- Bhel: A Quick Introduction

- Bhel: Operations And Roadmap

- Bhel Share: Price History

- Bhel Share Price: Technical Analysis

- Bhel Share Price Prediction By Blockchain Reporter

- Bhel Share Price Prediction 2023

- Bhel Share Price Prediction 2024

- Bhel Share Price Prediction 2025

- Bhel Share Price Prediction 2026

- Bhel Share Price Prediction 2027

- Bhel Share Price Prediction 2028

- Bhel Share Price Prediction 2029

- Bhel Share Price Prediction 2030

- Bhel Share Price: Experts’ Forecast

- Bhel Reports Robust Financial Performance

- Conclusion

In a country as vast and diverse as India, the development of critical infrastructure sectors like power, transmission, transportation, and renewable energy holds a top priority. These sectors are the backbone of any economy, and their robustness directly correlates with the nation’s growth, prosperity, and global standing. The power sector in India has undergone a significant transformation since its inception. From the early days of small, localized grids to the current expansive networks, the focus has always been on ensuring energy security and accessibility. The sector has been a focal point of various Five-Year Plans, and the government’s push towards electrification has been robust. Over the years, India has built one of the largest transmission networks in the world, connecting even the most remote areas.

The transportation sector is the lifeline that connects the length and breadth of the country. From the early days of the railway network laid down by the British to the modern, expansive roadways, ports, and airports, the focus has been on enhancing connectivity and reducing travel time. With climate change becoming a global concern, India has been at the top of adopting renewable energy solutions. Initiatives like the International Solar Alliance have put India on the global map as a leader in renewable energy. In these sectors, one name stands out for its contribution—Bharat Heavy Electricals Limited (BHEL). Established in 1956, BHEL has been a leader in engineering and manufacturing a wide range of products, systems, and services in these critical sectors. In this article, we will explore Bhel’s history since its inception, its roadmap, Bhel share price and its upcoming price trajectory till 2030 with in-depth technical analysis.

Bhel: A Quick Introduction

BHEL, founded in 1956, helped start India’s heavy electrical equipment industry. It got technical help from the Soviet Union and became a leader in thyristor technology in the 1980s. In 1991, it became a public company. BHEL makes a wide range of equipment for different industries, but most of its money comes from selling power generation equipment like turbines.

BHEL has been selling its products internationally for over 40 years. It has customers in 76 countries and has installed power plants that generate over 9,000 MW of electricity in 21 countries, including places like Malaysia and Egypt. They offer everything from complete projects to after-sales services.

As time went on, BHEL started making more and more types of equipment, like turbines that help generate electricity and transformers that help move electricity from one place to another. They even set up a big factory in Haridwar in 1967, which became famous for making really good, precise equipment.

But BHEL didn’t just focus on India. It also started selling its products to other countries. In fact, it has sold stuff to over 82 countries all around the world, including places in the Middle East, Africa, and Southeast Asia. People in other countries like BHEL’s products because they are high-quality and reliable, so they often choose BHEL for big projects.

Bhel: Operations And Roadmap

BHEL is a major company in India that designs, makes, and services a wide variety of products for important sectors like power, transportation, and defense. It has a big network of manufacturing and service centers in India and abroad and can produce equipment for generating 20,000 MW of electricity each year.

In 2015-16, BHEL was the market leader in India’s power sector with a 74% share. That year, it set a record by installing over 15,000 MW of power plants, a 59% increase from the previous year. It has also been involved in India’s nuclear program since 1976, making critical components for nuclear power plants.

BHEL, one of India’s top corporate R&D investors, spent ₹1,252 Crore on research in 2012-2013, making up 2.50% of its turnover. This focus on innovation led to a 21.5% increase in its Intellectual Property Rights, totalling 2170. The company’s R&D division in Hyderabad spearheads research in various fields, supported by specialized groups at its manufacturing divisions. BHEL has also set up expert centers and institutes, such as the Welding Research Institute and the Ceramic Technological Institute.

A notable achievement for BHEL was supplying its 100th space-grade battery to ISRO for the Chandrayaan 3 mission, made at its Bengaluru division. The company also contributed to the Kaiga power plant, which set a world record for running 962 continuous days. BHEL’s commitment to innovation has earned it global recognition. It’s one of only four Indian firms listed in ‘The Global Innovation 1000’ by Booz & Co. and was ranked the 9th most innovative company worldwide by Forbes in 2011.

In 2023, NPCIL and BHEL signed an agreement to work together on nuclear power plants using Pressurized Heavy Water Reactor technology. BHEL is involved in all three stages of India’s Nuclear Programme.

Also, in 2023, BHEL announced its involvement in the Indian Railways’ ambitious plans, particularly in updating the signaling systems. As technology advances, BHEL will play a key role in modernizing these systems.

Bhel Share: Price History

BHEL was listed on the stock exchanges in the late 1990s, and its initial years were marked by steady growth. The company’s shares were considered a safe bet for long-term investors, primarily because of its monopoly in the heavy electrical sector and strong government backing.

Bhel share price began trading in the Indian stock market at a price of ₹17 in 1999. However, the price remained stable for a few years as it failed to gain investors’ confidence. The early 2000s saw a surge in BHEL’s share price, mirroring the company’s robust performance. Bhel share price started its upward journey in early 2003 and reached ₹30 by the end of the year.

With the Indian economy booming and infrastructure projects on the rise, BHEL became the go-to company for heavy electrical equipment. This period could be termed the ‘Golden Era’ for BHEL shareholders, as the stock yielded impressive returns. Bhel share price continued to skyrocket, breaking above new highs each month. In early 2006, it broke above ₹100, and with a slight downward volatility, it managed to reach a high of ₹366 in 2007’s December.

However, like all good things, this period of prosperity was followed by a downturn. The global financial crisis of 2008 had a significant impact on BHEL’s share price. The company faced stiff competition from international players, and its market share began to erode. This led to a decline in the stock price, causing concern among investors. The share value witnessed a heavy selloff and dropped by over 50% in 2008, touching the ground at ₹158 in October. However, the price witnessed a robust rebound from that level since then, and it began a recovery rally in 2009. In 2010, Bhel share’s value reached ₹332, sparking a wave of investors’ interest.

However, this bullish momentum was short-lived as the share price triggered a heavy bearish momentum. In mid-2013, the share price dropped below ₹100 and reached a low of ₹77. However, it witnessed a slight rebound toward ₹186 in the next two years but failed to hold buying pressure. The price continued to decline heavily in the next few years, and the bearish dominance accelerated in 2020 due to the COVID-19 pandemic. Bhel share price touched a low below ₹20 in early 2020.

In recent years, BHEL has been focusing on diversification and modernization to regain its market share. While the stock has shown signs of recovery since 2020, it has yet to reach its previous highs. Bhel has risen by five times since the 2020 crash as the company’s foray into renewable energy and its efforts to secure international contracts have been viewed positively.

Bhel Share Price: Technical Analysis

Recently, the Bhel share price witnessed a solid bearish trend in the last few days, which has brought a heavy selloff among traders in the market. The market is heavily influenced by declining buying pressure among investors; however, Bhel still maintains a bullish momentum above the key support level and continues to hold its price stability. Despite facing critical support levels in the past, Bhel’s shares have managed to display a robust recovery and are now above the fear zone. A thorough technical analysis of Bhel share price reveals minor bullish indicators with bearish signals, which may soon send the price to increased volatility. Investors should exercise caution as the short-term movement for Bhel remains volatile.

According to TradingView, the Bhel share price is currently trading at ₹105.2, reflecting a decrease of over 2.23% in the last 24 hours. Our technical evaluation of Bhel’s price indicates that the bearish momentum may soon intensify if bulls fail to make a comeback to prevent the price from dropping. Examining the daily price chart, Bhel share price has found support near the ₹104 level, which is an immediate support level, and bulls are trying hard to hold the trend above this level. As the Bhel price continues to face bearish domination to surge above the ascending channel pattern at ₹113, bears may soon gain confidence and open short positions, pushing the price to lower levels in the coming days. The Balance of Power (BoP) indicator is currently trading in a bearish region zone at 0.57, hinting at a downward correction ahead.

To thoroughly analyze the price of Bhel shares, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a massive decline as Bhel’s price made a declining trend from ₹113 after failing to gain buying pressure near higher levels. The RSI trend line is heading toward the midline as it currently trades at level 54, and there’s an increased selling pressure building up to begin a downward correction for the Bhel price. It is anticipated that Bhel shares will soon attempt to break below its 38.6% Fibonacci level to meet its short-term bearish goals. If it fails to decline below this Fibonacci region, an uptrend might be on the horizon.

As the SMA-14 continues its upward swing toward the 57 level, it trades slightly above the RSI line, potentially holding promises of the stock’s bullish movement on the price chart. If Bhel shares rebound from the support line, it can pave the way to resistance at ₹113. A breakout above will drive the share price toward the upper limit of the Bollinger band at ₹122.

Conversely, if the Bhel fails to hold above the critical support level of ₹95, a sudden collapse may occur, resulting in further price declines and causing the Bhel share to trade near the Bollinger band’s lower limit of ₹80. If the price fails to continue a trade above the support line, it might trigger a more significant bearish downtrend toward ₹42.

Bhel Share Price Prediction By Blockchain Reporter

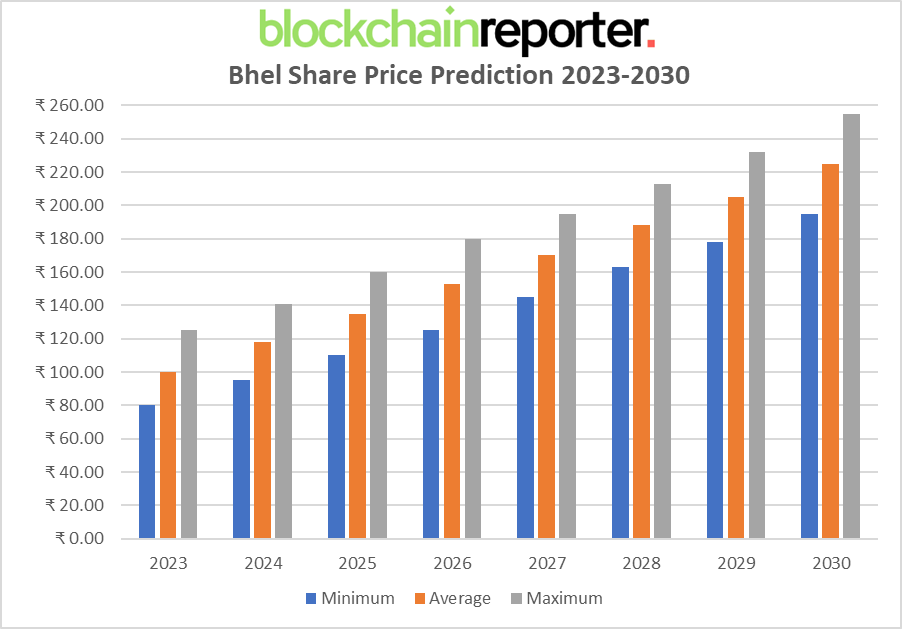

Bhel Share Price Prediction 2023

In 2023, the average price for BHEL shares is predicted to be around ₹100. The minimum price could potentially drop to ₹80, while the maximum price could rise to ₹125. BHEL’s commitment to innovation and its strong foothold in the engineering and manufacturing sectors are key drivers for this prediction.

Bhel Share Price Prediction 2024

By 2024, the average price for BHEL shares is projected to be around ₹118. The minimum price could be around ₹95, while the maximum price could soar to ₹141. The expected growth is due to BHEL’s strategic initiatives to expand its market presence and diversify its product offerings.

Bhel Share Price Prediction 2025

In 2025, the average share price for BHEL is expected to climb to ₹135. The minimum price is estimated to be ₹110, and the maximum could reach ₹160. This growth is likely due to BHEL’s continued focus on renewable energy projects and its efforts to modernize its existing infrastructure.

Bhel Share Price Prediction 2026

For the year 2026, the average share price of BHEL is predicted to be ₹153. The minimum and maximum prices are expected to be ₹125 and ₹180, respectively. The company’s investment in research and development and its push towards sustainability are expected to contribute to this upward trend.

Bhel Share Price Prediction 2027

By 2027, the average price for BHEL shares could rise to ₹170. The minimum price is projected to be around ₹145, while the maximum could hit ₹195. BHEL’s potential partnerships with international engineering firms and its expansion into global markets are likely to be significant factors in this prediction.

Bhel Share Price Prediction 2028

In 2028, the average share price for BHEL is forecasted to be ₹188. The minimum price could be around ₹163, and the maximum price could escalate to ₹213. The company’s focus on digital transformation and automation could play a pivotal role in driving this growth.

Bhel Share Price Prediction 2029

For 2029, the average share price of BHEL is estimated to be ₹205. The minimum price could potentially be ₹178, while the maximum could reach ₹232. The company’s commitment to environmental sustainability and its potential entry into new sectors like electric vehicle charging infrastructure could be key drivers.

Bhel Share Price Prediction 2030

By the year 2030, the average price for BHEL shares is projected to be around ₹225. The minimum price could be ₹195, and the maximum could soar to ₹255. As BHEL continues to innovate and adapt to market demands, its long-term prospects look promising.

Bhel Share Price: Experts’ Forecast

Domestic brokerage firm Nuvama Institutional Equities has elevated its rating of Bharat Heavy Electricals Ltd (BHEL) to a ‘buy’ recommendation. The firm has also maintained BHEL on its exclusive “braveheart” list, citing limited competition and an imminent revival in thermal capital expenditures as key factors.

Nuvama has significantly raised the target price for BHEL’s stock by 47%, moving it toward ₹150. According to the brokerage’s analysis, the stock has the potential to experience an upside of more than 30% from its current trading levels.

The stock of BHEL has recently broken through its prior swing high, accompanied by a significant increase in trading volumes. According to Ajit Mishra, Senior Vice President of Technical Research at Religare Broking Ltd., the current chart pattern suggests that the ongoing recovery is likely to persist. Investors are advised to consider buying the stock with a target price of Rs 114 over the next one to two months.

Bhel Reports Robust Financial Performance

Bharat Heavy Electricals Limited (BHEL), a leading player in India’s heavy electrical equipment industry, has released its annual report for the fiscal year 2022-23, showcasing impressive financial and operational achievements.

Financial Highlights

- Revenue Surge: The company reported a 10% increase in its revenue from operations, reaching ₹23,365 Crore as compared to ₹21,211 Crore in the previous fiscal year.

- Profit Growth: BHEL also saw a rise in its Profit After Tax (PAT), which stood at ₹448 Crore, up from ₹410 Crore last year.

Operational Efficiency

- Receivables Management: Despite a 9% increase in total receivables, the company managed to reduce the number of days of Revenue from Operations from 571 to 567 days. Additionally, Trade Receivables in terms of the number of days have reduced to 102 days from 107 days in FY 2021-22.

Record Order Bookings

- Historic Orders: BHEL secured orders worth ₹23,548 Crore, marking the highest in the last five years. The company also reported its highest-ever orders in the defense sector, including an exclusive order for 20 upgraded SRGMs (main guns on Indian warships).

- Thermal Power Leadership: The company won the only thermal EPC order—2×660 MW, NTPC Talcher Thermal Power Plant—awarded in the last four years, reaffirming its market dominance.

Business Expansion

- Spares & Services: The Spares & Services Business segment recorded a growth of over 25%.

- Outstanding Order Book: As of March 31, 2023, the total outstanding order book stood at ₹91,336 Crore. With the recent prestigious order for 80 “Vande Bharat” trainsets in April 2023, the order book has crossed ₹1 Lakh Crore, the highest in the last four years.

Awards and Recognition

- Quality Reporting: BHEL has twice won the ICAI Award for ‘Excellence in Financial Reporting’ in the ‘Infrastructure and Construction Sector’ category, highlighting its commitment to quality accounting and reporting practices.

The annual report underscores BHEL’s strong financial health and its ability to secure large-scale orders, particularly in the defense and thermal power sectors.

Conclusion

Bhel share price has shown overwhelming performance over the last few months. Moreover, its diverse portfolio and working sectors have been a great option for investors in the long term. BHEL’s dominance in the Indian market is evident from its widespread network of manufacturing units, service centers, and project sites across the country. It has been a key contributor to India’s power infrastructure, supplying a substantial portion of the country’s power generation equipment.

While BHEL has a strong historical track record, it faces challenges such as increasing competition, both domestically and internationally, and the need for technological upgrades to meet industry standards. Additionally, the company’s performance is closely tied to government policies and economic cycles, making it susceptible to external factors. Hence, it is advised to do your own research before investing in this stock.