Bitcoin’s price experienced a 10% surge following President Donald Trump’s announcement of a U.S. strategic cryptocurrency reserve. Bitcoin price faced a strong bullish pressure as it broke above the $90K mark. Currently, the buying demand is on a rise as BTC continues to break above immediate resistance channels. Over the past 24 hours, Bitcoin’s trading volume has increased by more than 281%%, totaling $76.3 billion.

In a broader perspective, Bitcoin fell below $100,000 on January 7 and showed a downward trend. It reached a low of approximately $89,397 on January 13. On Feb 3, Bitcoin again crashed and reached a low near $91K. In recent days, the price made a severe downtrend toward $80K but has now recovered. Over the last 24 hours, its total market capitalization surged by 7.5%, settling at $1.81 trillion.

Bitcoin Faced Nearly $415 Million in Liquidation

President Trump’s announcement of an upcoming U.S. strategic cryptocurrency reserve, featuring assets like bitcoin, ether, XRP, Solana, and Cardano, has significantly influenced recent price trends. This effort seeks to establish the U.S. as a leader in the cryptocurrency sector, highlighting a change in regulation under the new Trump administration.

Bitcoin experienced a sharp increase in its price, surging from the low of $85,075 to $95,000. Additionally, institutional interest has also surged. Simon Gerovich, CEO of Metaplanet, a Japanese hotel developer that has pivoted to a bitcoin treasury firm, announced on Sunday the purchase of 156 BTC for about $13.4 million, at an approximate rate of $85,890 per bitcoin.

Gerovich stated that the company now possesses a total of 2,391 BTC. This acquisition highlights ongoing institutional belief in the long-term value of Bitcoin.

The drop in selling pressure is further triggered by the latest U.S. macroeconomic figures meeting inflation expectations. The January PCE index, which is the Federal Reserve’s favored inflation measure, reported a decline to 2.6%.

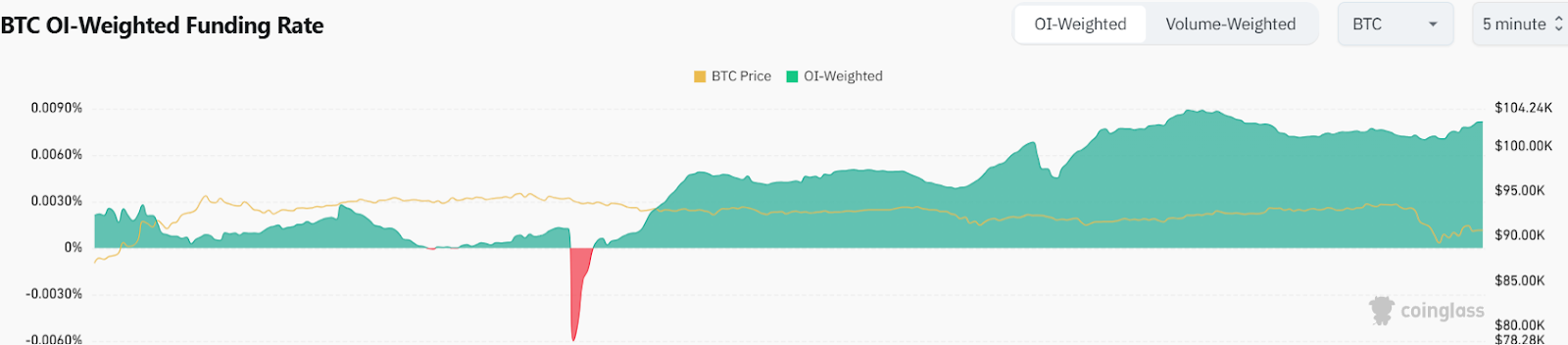

Recent data from Coinglass reveals that Bitcoin saw nearly $415 million in total liquidations over the last 24 hours, with buyers liquidating $154 million and sellers around $261 million, indicating a significant increase in short liquidations. Additionally, the open interest for Bitcoin has surged by 3.2%, touching over $52.8 billion in the last 24 hours.

Also, Bitcoin’s funding rate trades at +0.007%, indicating that buyers remain bullish. This could help buyers to continue pushing the BTC price upwards.

Bitcoin Price Prediction: Technical Analysis

Bitcoin’s price is experiencing strong bullish pressure as it continues to break above immediate Fib levels. However, after reaching a high at around $95K, BTC price witnessed a minor downward correction toward $90K. Currently, Bitcoin trades at $90,844, reflecting a 5.7% surge in the past 24 hours.

The BTC/USDT trading pair will now aim for a retest of the $95K level. As buying pressure rises, buyers will continue to defend further decline. If BTC price surges above $95K, we might see a recovery toward $97,000.

On the other hand, if Bitcoin fails to meet buyers’ demand around $95K, we might see a decline again toward the low of $87.3K. A drop from this level might send the price toward $82.6K.

Bitcoin Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, BTC price might aim for $95K. If it surges above that level, we might see $97,000. On the other hand, $87.3K is the lower range.

Long-term: According to Coincodex’s Bitcoin price prediction, the price of Bitcoin is expected to increase by 32.05% and hit $122,735 by April 2, 2025. Coincodex’s technical indicators suggest a Neutral current sentiment, while the Fear & Greed Index registers at 33, indicating Fear. Over the past 30 days, Bitcoin has had 13 out of 30 green days, exhibiting a price volatility of 4.92%. Based on this forecast, it is currently considered a good time to purchase Bitcoin.

How much is Bitcoin price today?

Bitcoin price is trading at $90,844, at the time of writing. The BTC price has dropped by over 0.29% in the last 24 hours.

What is the BTC price prediction for March 3?

Throughout the day, BTC price might aim for $95K. If it surges above that level, we might see $97,000. On the other hand, $87.3K is the lower range.

Is Bitcoin a Good Buy Now?

According to long-term forecasts, Bitcoin price might reach $122,735 by April 2. This makes BTC price a good investment considering its monthly yield.

Investment Risks for Bitcoin

Investing in Bitcoin can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.