Japanese Market Strategy Unveiled

Today, Binance Japan held a virtual business discussion, where Mr. Tsuyoshi Chino, the company’s head, shared their insights on their ambitions within Japan, highlighting potential collaboration opportunities with stablecoins.

Binance Japan has been in the limelight since its service inception on August 2nd. During this digital meet-up, Mr. Chino detailed their plans for domestic expansion. These include insights into the equities they handle, leverage trading, and features available in Binance’s international version.

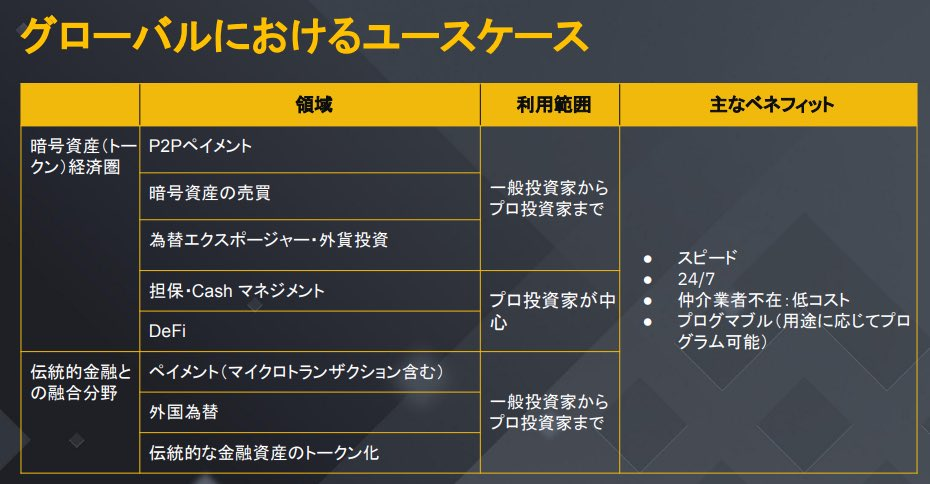

Furthermore, Mr. Chino expressed Binance Japan’s intent to connect their ecosystem with Japanese private entities and governmental bodies, extending beyond just crypto transactions. Central to this vision are stablecoins, which they aim to integrate into the existing financial infrastructure. Active partnership endeavors, leveraging Binance’s impressive tech and track record, are also on the cards.

At present, Binance Japan’s primary services comprise cryptocurrency spot trading and their crypto lending offering, “Simple Earn.” They’re also eyeing leverage trading expansion, aligning it with their international version once they secure the necessary licensing.

Globally, Binance boasts a plethora of services, including the “Launchpad” IEO platform for budding projects, a staking service, and an NFT marketplace. Though Mr. Chino remained tight-lipped about the exact timeline for launching these services in Japan, he reassured their gradual incorporation, complying with local regulations.

With an impressive record of managing 34 equities from day one, Binance Japan takes the lead in the country. It’s also worth noting that Binance’s tokens “Build and Build (BNB)” and “Algorand (ALGO)” marked their debut in Japan.

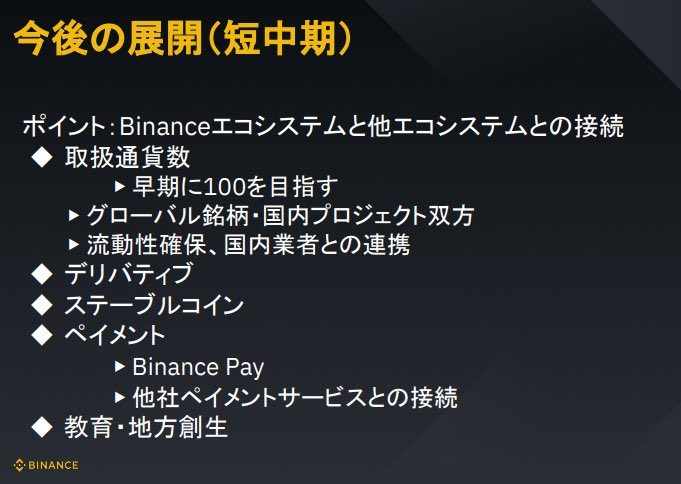

Contrastingly, Binance’s global counterpart handles a whopping 350 stocks. Mr. Chino has a preliminary target of managing 100 equities, with a special emphasis on those that resonate with the Japanese market.

Stablecoins: Opportunities and Hurdles

Binance Japan is fervently working on synergizing the Binance Global ecosystem with Japanese market dynamics. Their short-to-mid-term objectives encompass Security Token Offering (STO) payments through stablecoins, merchant onboarding for “Binance Pay”, educational initiative development, and more.

A significant point of interest for Mr. Chino is the recent regulatory upliftment for Japanese yen stablecoins. He highlighted Japan’s regulatory predictability, viewing it as a boon for business expansion.

Japan’s stablecoin issuance framework is stringent, restricted to specific entities like banks and trusts. Nevertheless, collaborations for joint developments are under consideration. Mr. Chino perceives potential in using yen-based stablecoins for varied purposes like trade deals and programmable payments.

The Japanese central bank’s CBDC venture and the evolving landscape of programmable payments also hold promise. Mr. Chino, in an exclusive chat with CoinPost, discussed the potential of growing Binance’s user base in Japan by collaborating with local brokerage firms.

The Road Ahead: A Blend of Traditional and Virtual Finance

Drawing parallels with the U.S., where traditional and digital finance are merging, Mr. Chino foresees a similar trajectory in Japan. He believes that the future will unveil diverse trading modalities, not just limited to crypto exchanges.

Institutional investor participation is crucial for ensuring market liquidity. Moreover, Mr. Chino hinted at flexible business models, suggesting indirect account access to Binance.

Taking charge of Binance Japan in July 2022, Mr. Chino has showcased his prowess by rapidly acquiring Sakura Exchange. For Binance Japan’s ambitious ecosystem integration, having teams skilled in Japanese negotiations and partnerships is vital.

With an international outlook, the keys to success encompass proactivity and taking strategic actions. Whether it’s Web3 projects, talent acquisition, or corporate collaborations, Binance Japan is proactive, with numerous proposals already in the pipeline. Mr. Chino stressed the firm’s commitment to talent acquisition to fuel their Japanese business expansion.