In this technologically advanced world, criminals, in general, have been presented with more options to launder their money from illegal deals. UN assessment estimates suggest that money laundering accounts for 2-5% of the world’s gross domestic product, between US$800 and 2 trillion every year worldwide. Over 90% remain somewhat undetected. The actual laundering volume of cryptos like bitcoin, however, is still to be verified.

For their “anonymous” nature, cryptocurrencies such as bitcoin fit the description perfectly for washing money purposes. When cryptos came around in 2017, launderers used them primarily to transfer vast sums of money, undetectably. Money launders are shying away from using cryptocurrencies, and it’s no surprise as to why:

Using Bitcoin: Tracking the Fund Source

One of the significant advantages of blockchain cryptocurrencies like bitcoin is the recording and publication of all transactions. Therefore it’s always easy to observe transactions and how much money goes from one account to another.

But this openness holds crucial details. While everyone can see the financial flow, you cannot track bitcoins themselves. It is because bitcoins do not exist as individual recognizable items with serial numbers like fiat. Instead, bitcoins are values that you can move from one address to another.

It doesn’t end there; financial watchdogs and crypto sources can identify illegal funds’ sources. As such, funds transferred from an exchange with little Know Your Customer regulations or even AML regulations, could be a red flag.

Similarly, the government might also link a single crypto wallet to several banks and credit cards, denoting a group of people utilizing a wallet to shift funds.

Risks Within Specific Jurisdictions

Some countries go beyond simply warning the public and broaden their money laundering and counterterrorism laws and regulations to include crypto markets and require banks and other financial institutions which facilitate these markets to comply with all due diligence requirements laid down by these laws.

For instance, Australia, Canada, and the Isle of Man recently enacted laws to bring cryptocurrency transactions and institutions that facilitate them under the ambit of money laundering and counter-terrorist financing laws.

In several jurisdictions, they have further restricted investments in cryptocurrencies, the extent of which varies from jurisdiction to jurisdiction. Almost all cryptocurrencies were prohibited in Algeria, Bolivia, Morocco, Nepal, Pakistan and Vietnam.

Criminals in jurisdictions with low restrictions have chances that they can use, in addition to the absence of complete execution of preventive measures and the existence of regulatory bodies. However, in higher-risk jurisdictions, money launders prefer to look for other means of washing their money.

Cryptocurrencies Going Mainstream

In this way, many huge enterprises will accept digital monetary payments on their products and services, slowly shaping their standing as an effective medium for exchanging value in the digital era. Many important banks, including several central banks, can replace paper fiat through blockchain technology.

President Nayib Bukele recently said that El Salvador would become the first country to make a legitimate offer for bitcoin. Bukele has disclosed that on 7 September, the “Bitcoin Law” is coming into force.

The country provides each adult citizen $30 in Bitcoin when they download and register on the new crypto app, Chivo. The $30 support is the most recent move of the nation to press for legal currency use of Bitcoin.

Reports have identified institutional adoption as a cause for the rise of bitcoin, with corporations like Tesla purchasing a digital coin with cash on their balance sheets. A few of the leading Wall Street banks, Morgan Stanley and Goldman Sachs, also make Bitcoin exposure to wealth management clients.

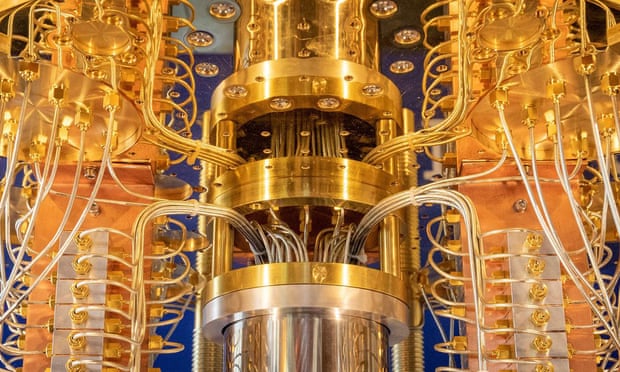

Bitcoin Propels the Rise of Quantum Computers

Although quantum computing is still very early, governments and private companies like Microsoft and Google work to achieve this. Within ten years, quantum computers could be sufficiently powerful to disrupt the cryptographic safety that protects cell phones, bank accounts, email and, yes, bitcoin wallets.

Someone using quantum calculation could theoretically reverse-engineer your private key, forge a digital signature and empty your bitcoin wallet afterwards.

If you thought Quantum computers are a whole new concept, they are not. As the current work of the Swedish Central Bank on Quantum Technology for economists makes out, Wootters and Zurek’s no-cloning theorem is the original concept of quantum money, which dates from the early 1980s.

Not all is lost in the Bitcoin industry when quantum computers naturally come. Even if developers built quantum computers tomorrow, although destabilizing, this could be for Bitcoin, the extinction of decentralized cryptocurrencies would not mean. In the long term, alternatives to Bitcoin expectations may rely on the features and communications of quantum computing. However, money launderers don’t take chances in this respect.

Trading in Bitcoin: Suspicious Transaction Patterns, Frequency and Size

The actual transaction pattern of transactions may be related in some cases with the money laundering risk. Criminal gangs mainly transfer several times without any commercial rationale, raising why such transactions are occurring.

In addition, significant amounts from several wallets might be transacted high-frequency in one account during a single period.

Criminals may utilize the frequency and size of transactions as a cover-up to illegal operations. When the transactions are high value, consecutive and occur within a short time, this is enough to raise suspicion. When money launders transfer funds, they are moving them from regulated jurisdictions into unregulated jurisdictions.

All this can be pointers in the direction of money launderers making the risk not worth indulging.

Conclusion

Cryptocurrencies are growing day by day, and more people are investing in them. As more people invest in them, the governments are trying to regulate them and develop ways to track them.

To a money launder, washing through cryptocurrencies is one terrible idea. It leaves a permanent trail that everyone can see. Those who have previously relied on cryptocurrencies to do the “dirty” transactions for them years later get arrested for their alleged crimes.