In the last 24 hours, the price of BNB is attempting to meet buyers’ demand as it surged toward $610. Though buyers are trying to send the price above immediate Fib level, sellers are strongly defending a surge above $610. Additionally, BNB’s trading volume has surged by 1.6% in the past 24 hours, reaching $1.65 billion.

Looking at the bigger picture, BNB’s price has been facing increasing downward volatility since the crash on February 3. However, BNB is now recovering toward a bullish rally. In the last 24 hours, its market cap has dropped by 0.72% to $85.4 billion.

BNB’s Long-Liquidation Surges

BNB recently exhibited a strong bullish push, breaking past the $600 barrier. However, its momentum is being tested as it struggles to surpass the $610 level due to robust resistance from bearish traders.

In the trading activity over the last 24 hours, significant movements have been noted. Coinglass reports that around $528.7K in BNB trades were settled, with $402K originating from buyers liquidating their long positions, while sellers closed positions amounting to $126.7K.

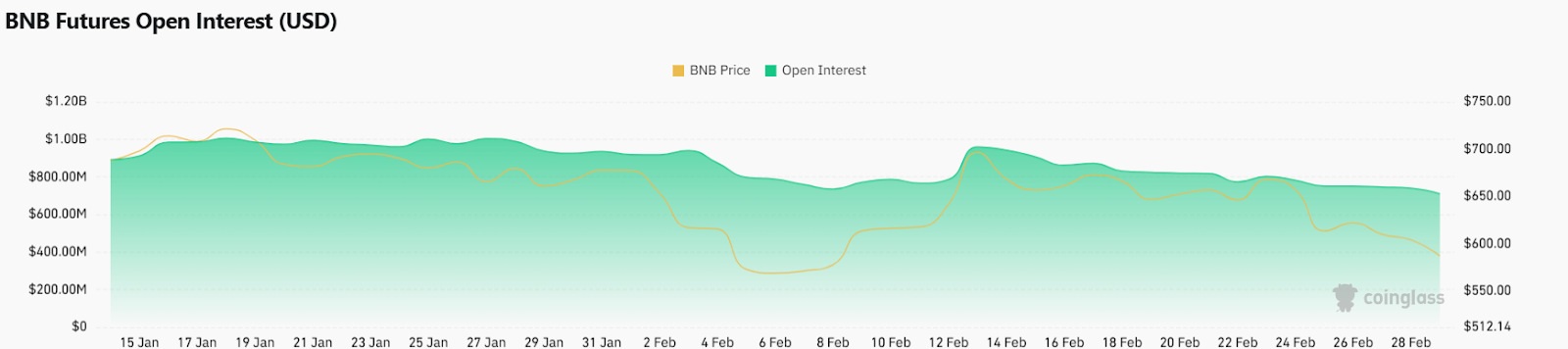

The total open interest in BNB, representing all active trading contracts, has risen slightly by 1.6% to $682 million, suggesting a modest increase in trading interest. Despite this, the negative funding rate of -0.005% indicates a less favorable view on BNB.

Additionally, the drop in the long to short position ratio to 0.78 highlights a growing preference for short positions among traders, with 55% anticipating a decrease in BNB’s price in the near future, signaling potential bearish sentiment on the horizon.

BNB Price Prediction: Technical Analysis

Binance Coin (BNB) has staged a robust recovery, successfully breaking the $600 threshold. Despite this rise, it faced resistance at $610 where selling pressures intensified, leading to difficulties in sustaining the upward momentum. Currently, BNB is trading at $602, having risen by 0.56% over the past 24 hours.

In the trading arena, the BNB/USDT pair is approaching a descending resistance line, which could potentially lead to a rejection and a subsequent retest of the $600 zone. However, the Relative Strength Index (RSI) standing at 55 suggests that BNB is in the buying zone, indicating possible buying interest that could push the price over the resistance line, potentially reaching as high as $625.

Conversely, should the sellers gain the upper hand, BNB could be pushed down towards the critical support level at $550. A failure to maintain above this level could precipitate a sharp decline towards $501.

BNB Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, BNB price might aim for a surge toward the resistance line. If the price moves above that level, we might see a trade around $625. On the downside, $550 is the range.

Long-term: According to Coincodex’s current Binance Coin price prediction, the price of Binance Coin is expected to increase by 48.08%, reaching $891.71 by April 6, 2025. Technical indicators from Coincodex point to a Bearish current sentiment, while the Fear & Greed Index registers at 34, indicating Fear. In the last 30 days, Binance Coin has seen 16 green days, which accounts for 53% of the time, with a price volatility of 5.49%. Based on these insights, the forecast suggests that it is currently an unfavorable time to invest in Binance Coin.

How much is the BNB price today?

BNB price is trading at $602 at the time of writing. The BNB price has surged by over 0.56% in the last 24 hours.

What is the BNB price prediction for March 7?

Throughout the day, BNB price might aim for a surge toward the resistance line. If the price moves above that level, we might see a trade around $625. On the downside, $550 is the range.

Is BNB a Good Buy Now?

According to long-term forecasts, the BNB price might reach $891.71 by April 6. This makes BNB price a good investment considering its monthly yield.

Investment Risks for BNB

Investing in BNB prices can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.