- 1. Adani Wilmar Limited (AWL): A Quick Introduction

- 2. Adani Wilmar: Roadmap And Acquisitions

- 3. AWL Share Price Prediction: Price History

- 4. AWL Share Price Prediction; Technical Analysis

- 5. Adani Wilmar Price Prediction By Blockchain Reporter

- 6. Adani Wilmar Share Price Prediction: Industry Experts

- 7. Should You Invest In Adani Wilmar? Here’s The Best Entry Point

- 8. Adani Wilmar: Financial Reports

- 9. Conclusion

- 10. FAQ

- 10.0.1. Who are the owners of Adani Wilmar Limited (AWL)?

- 10.0.2. What products does Adani Wilmar Limited (AWL) offer?

- 10.0.3. How has Adani Wilmar Limited (AWL) grown over the years?

- 10.0.4. What controversies has Adani Wilmar Limited (AWL) faced?

- 10.0.5. What impact did the Hindenburg report have on AWL's share price?

- 10.0.6. How has AWL's share price performed in the past?

- 10.0.7. What are the predictions for AWL's share price in the future?

- 10.0.8. What is the consensus among industry experts regarding AWL's share price?

- 10.0.9. Is it a good time to invest in Adani Wilmar Limited (AWL)?

- 10.0.10. How has Adani Wilmar performed financially?

- Adani Wilmar Limited (AWL): A Quick Introduction

- Adani Wilmar: Roadmap And Acquisitions

- Stock Manipulation And Controversies

- Adani-Hindenburg Issue Causes A Big Impact

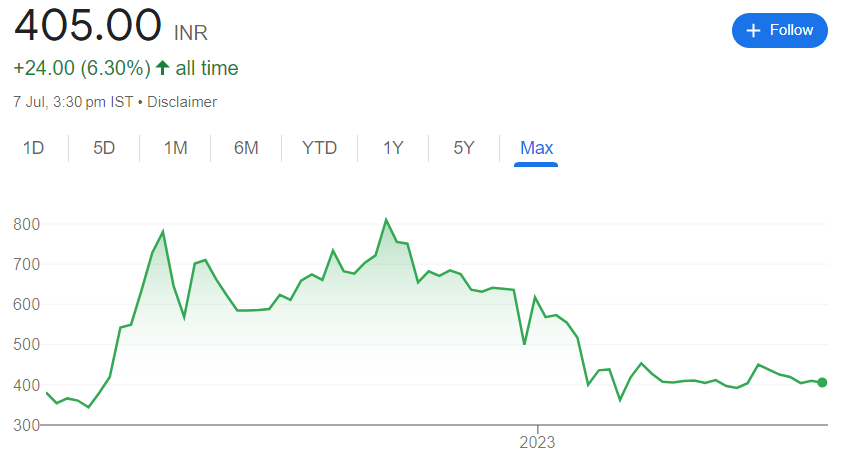

- AWL Share Price Prediction: Price History

- AWL Share Price Prediction; Technical Analysis

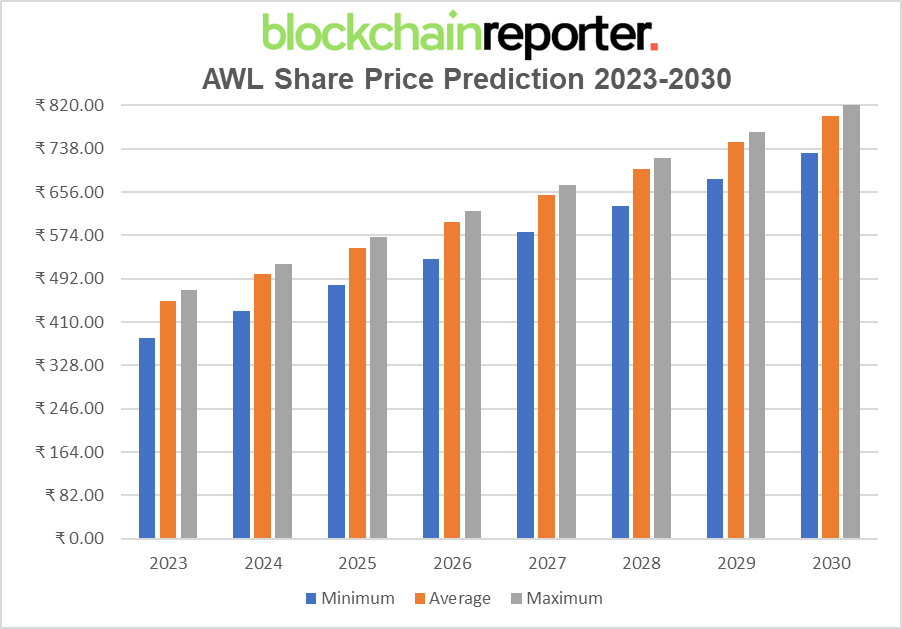

- Adani Wilmar Price Prediction By Blockchain Reporter

- AWL Share Price Prediction 2023

- AWL Share Price Prediction 2024

- AWL Share Price Prediction 2025

- AWL Share Price Prediction 2026

- AWL Share Price Prediction 2027

- AWL Share Price Prediction 2028

- AWL Share Price Prediction 2029

- AWL Share Price Prediction 2030

- Adani Wilmar Share Price Prediction: Industry Experts

- Should You Invest In Adani Wilmar? Here’s The Best Entry Point

- Adani Wilmar: Financial Reports

- Conclusion

- FAQ

Adani Wilmar Limited (AWL), a joint venture between two industry titans, the Adani Group of India and the Wilmar International of Singapore, has emerged as a solid player in the agri-business sector. Since its inception in 1999, AWL has been instrumental in transforming the landscape of the Indian food industry, building a niche for itself as a leading food company. The genesis of AWL marked the beginning of a new era in the Indian agri-business sector. The Adani Group, a global integrated infrastructure player with a strong presence in logistics, energy, agri, and ancillary industries, joined forces with Wilmar International, Asia’s leading agri-business group with a significant presence in over 50 countries. This strategic partnership leveraged the Adani Group’s robust infrastructure and logistics capabilities with Wilmar’s extensive experience in oilseed crushing, edible oils refining, sugar milling and refining, specialty fats, oleochemicals, biodiesel and fertilizer manufacturing, and grain processing.

The result was a company that has since grown exponentially, with its flagship brand, ‘Fortune’, becoming a household name in India. Offering a range of products, including edible oils, basmati rice, pulses, soya chunks, wheat flour, and more, AWL’s success can be attributed to its relentless focus on quality, innovation, and a customer-centric approach. However, like any major corporation, AWL has had its share of challenges. Recently, the company found itself in the crosshairs following a report by Hindenburg Research, which led to a significant drop in its share price. This has led many to question: Will Adani Wilmar recover following the Hindenburg report? Let’s find out from our AWL share price prediction.

Adani Wilmar Limited (AWL): A Quick Introduction

Adani Wilmar Limited (AWL), an Indian multinational corporation specializing in food and beverages, is a collaborative venture between Adani Enterprises and Wilmar International. As the largest palm oil processor in the country, AWL has firmly established its presence since its inception in 1999 by founder Gautam Adani. Headquartered in Ahmedabad, India, the company operates 22 plants spread across ten Indian states. AWL’s products find their way to markets in the Middle East, Africa, and Southeast Asia.

The company’s flagship brand, Fortune, is renowned for its edible oils and food products. From 2014 to 2017, AWL expanded its product portfolio under the Fortune brand to include packaged goods like rice, soya chunks, and flour. The years 2019 and 2020 marked AWL’s foray into the personal care segment with the launch of the Alife brand and the Ready to Cook (RTC) product market. As of 2021, AWL commanded a significant 18.3% share of India’s branded edible oil market.

In a significant milestone, Adani Wilmar launched its initial public offering (IPO) on January 27, 2022, which ran for three days and closed on January 31, 2022. The company was listed on February 8, 2022.

Despite the challenges posed by the volatile global economy and the ever-changing agri-business landscape, AWL remains optimistic about the future. The company’s strategic focus on innovation, sustainability, and customer-centricity, coupled with its robust infrastructure and logistics capabilities, position it well for continued growth and success.

Adani Wilmar: Roadmap And Acquisitions

In 2005, Adani Wilmar Limited (AWL) expanded its operations by acquiring the Mantralayam and Haldia plants, both specializing in refining. Between 2006 and 2009, the company continued its acquisition spree, taking over several crushing and refining units located in Bundi, Shujalpur, Nagpur, and Neemuch. It also acquired Rajshri Packagers, Acalmar Oils and Fats, and Satya Sai Agroils, all of which are refining units.

In 2011, AWL further broadened its portfolio by acquiring the Alwar and Mundra castor units, which are involved in crushing, refining, and industry essentials. The company also took over Gokul Refoils & Solvent, an edible oil refining company.

In 2018, AWL made significant acquisitions, including a refinery from Louis Dreyfus Commodities, an edible oil refinery from Cargill, and rice plants from Ferozepur Foods. AWL also entered into joint ventures with KOG-KTV Foods Pvt Ltd, KTV Health Foods Pvt. Ltd, and Visakha Polyfab Pvt Ltd.

Fast forward to 2022, AWL made a significant move by acquiring the Kohinoor, Trophy Royale, and Charminar rice brands from Mccormick & Company.

Stock Manipulation And Controversies

In 2016, the Maharashtra State Government issued a statement asserting that Adani Wilmar had breached the rules set by the Food and Drug Administration, Maharashtra State. The company had been promoting its blended edible vegetable oil, Fortune Vivo, with claims of medicinal properties, including diabetes regulation. Following these allegations, a raid was conducted on Adani Wilmar’s storage facility in Panvel by Madan Yerawar, Minister of State for FDA, due to misleading information found on product advertisements and packaging.

The Adani Group is also involved in the development of a significant port in Myanmar, leasing land from a corporation under the control of the Myanmar military.

In August 2021, the Securities and Exchange Board of India (SEBI) paused Adani Wilmar’s IPO. Although SEBI did not disclose a specific reason, media reports suggested that the halt was due to an investigation into Foreign Portfolio Investment (FPI) in Adani Enterprises, the Adani Group’s flagship company.

In June 2022, a report by C4ADS stated that food companies, including Adani Wilmar, were indirectly supporting forced labour through their indiscriminate import of tainted palm oil.

On February 9, 2023, the Himachal Excise Department conducted a raid on an Adani warehouse. According to the nonprofit organization Adani Watch, Adani, through its joint venture with Wilmar, is a significant refiner and trader in the palm oil industry, which has been responsible for extensive deforestation in Southeast Asia.

Adani-Hindenburg Issue Causes A Big Impact

The fortune of one of India’s wealthiest individuals took a hit following a report by Hindenburg, an investigative institute. Shares of Adani Enterprises, along with other stocks under the Adani Group, experienced a sharp decline after Hindenburg Research, a research firm based in New York, leveled accusations against the conglomerate. The firm alleged that the Adani Group had been involved in a long-standing scheme of stock manipulation and accounting fraud.

The investigative firm claims that the Adani Group has been involved in audacious stock manipulation and accounting fraud schemes amounting to ₹17.8 trillion (US$ 218 billion) over several decades.

According to the report by Hindenburg, the Adani family has been controlling offshore shell companies in tax havens ranging from the Caribbean and Mauritius to the United Arab Emirates. These entities, the report alleges, have been used as conduits for corruption, money laundering, and theft from taxpayers while simultaneously diverting funds from the group’s publicly-traded companies.

Hindenburg Research saw a chance to profit from overpriced stocks. They asserted that the shares were overvalued by 85%, providing an opportunity for short selling. This overseas activity led to a significant drop in Adani companies’ share prices.

By the end of February, the market capitalization of Adani companies had plummeted by $134 billion to $98 billion. Consequently, Adani’s net worth decreased from approximately $120 billion to $46 billion.

After the report was published, assertions were made that the Adani Group had been exonerated by the highest court, leading to a significant surge in their companies’ share prices. This raises questions about the Hindenburg report, which triggered the steep fall in Adani stocks. Was the report misguided and malicious? Could it be considered ‘anti-India’?

AWL Share Price Prediction: Price History

Adani Wilmar’s journey in the public market began with its initial public offering (IPO) in February 2022. The IPO marked a significant milestone for the company, reflecting investor confidence in its business model and growth prospects. The response to the IPO was positive, with shares being oversubscribed, indicating strong investor interest.

Following the IPO, AWL’s shares witnessed a period of volatility. On 11 Feb 2022, AWL shares started trading ₹381, and it quickly declined to a bottom level of ₹344 on 11 March. However, since then, the price continued to rise as it gained increased buying momentum from investors. During this period, AWL’s share price was influenced by various factors, including the company’s financial performance, market sentiment, and broader economic indicators.

Several key events have had a significant impact on AWL’s share price. For instance, the company’s strategic acquisitions and expansion into new product categories have been viewed positively by the market, leading to an increase in share price. AWL’s share price continued to rise and broke above multiple Fib channels. AWL price touched a high of ₹780 by April’s end.

However, the price became a victim of selling pressure, and it quickly dropped to a low of ₹560 and continued to display volatility for the next few weeks. In July, the price then again saw a spike in investor interest as it gained momentum near the dip. AWL share broke through its critical resistance of ₹700 in August, and it then skyrocketed to its all-time high of ₹841 in September.

However, several controversies and allegations sparked a bearish sentiment among investors, and AWL price dropped below ₹500 by 2022’s end. Due to Hindenburg’s allegations, the price initiated extreme selling pressure, and it dropped below multiple crucial support levels in 2023’s Q1. It touched a low of ₹360 in February; however, after winning the case in the Supreme Court, Adani shares rose, and AWL price stabilized near the ₹400 mark.

AWL Share Price Prediction; Technical Analysis

Recently, the Adani Wilmar Limited share price experienced a solid bearish trend, which has brought more selling pressure to the market. The market was heavily influenced due to the poor performance of the Adani group; however, it showed a strong recovery in the last few months and maintained its price stability. Despite facing critical support levels, Adani Wilmar Limited has managed to display a surprising recovery and is now above the bearish territory. A thorough technical analysis of AWL share price reveals bullish indicators, which may soon send the price to new highs. Investors should exercise caution as the short-term growth strategy for AWL appears volatile. The current momentum may not be sustainable as Adani Group is still in a bearish phase.

According to TradingView, the Adani Wilmar Limited price is currently trading at ₹405, reflecting a decrease of over 0.5% in the last 24 hours. Our technical evaluation of AWL price indicates that the bearish momentum may soon fade as bulls may make a comeback to prevent the price from dropping below ₹327. Examining the daily price chart, AWL’s share price has found support near the ₹394 level, from which the price may try to gain further momentum and breach upcoming Fib channels. As the AWL price’s bearish levels struggle below the EMA20 trend line, bears may soon gain confidence and open short positions, pushing the price to lower levels in the coming days. The Balance of Power (BoP) indicator is currently trading in a bearish region zone at 0.48, hinting at a downward correction ahead.

To thoroughly analyze the price of Adani Wilmar Limited shares, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a solid decline as AWL price dropped below the support of ₹404. The trend line is heading toward the overselling region as it currently trades at level 36, and there’s an increased selling pressure building up to begin a downward correction for the AWL price. It is anticipated that AWL’s price will soon attempt to break below its 38.6% Fibonacci level to achieve its short-term bearish goals. If it fails to drop below this Fibonacci region, an uptrend might be on the horizon.

As the SMA-14 continues its downward swing toward the 44 level, it trades slightly above the RSI line, potentially holding promises of the stock’s upward correction on the price chart. If AWL shares surge, it can pave the way to resistance at ₹410. A breakout above will drive the share price toward the upper limit of the Bollinger band at ₹417-₹420.

Conversely, if the AWL fails to hold above the critical support level of ₹401, a sudden collapse may occur, resulting in further price declines and causing the AWL share to trade near the Bollinger band’s lower limit of ₹388. If the price fails to continue a trade above ₹365, it may trigger a more significant bearish downtrend.

Adani Wilmar Price Prediction By Blockchain Reporter

AWL Share Price Prediction 2023

In light of the ongoing market trends and AWL’s growth prospects, we predict a positive outlook for AWL’s share price in 2023. We anticipate an average trading price of around ₹450, with a potential low of ₹380 and a high of ₹470.

AWL Share Price Prediction 2024

Moving into 2024, we expect to see a continued upward trend in AWL’s share price. Factoring in an annual increase, we forecast an average price of ₹500, with a minimum value of ₹430 and a maximum value of ₹520.

AWL Share Price Prediction 2025

By 2025, we predict AWL’s share price to reach an average of ₹550, with a potential low of ₹480 and a high of ₹570. This prediction considers the company’s continued growth and the potential of the agri-business sector.

AWL Share Price Prediction 2026

For 2026, we project an average trading price of ₹600 for AWL, with a minimum value of ₹530 and a maximum potential of reaching ₹620. This forecast takes into account the company’s strategic initiatives and broader market trends.

AWL Share Price Prediction 2027

By 2027, we anticipate AWL’s share price to reach an average of ₹650, with a potential low of ₹580 and a high of ₹670.

AWL Share Price Prediction 2028

Moving into 2028, we forecast an average price of ₹700 for AWL, with a minimum value of ₹630 and a maximum value of ₹720. This prediction considers the company’s continued growth and the potential of the agri-business sector.

AWL Share Price Prediction 2029

For 2029, we project an average trading price of ₹750 for AWL, with a minimum value of ₹680 and a maximum potential of reaching ₹770.

AWL Share Price Prediction 2030

By 2030, we anticipate AWL’s share price to reach an average of ₹800, with a potential low of ₹730 and a high of ₹820. This prediction is based on Adani’s dominance and the overall economic outlook.

Adani Wilmar Share Price Prediction: Industry Experts

View 7 reports from 3 analysts provided long-term price targets for Adani Wilmar Ltd. The average target price for Adani Wilmar Ltd. stands at ₹613.00. This consensus estimate suggests a potential increase of 51.77% from the most recent closing price of ₹403.90.

JP Morgan, a foreign brokerage firm, holds the view that the share price of Adani Wilmar, the newest Adani Group company to be listed on exchanges, may remain stable. The firm has begun coverage of the stock.

The brokerage’s analysts are of the opinion that the stock is currently priced accurately. They have assigned a ‘neutral’ rating to the stock, with a base case target price of Rs 367.

Should You Invest In Adani Wilmar? Here’s The Best Entry Point

Adani Wilmar’s diversified portfolio, strategic growth initiatives, and strong market presence make it an attractive prospect for investors.

However, like any investment, AWL shares come with their own set of risks. The agri-business sector is subject to various factors, such as commodity price fluctuations, regulatory changes, and environmental concerns, all of which can impact AWL’s performance.

Moreover, recent allegations against the Adani Group and the subsequent volatility in its share prices serve as a reminder of the potential risks involved. However, investing in Adani Wilmar Limited at a price of ₹350 will be profitable in the long term.

Adani Wilmar: Financial Reports

Adani Wilmar, a leading FMCG company, recently shared its Q1 updates for the fiscal year 2023-24, highlighting its latest product launches during this period. The company reported a 25% year-on-year volume growth in the edible oil category for the quarter, attributing this to robust consumer demand and a weak base in Q1FY23 due to high edible oil prices triggered by the Russia-Ukraine conflict. Adani Wilmar has been steadily concentrating on expanding its domestic oils portfolio, particularly mustard oil and rice bran health oil.

In the food and FMCG category, the company stated that its food business continued its growth trajectory, with segment revenues increasing by 30% year-on-year to exceed Rs 1000 crore for the quarter on a standalone basis. This growth was driven by a surge in sales of branded products in the domestic market. “Most of our branded food products saw a volume increase of over 25% for the quarter, with many of the new products launched in the market in the past 1 to 2 years experiencing even faster growth,” the company stated.

Conclusion

Adani Wilmar’s performance, reflected in its share price and financial results, demonstrates its commitment to growth and innovation. Its recent product launches and consistent focus on expanding its domestic oils portfolio underscore its ability to adapt to market trends and consumer demands.

However, like any company, Adani Wilmar Limited has faced its share of challenges. Allegations of regulatory contraventions and market volatility have tested the company’s fundamentals. Yet, AWL’s ability to navigate these challenges reflects its robust management and strategic vision.

FAQ

Who are the owners of Adani Wilmar Limited (AWL)?

Adani Wilmar Limited is a joint venture between the Adani Group of India and Wilmar International of Singapore, two industry titans in the agri-business sector.

What products does Adani Wilmar Limited (AWL) offer?

AWL offers a range of products, including edible oils, basmati rice, pulses, soya chunks, wheat flour, and more under its flagship brand, ‘Fortune’. In 2019 and 2020, AWL also entered the personal care segment and the Ready to Cook (RTC) product market.

How has Adani Wilmar Limited (AWL) grown over the years?

Since its inception in 1999, AWL has expanded through strategic partnerships and acquisitions, adding several crushing and refining units to its portfolio. In 2022, AWL made a significant move by acquiring the Kohinoor, Trophy Royale, and Charminar rice brands from Mccormick & Company.

What controversies has Adani Wilmar Limited (AWL) faced?

AWL has faced several controversies, including accusations of misleading product information, stock manipulation, support of forced labor, and involvement in deforestation in Southeast Asia. In June 2022, a report by Hindenburg Research alleged that the Adani Group, AWL’s parent company, had been involved in audacious stock manipulation and accounting fraud schemes.

What impact did the Hindenburg report have on AWL’s share price?

The allegations made in the Hindenburg report led to a significant drop in AWL’s share price. By February 2023, the market capitalization of Adani companies had decreased by $134 billion to $98 billion.

How has AWL’s share price performed in the past?

AWL’s share price has witnessed a period of volatility since its initial public offering (IPO) in February 2022. Following the IPO, AWL’s shares experienced both ups and downs, influenced by various factors such as the company’s financial performance, market sentiment, and broader economic indicators.

What are the predictions for AWL’s share price in the future?

By 2023, the average trading price for AWL is predicted to be around ₹450, with a potential low of ₹380 and a high of ₹470. This is expected to gradually increase over the years, reaching an average of ₹800 by 2030.

What is the consensus among industry experts regarding AWL’s share price?

The average target price for AWL stands at ₹613.00, according to seven reports from three analysts. JP Morgan, a foreign brokerage firm, has assigned a ‘neutral’ rating to the stock, with a base case target price of Rs 367.

Is it a good time to invest in Adani Wilmar Limited (AWL)?

Despite potential risks such as commodity price fluctuations, regulatory changes, and recent allegations against the Adani Group, AWL’s diversified portfolio, strategic growth initiatives, and strong market presence make it an attractive prospect for long-term investment.

How has Adani Wilmar performed financially?

In its Q1 updates for the fiscal year 2023-24, AWL reported a 25% year-on-year volume growth in the edible oil category, attributing this to robust consumer demand.

READ MORE:

Yes Bank Share Price Prediction 2025: Will Yes Bank Stock Recover from Crisis?

Reliance Power Share Price Future Prediction 2025: Will RPOWER Stock Reach ₹100 In 2023?

Xxc Renegade 1000 Xxc Price Prediction: Will This ATV Gain Popularity In 2023?

AMC Stonk-O-Tracker: The Power of Retail Investors in the Market