In the last 24 hours, the price of BNB attempted meet buyers’ demand as it surged toward $630; however, it faced selling pressure and declined. Now, buyers are now on an upward rally again as BNB price aims to regain the $630 level. Additionally, BNB’s trading volume has dropped by 2.89% in the past 24 hours, reaching $2.09 billion.

Looking at the bigger picture, BNB’s price has been facing increasing volatility since the crash on February 3. Additionally, it lost buyers’ demand due to the recent $1.5 billion theft in Bybit. In the last 24 hours, its market cap has dropped by 1.4% to $87.6 billion.

BNB Faced a Surge in Long Liquidation

BNB has been experiencing rising volatility as it attempts to breach the $630 mark. Despite a recent effort to surpass this level, it was unable to sustain upward momentum, succumbing to increasing selling pressure and subsequently falling below $620.

Over the last 24 hours, significant trading activity has been noted in BNB. According to Coinglass, approximately $1.61 million worth of BNB was traded, with $1.43 million stemming from buyers liquidating their long positions and sellers closing around $177,000 worth of positions.

Open interest in BNB has also seen a notable increase, reaching $757 million, up 0.48% from the previous day, suggesting a growing demand. Nonetheless, the funding rate remains negative at 0.0013%.

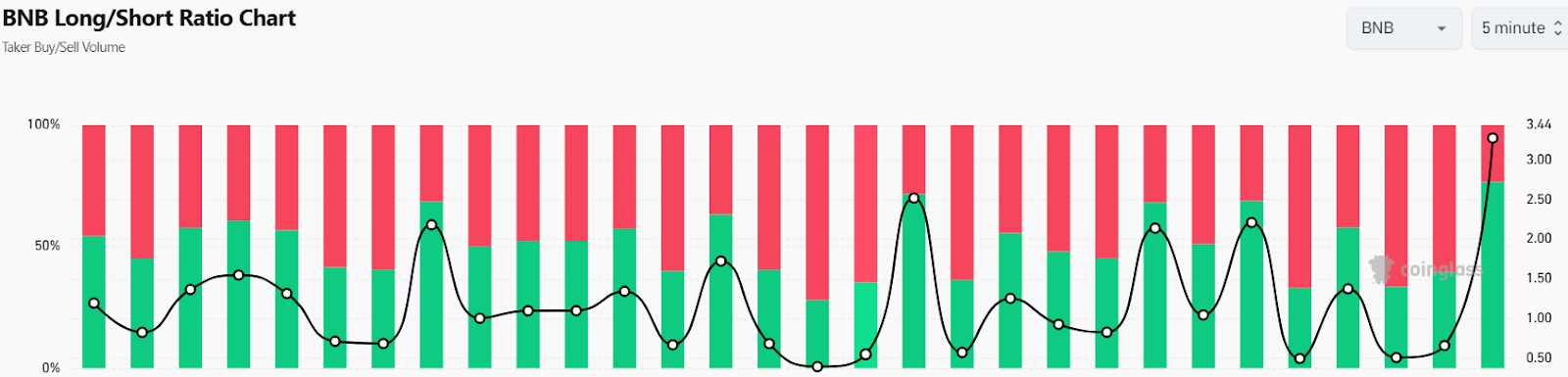

Despite these challenges, the sentiment among traders might be shifting towards optimism, as evidenced by the increasing ratio of long to short positions at 3.279. Currently, 77% of traders are betting that BNB’s price will rise, indicating a potential shift towards a bullish market.

BNB Price Prediction: Technical Analysis

Binance Coin (BNB) tried to sustain momentum above $630 but encountered significant resistance, leading to a sharp decline on the price chart, which pushed its value below $620. This caused increased volatility in the $610-$630 range. Currently, BNB is trading at $615, marking a 1.68% decrease in the last 24 hours.

The BNB/USDT trading pair aims for $647 but may face substantial resistance, potentially leading to a retest of the $600-$630 zone. With the Relative Strength Index (RSI) at 43, just below the midpoint, BNB could experience strong selling pressure. If the price manages to break above $647, a correction toward $685 could occur.

On the other hand, a drop below $595 could send the price down toward $560.

BNB Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, BNB price might continue to surge toward $647. If the price moves above that level, we might see a trade around $685. On the downside, $595 is the range.

Long-term: According to the latest analysis from Coincodex, the price of Binance Coin is projected to increase by 13.36%, hitting $714.57 by March 28, 2025. Current technical indicators suggest a bearish sentiment, while the Fear & Greed Index is at 21, indicating Extreme Fear. Over the last 30 days, Binance Coin has experienced 16 green days, representing 53% of the time, with a price volatility of 5.47%. Based on these predictions from Coincodex, it is currently advised against buying Binance Coin.

How much is the BNB price today?

BNB price is trading at $615 at the time of writing. The BNB price has dropped by over 1.6% in the last 24 hours.

What is the BNB price prediction for February 27?

Throughout the day, BNB price might continue to surge toward $647. If the price moves above that level, we might see a trade around $685. On the downside, $595 is the range.

Is BNB a Good Buy Now?

According to long-term forecasts, the BNB price might reach $714.57 by March 28. This makes BNB price a good investment considering its monthly yield.

Investment Risks for BNB

Investing in BNB prices can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.