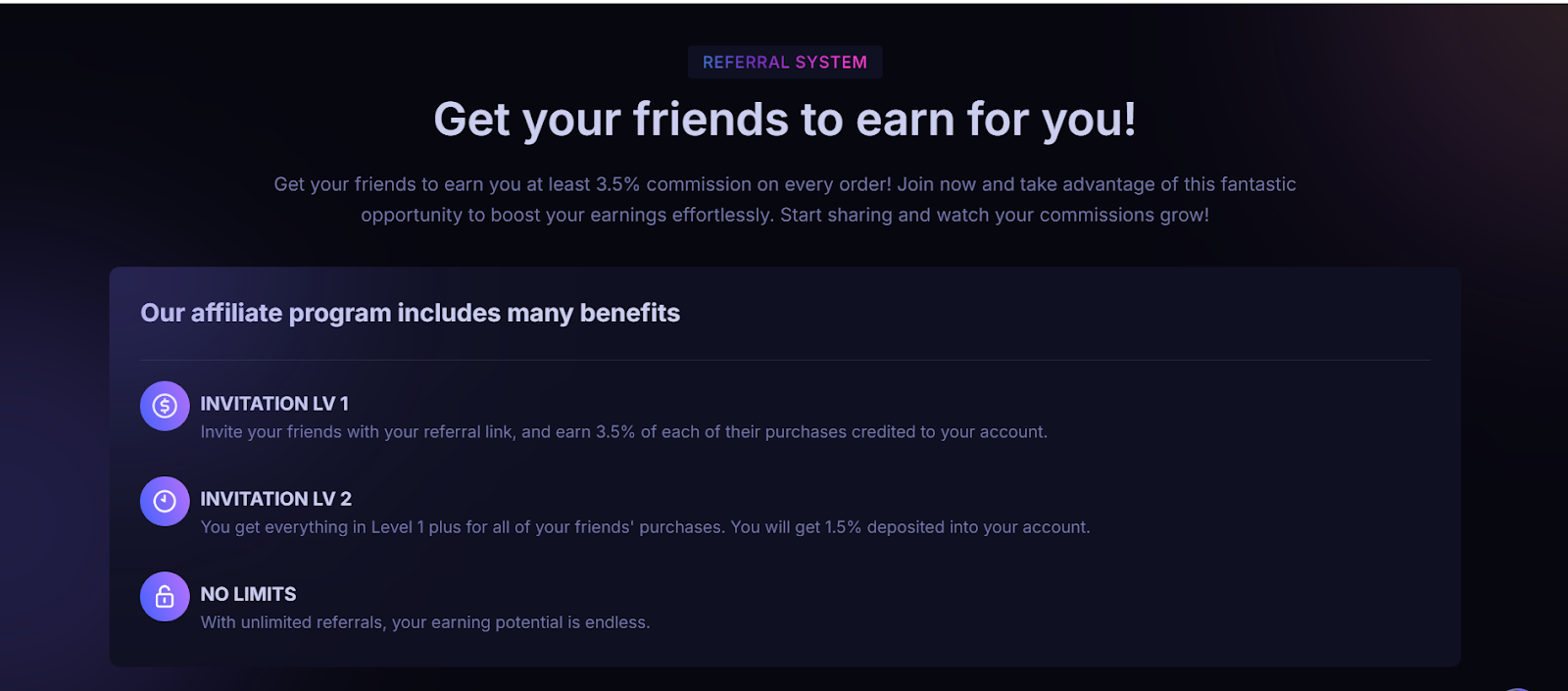

- 7. Referral Program on OkayCoin

- 8. 2. Yield Farming

- 9. 3. Crypto Lending

- 10. 4. Liquidity Mining

- 11. 5. Dividend-Paying Tokens

- 12. 6. Masternodes

- 13. Conclusion

In 2024, cryptocurrencies continue to allow options for earning passive income in various ways. From staking up to yield farming, these methods are available and profitable for everyone who wants to maximize his or her crypto investments. Now, we are going to describe six brilliant and simple ways of passive income with the help of cryptocurrencies.

- Crypto staking

- Yield Farming

- Crypto Lending

- Liquidity Mining

- Dividend paying tokens

- Masternodes

Crypto staking

Crypto staking refers to the process of locking up one’s cryptocurrencies to contribute to the security of blockchain networks and the validation of transactions. In return, they get rewards in the form of more crypto. It’s a passive income strategy that requires less involvement, thus ideal for any kind of investor, be it a novice or an experienced one.

What is Staking?

Staking has major implications with Proof of Stake blockchain networks, where participants hold their own cryptocurrency for block validation in order to maintain the security of the network. Unlike PoW blockchains, which heavily rely on power-consuming mining, PoS relies on stakers who are incentivized with extra crypto in return for their participation. The more tokens you stake, the higher your chances of being selected to validate transactions and, by extension, earning rewards. This has an added advantage, in that it not only brings you passive income but also adds value to the health of the blockchain ecosystem as a whole.

Start it with the One of Leading Platform – OkayCoin

OkayCoin is one of the major crypto platforms that has given a concrete staking service for its users in staking their assets with much ease. On OkayCoin, you can stake some popular cryptocurrencies, including Bitcoin, Ethereum, and Polkadot, among others. You stake based on the period and amount you stake.

How to Choose the Best Crypto Staking Platform

The best crypto staking platform is a function of many factors. First, there is the range of supported assets. It should be able to let you stake the type of crypto you own. Secondly, check the APY offered. Different platforms offer different rewards. Thirdly, consider the security that a platform assumes on behalf of your staked assets. Lastly, think about the fees of the platform and flexibility in withdrawal, and ease of use for the help of beginners.

How to get started on OkayCoin

- Create Account: Log in to the website of the OkayCoin exchange and click “Sign Up.” An email address is required, and then a password should be created.

- Verify Identity: Pass the procedure of KYC by uploading identification issued by your government, and then proceed with an in-screen process.

- Fund Account: Deposit to your account either by transferring crypto or using fiat currencies such as USD.

- Choose your staking option: Navigate to the staking section, select an asset you want to stake, and review the staking terms such as duration and APY.

- Start staking: Confirm your staking terms and begin earning at once. At the time you sign up, you will get a welcome bonus of $100.

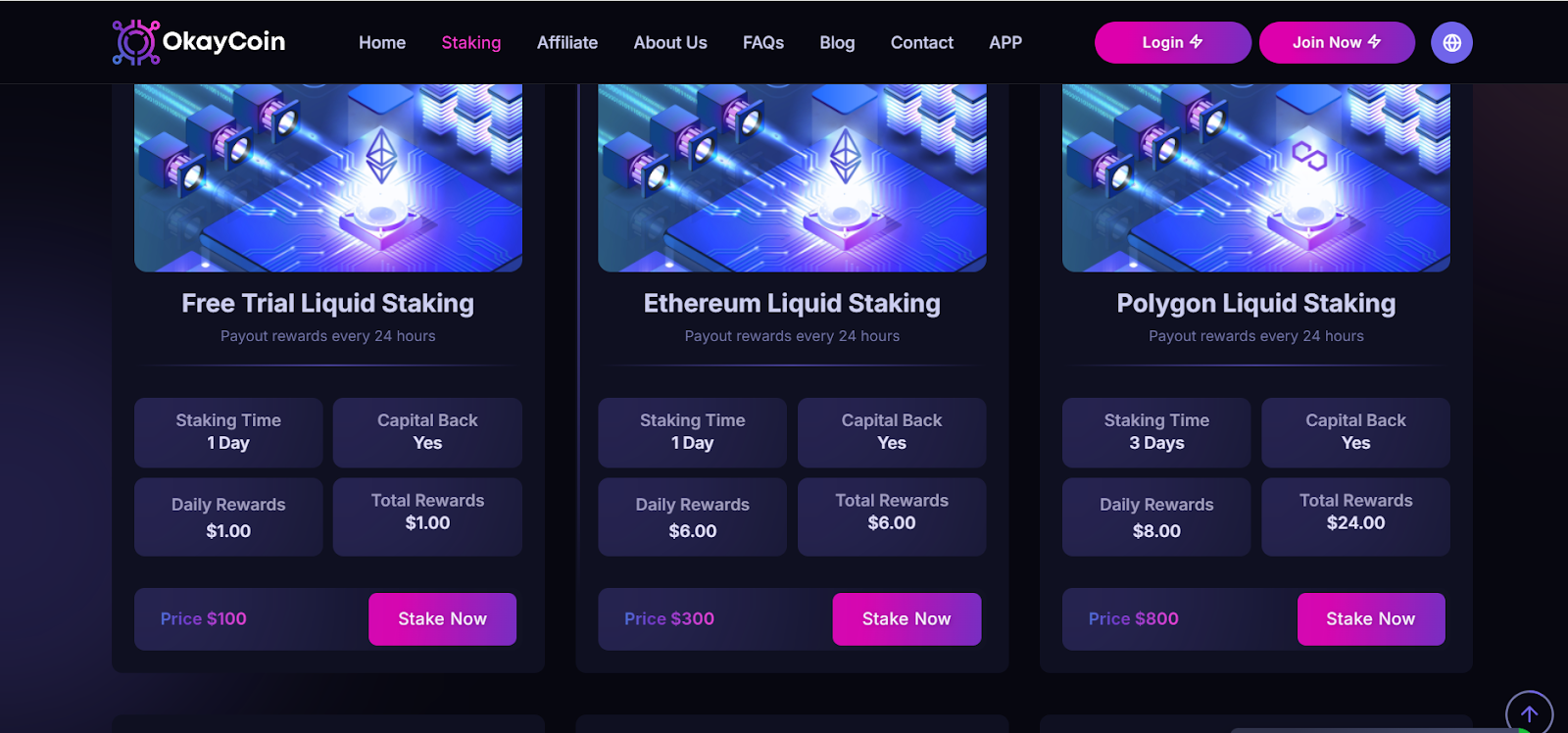

Staking plans in OkayCoin

The availability of pools on OkayCoin varies for each cryptocurrency. You can stake your assets, such as Bitcoin, Ethereum, and Polkadot, on the platform for various periods that may either be flexible or of fixed terms. Some of these include:

- Free Trial Staking Plan: $100 for 1 day and earn $1 daily.

- Ethereum Staking Plan: $300 for 1 day and earn $6 daily.

- Polygon Staking Plan: $800 for 3 days and earn $8 daily.

- TRON taking Plan: $1200 for 7 days and earn $12 daily.

- Polkadot Staking Plan: $3000 for 7 days and earn $33 daily.

- Celestia Staking Plan: $6000 for 14 days and earn $72 daily.

- Aptos Staking Plan: $10,000 for 15 days and earn $140 daily.

- Sui Staking Plan: $20,000 for 15 days and earn $280 daily.

- Avalanche Staking Plan: $35,000 for 20 days and earn $525 daily.

- Cardano Staking Plan: $56,000 for 30 days and earn $896 daily.

- Solana Staking Plan: $78,000 for 30 days and earn $1,404 daily.

Referral Program on OkayCoin

OkayCoin’s referral program was quite attractive because one got extra rewards through referral. The referrals go this way: if someone refers a friend or family member to the platform, he will get the bonus of 3.5% commission on every order.

2. Yield Farming

Yield farming is one of the hot DeFi activities to which investors sell liquidity to a decentralized exchange in return for yield rewards. Yield farmers can earn returns by locking their crypto into liquidity pools powering decentralized trading. There are the likes of Uniswap and PancakeSwap offering competitive yields to interested participants. Yield farming does have higher risks than staking but can be very profitable if someone manages risks properly.

3. Crypto Lending

Crypto-lending platforms enable one to lend their assets to borrowers for interest in return. With Aave and BlockFi, among others, making the process easy, you can lend your crypto at interest rates between 4-12% depending on the asset and the chosen platform. To lenders, it is a very good way to make passive income without having to trade or sell your holdings.

4. Liquidity Mining

Liquidity mining is a way to get rewarded for providing liquidity to decentralized exchanges. Similar to yield farming, in focus, the difference in liquidity mining lies in incentivizing liquidity providers with platform tokens. Many of the DeFi protocols-for example, Compound and SushiSwap-pay rewards to liquidity providers through governance tokens. In return, those who receive governance tokens also gain additional benefits and have voting rights over changes in the protocol.

5. Dividend-Paying Tokens

Some crypto projects issue dividend-paying tokens similar to traditional stocks. Such tokens pay parts of their income to their token holders periodically or even continuously. A good example is KuCoin, which provides KuCoin Shares-KCS-and pays dividends based on their trading fees. This can be considered one of those passive incomes where investors earn by needn’t actively participate in trading.

6. Masternodes

The masternodes are different nodes, much like staking, that keep the operations of a blockchain up and running but, in turn, require a decent investment in crypto. This is because, in return, the operators of masternodes are rewarded for keeping the network secure and up. Some popular masternode projects include Dash and PIVX, whereby one can earn passive income through the operation of a masternode. In this, the knowledge required will be a bit on the higher side, coupled with initial capital investment, but it is very rewarding.

Conclusion

These six intelligent, simple methods of passive income-which further include crypto staking on OkayCoin-offer you the ways to grow your crypto portfolio in 2024. Whether it is low-risk staking or higher-risk liquidity mining that works for you, these indeed let you put your assets to work. With OkayCoin’s secure platform, staking has never been easier, and the referral program gives you more income on top. Diversify your methods to maximize passive earnings as the world of cryptocurrencies changes.