In a surprising twist, Bitcoin, the leading cryptocurrency, has soared beyond the $28,000 threshold, a height unseen since August 17th. This sudden surge in demand has reignited the optimism of crypto enthusiasts and ignited a wave of conversations among market experts and investors. With Bitcoin experiencing significant accumulation during its dips, on-chain analytics company Santiment anticipates a climb to $30K, provided these major holders resist cashing in for profits.

Bitcoin Begins Its Uptober Journey; Wipes $39 Million Short-Positions

Over $60 million in crypto shorts faced abrupt liquidation following an unexpected rise in the prices of Bitcoin, ETH, and other digital currencies on October 2. Data from TradingView reveals that Bitcoin experienced a swift 3% increase within a mere 15 minutes, jumping from $27,100 to $28,000. It later stabilized slightly above the $28,000 threshold at the report’s time.

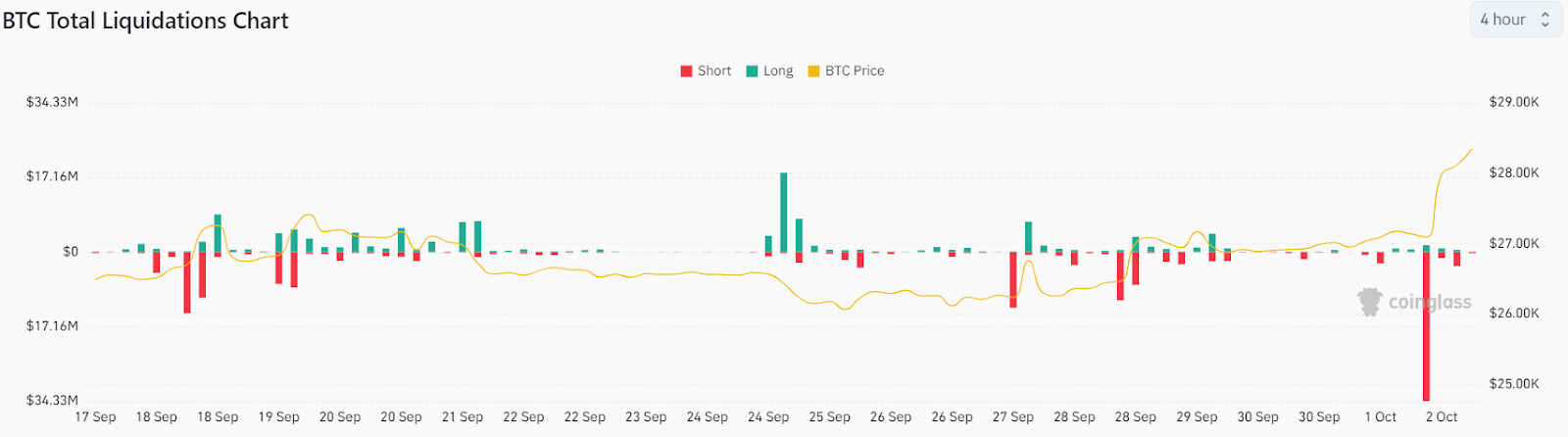

Data from Coinglass reveals that BTC price witnessed a surge in short-liquidation worth $39 million over the past few hours after the price experienced buying demand near $27K. This extensive liquidation highlights the growing buying pressure, particularly as bears couldn’t sustain a selling momentum. For those unfamiliar, short-liquidation is when traders, expecting a price decrease, are compelled to exit their positions, often at a loss, due to unexpected upward movements.

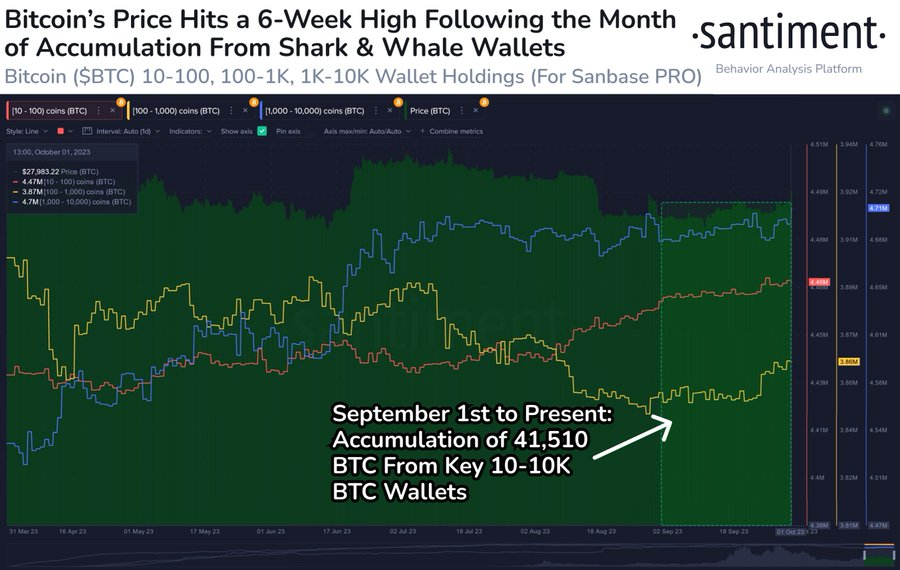

The reason behind the sudden surge is simple, according to Santiment. On-chain data reveals that as September was one of the worst months for Bitcoin this year, it plunged the asset to multiple dips. This created a profitable opportunity for whales to accumulate BTC at a discounted price. Santiment reveals that wallets holding between 10 to 10,000 BTC were on a shopping spree, accumulating a staggering $1.17 billion worth of Bitcoin (41,510 BTC) since the start of September. Such aggressive accumulation patterns are the reason for the sudden surge, beginning the trend of ‘Uptober.’

Bitcoin Sees A Rise In Profit-Booking Concerns

With BTC’s price comfortably surpassing the $28K milestone, there’s growing concerns about potential bearish trends. Many speculate that significant holders may seek to exit the market if BTC encounters forthcoming resistance. Such a move could instill anxiety among BTC investors, potentially triggering a substantial selloff and pushing BTC into a bearish zone. Nonetheless, analytics firm Santiment projects that if BTC maintains its current stance, it could soon approach the pivotal $30K level.

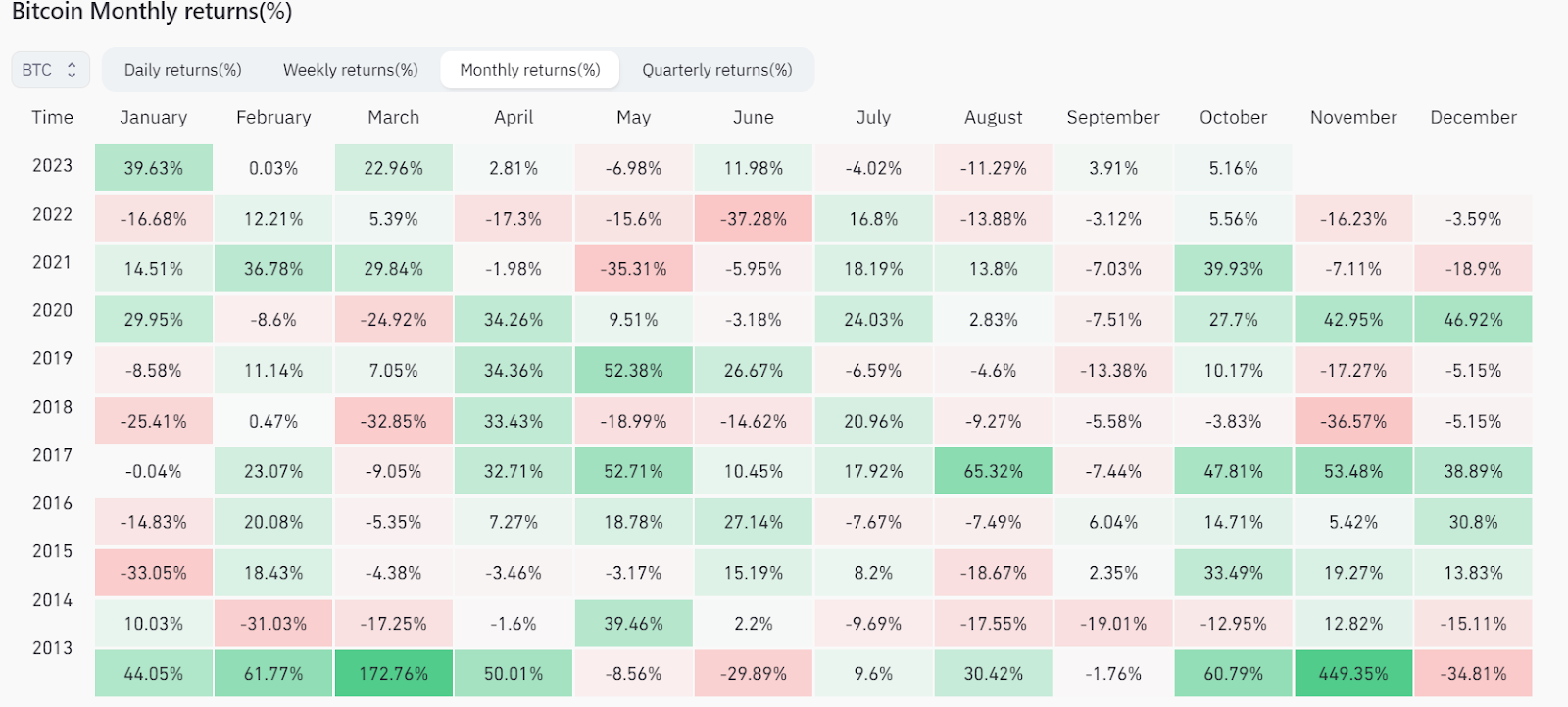

However, Bitcoin has largely showcased a bullish trend in October. From 2013 onwards, Bitcoin’s price has typically risen in October, with 2014 and 2018 being the only exceptions.

A closer look at the statistics reveals that Bitcoin didn’t just experience positive growth; it yielded an impressive average return of over 20% for the month. Given this historical performance and the average return rate, there’s a strong argument for Bitcoin’s potential price movement this October. If history repeats itself and the crypto ETF market remains positive, we might see Bitcoin’s price reaching an estimated value of $32,400 from the $27K level.

Furthermore, Bitcoin’s Open Interest (OI) metric has witnessed a remarkable increase, soaring by $600 million today and currently standing at $11.89 billion. A significant rise in open interest can impact Bitcoin’s price. Historically, an uptick in OI often indicates heightened trading interest, potentially leading to more pronounced price fluctuations.

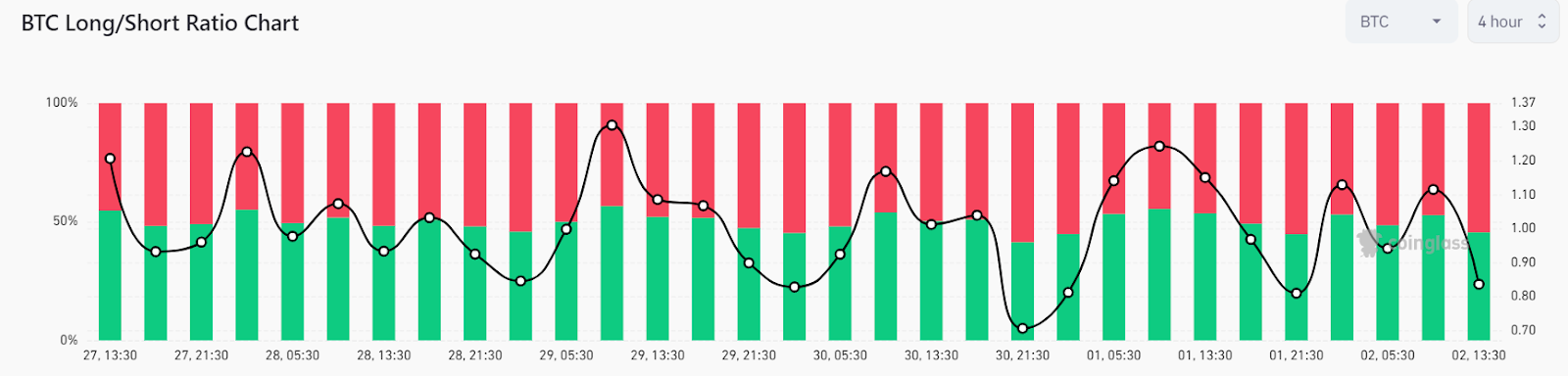

Yet, despite the bullish sentiment among traders, BTC’s price could encounter selling pressure around $28,500. The market is showing signs of increasing bearishness, with a noticeable uptick in short positions near the immediate resistance. Given the long/short ratio at 0.8359 and a dominant 54.47% short-positions, a bearish reversal seems plausible.