- 1. Kick-off: Understanding the Stock Market Landscape

- 1.1. Understanding the Core Players: FIIs and DIIs

- 1.2. The Role of NSE in the Indian Stock Market

- 1.3. Deciphering Financial Investment Data

- 1.4. FII DII Data and Its Influence on the Stock Market

- 1.5. Analyzing NSE Trading Statistics

- 1.6. Equity Portfolio of Institutional Investors

- 1.7. The Impact of FIIs and DIIs on NSE Indices

- 2. Endnote: Navigating the Stock Market Successfully

- 3. FAQ

- 3.0.1. What are FIIs and DIIs?

- 3.0.2. What is the role of FIIs and DIIs in the Indian Stock Market?

- 3.0.3. What is FII DII data in NSE?

- 3.0.4. Why is the analysis of FII DII data important?

- 3.0.5. What is the impact of FIIs and DIIs on NSE indices?

- 3.0.6. What is NSE Trading Statistics?

- 3.0.7. How does the NSE influence the Indian Stock Market?

- 3.0.8. What is the significance of tracking institutional buying and selling data?

- 3.0.9. What does the equity portfolio of foreign and domestic institutional investors signify?

- 3.0.10. How does Financial Investment Data aid in navigating the Stock Market?

- Kick-off: Understanding the Stock Market Landscape

- Understanding the Core Players: FIIs and DIIs

- The Role of NSE in the Indian Stock Market

- Deciphering Financial Investment Data

- FII DII Data and Its Influence on the Stock Market

- Analyzing NSE Trading Statistics

- Equity Portfolio of Institutional Investors

- The Impact of FIIs and DIIs on NSE Indices

- Endnote: Navigating the Stock Market Successfully

- FAQ

Kick-off: Understanding the Stock Market Landscape

The Indian Stock Market, a dynamic and complex financial ecosystem, is largely influenced by the activities of Foreign and Domestic Investors in the National Stock Exchange (NSE). An exploration of FII DII data in NSE gives investors a critical lens through which they can decode the market’s intricate workings and predict investment trends. This article aims to provide an extensive analysis of the key components of the stock market, elucidating the roles of institutional investors, the influence of their trading activities on market sentiment, and their overall impact on the market indices.

Understanding the Core Players: FIIs and DIIs

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) are crucial participants in the financial markets. Their trading activity often plays a pivotal role in shaping market sentiment and influencing share prices. By analyzing FII DII trading patterns, investors can gain valuable insights into market trends and devise effective investment strategies.

The Role of NSE in the Indian Stock Market

The National Stock Exchange, one of the largest stock exchanges globally, is a significant hub for securities trading in India. Its influence on the Indian Stock Market is considerable, and it serves as a barometer for the country’s economic health. The NSE’s trading volume and market capitalization offer valuable insights into the performance of the financial markets and the economy as a whole.

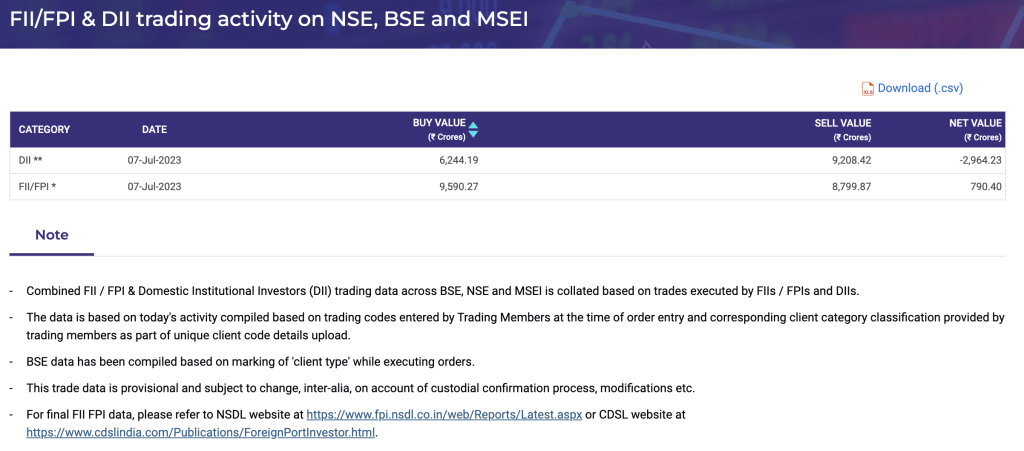

Deciphering Financial Investment Data

Financial Investment Data provides a comprehensive view of the financial activities and transactions in the stock market. The data encapsulates essential details about equity trading, portfolio investment, FII and DII statistics in the Indian Stock Market, and more. This information is instrumental in understanding investor behavior and predicting market fluctuations.

FII DII Data and Its Influence on the Stock Market

The FII DII data NSE is a significant determinant of the stock market trends. The buying and selling activity of these institutional investors often influences the Nifty50 and other market indices, thereby dictating the direction of the market. Understanding this data can provide investors with an edge in predicting market trends and making informed decisions.

Analyzing NSE Trading Statistics

NSE Trading Statistics offer a wealth of information about the stock market’s performance, including data on trading volumes, share prices, and market capitalization. By analyzing this data, investors can gauge market sentiment, identify potential investment opportunities, and make strategic investment decisions.

Equity Portfolio of Institutional Investors

The equity portfolio of foreign and domestic institutional investors sheds light on their investment preferences and strategies. By studying the equity portfolio of FIIs and DIIs, investors can identify trending sectors and potentially profitable investment opportunities.

The Impact of FIIs and DIIs on NSE Indices

The activities of FIIs and DIIs significantly influence the NSE indices. Their buying and selling patterns, captured through NSE FII DII activity data, can cause market fluctuations. Therefore, tracking these activities can help investors anticipate market trends and adapt their investment strategies accordingly.

Endnote: Navigating the Stock Market Successfully

The Indian Stock Market, with its dynamic nature and complex mechanisms, can be challenging to navigate. However, understanding FII DII data in NSE, the influence of foreign and domestic investors, and the role of FIIs and DIIs in the stock market can provide investors with a comprehensive perspective. This knowledge can be instrumental in devising effective investment strategies, anticipating market trends, and making informed investment decisions. By staying updated with financial statistics and maintaining a close eye on the institutional trading activity, investors can successfully navigate the Indian Stock Market and maximize their investment returns.

FAQ

What are FIIs and DIIs?

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) are organizations or investment companies that invest in Indian financial markets. They play a significant role in shaping the direction of the stock market.

What is the role of FIIs and DIIs in the Indian Stock Market?

FIIs and DIIs, through their buying and selling activities, influence the direction of the stock market. Their activities can impact share prices, market indices, and overall market sentiment.

What is FII DII data in NSE?

FII DII data refers to the record of buying and selling activities of Foreign Institutional Investors and Domestic Institutional Investors in the National Stock Exchange. This data provides insights into the market’s overall health and direction.

Why is the analysis of FII DII data important?

Analysis of FII DII data can help predict market trends, understand investor sentiment, and provide valuable insights for making informed investment decisions.

What is the impact of FIIs and DIIs on NSE indices?

The buying and selling activities of FIIs and DIIs can significantly impact NSE indices. When these institutions invest heavily in the market, indices typically rise. Conversely, when they withdraw or sell their investments, indices can fall.

What is NSE Trading Statistics?

NSE Trading Statistics are a comprehensive set of data that provides detailed information about trading volumes, share prices, and market capitalization in the National Stock Exchange.

How does the NSE influence the Indian Stock Market?

As one of the largest stock exchanges in India, the NSE has a significant influence on the Indian Stock Market. The exchange’s trading volume and market capitalization offer valuable insights into the performance of the financial markets and the economy as a whole.

What is the significance of tracking institutional buying and selling data?

Tracking institutional buying and selling data is crucial to understanding market trends and investor sentiment. This information can help predict market movements and provide valuable insights for developing effective investment strategies.

What does the equity portfolio of foreign and domestic institutional investors signify?

The equity portfolio of institutional investors provides insights into their investment preferences and strategies. By studying these portfolios, investors can identify trending sectors and potentially profitable investment opportunities.

How does Financial Investment Data aid in navigating the Stock Market?

Financial Investment Data provides a comprehensive view of the financial activities and transactions in the stock market. This information aids in understanding investor behavior, predicting market fluctuations, and making informed investment decisions.

READ MORE:

Kibho Cryptocurrency: A Fine Choice for Huge Crypto Returns

Xxc Renegade 1000 Xxc Price Prediction: Will This ATV Gain Popularity In 2023?

YIMUSANFENDI: The Vanguard of Information-Driven Innovation

Yes Bank Share Price Prediction 2025: Will Yes Bank Stock Recover from Crisis?

AMC Stonk-O-Tracker: The Power of Retail Investors in the Market

How Can Features of Blockchain Support Sustainability Efforts

Controlling Bitcoin Mining Hashrate: Report on Core Scientific 545M & Riot Blockchain 215M Earning

Understanding the IEX Share Price on the National Stock Exchange

Reliance Power Share Price Future Prediction 2025: Will RPOWER Stock Reach ₹100 In 2023?