Bitcoin price faced a strong bullish pressure due to increasing buying domination. As a result, BTC price surged toward $91K but faced a minor correction later. Over the past 24 hours, Bitcoin’s trading volume has dropped by more than 18.6%, totaling $58.8 billion.

In a broader perspective, Bitcoin fell below $100,000 on January 7 and showed a downward trend. It reached a low of approximately $89,397 on January 13. On Feb 3, Bitcoin again crashed and reached a low near $91K. In recent days, the price has been on a severe downtrend toward $80K; however, it is aiming for a recovery. Over the last 24 hours, its total market capitalization surged by 5.8%, settling at $1.77 trillion.

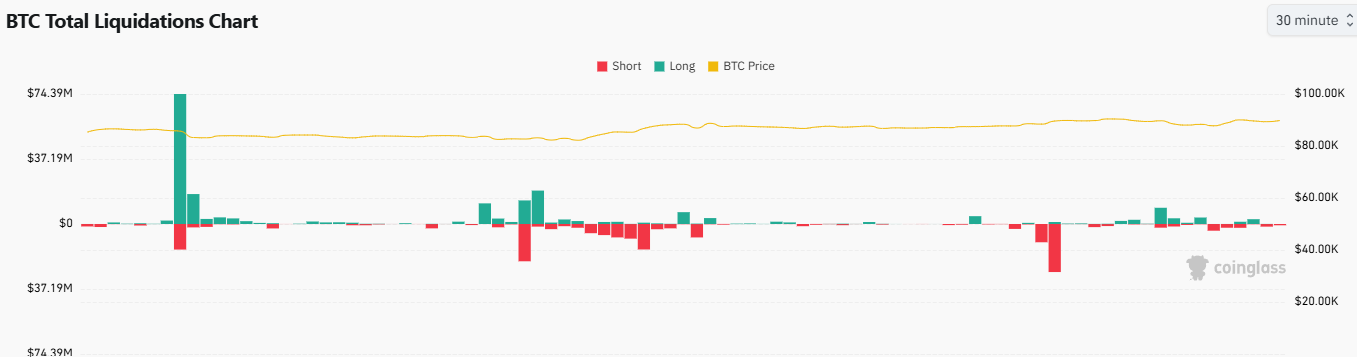

Bitcoin’s Short Liquidation Rises

Bitcoin experienced a sharp sell-off on February 27, plunging to below $78,000 for the first time in over three months. On-chain data analysis indicates that this decline was predominantly due to losses by “Bitcoin tourists”—new traders who recently entered the market.

However, the market has now rebounded toward the $90K level. This surge came ahead of the commencement of the first crypto summit in the White House.

Recent data from Coinglass reveals that Bitcoin saw nearly $148 million in total liquidations over the last 24 hours, with buyers liquidating $49.6 million and sellers around $98.5 million, indicating a significant increase in short liquidations. Additionally, the open interest for Bitcoin has surged by 5%, touching over $49.5 billion in the last 24 hours.

Additionally, Bitcoin’s funding rate trades at +0.0061%, indicating that buyers remain bullish. This could help buyers to continue pushing the BTC price upwards.

Bitcoin Price Prediction: Technical Analysis

Bitcoin’s price is experiencing strong bullish pressure as BTC aims for a break above the $90K level. However, bears are strongly defending a surge as Bitcoin faces multiple rejections around the descending resistance line. Currently, Bitcoin trades at $89,332, reflecting a 5.1% rise in the past 24 hours.

The BTC/USDT trading pair will now aim for a retest of the $90K level. As buying pressure rises, buyers will continue to defend further decline. If BTC price surges above $90K, we might see a recovery toward $95,000.

On the other hand, if Bitcoin fails to meet buyers’ demand around $95K, we might see a decline toward the low of $86K.

Bitcoin Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, BTC price might aim for $90K. If it surges above that level, we might see $95,000. On the other hand, $86K is the lower range.

Long-term: According to the current Bitcoin price prediction on Coincodex, the price of Bitcoin is expected to increase by 30.36% and reach $117,741 by April 4, 2025. Coincodex’s technical indicators suggest that the current market sentiment is Bearish, and the Fear & Greed Index is at 20, indicating Extreme Fear. Over the last 30 days, Bitcoin has seen 14/30 (47%) green days with a price volatility of 5.09%. Based on this forecast, it is currently not a favorable time to purchase Bitcoin.

How much is Bitcoin price today?

Bitcoin price is trading at $89,332, at the time of writing. The BTC price has surged by over 5.1% in the last 24 hours.

What is the BTC price prediction for March 5?

Throughout the day, BTC price might aim for $90K. If it surges above that level, we might see $95,000. On the other hand, $86K is the lower range.

Is Bitcoin a Good Buy Now?

According to long-term forecasts, Bitcoin price might reach $117,741 by April 4. This makes BTC price a good investment considering its monthly yield.

Investment Risks for Bitcoin

Investing in Bitcoin can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.