Last week, Bitcoin reached a multi-month high of over $26,000; however, it has since retraced and settled between $24,000 and $25,000. In the last 24 hours, most cryptocurrencies have seen significant losses, increasing BTC’s market dominance to levels not seen since June 2022.

About a week ago, Bitcoin’s price performance hit rock bottom as it fell below $20,000 for the first time in two months. Yet, Bitcoin boomed as the financial crisis in the US and Europe deepened.

It began its ascent over $22,000 and eventually reached about $24,000. Nonetheless, the surge persisted for hours after that, sending BTC to a high of almost $26,500 (on Bitstamp) and setting a new nine-month high.

At this time, the bears made themselves known, and the asset’s upward momentum was halted. Instead, they drove it south, and bitcoin dropped all the way below $24,000 yesterday. The cryptocurrency has recovered some of its value and is now trading at about $25,000. Despite its supremacy over cryptocurrencies, its market cap has remained below $500 billion. There hasn’t been this degree of domination since last June.

Altcoins plunge

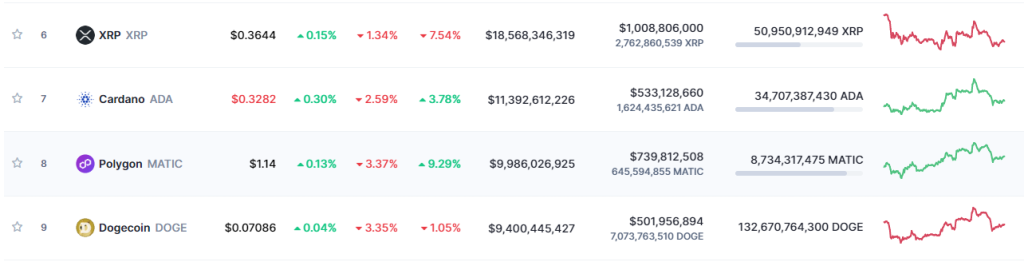

Other cryptocurrencies also soared mid-week to new local heights, but most have gone red today. The price of ether has dropped by close to 1% as Ripple also retraced by a comparable proportion as of writing. Additional losses came from Cardano, Polygon, Dogecoin, Solana, Polkadot, Shiba Inu, Litecoin, and Avalanche, recording a decline of between 1% and 8% across the board within the same period despite some recording good weekly gains.

Only Binance Coin stands out as the asset showed a daily increase among the top 10 altcoins, trading at $317 as of writing.

The total value of the cryptocurrency market, as measured by CMC, has dropped to $1.09 trillion, almost $70 billion less than its all-time high established on Tuesday.

Why is BTC dominating?

Amid the recent banks’ saga in the US, many investors seem to question the credibility of banks with many looking into Bitcoin despite having not-so-much crypto knowledge. This rise in BTC trust can be attributed to the recent statements by many crypto personals that Bitcoin was built to thrive under such.

According to Novogratz in a recent CNBC interview, Bitcoin is going to thrive now more than ever as Satoshi’s goal with Bitcoin was to kill the uncertainity presented by banks.