A prominent blockchain data platform Glassnode has recently disclosed the latest statistics about the prominent crypto token Bitcoin (BTC). The platform has pointed out that Bitcoin’s realized capitalization is still lower than the $400B mark. As per Glassnode, the token remained effective in reaching $31.7k as its annual price was high temporarily. Nonetheless, the token’s market is still restricted within a very constricted trading range, it added.

Statistics From Glassnode Indicate a Gradual Elevation in Bitcoin’s Realized Capitalization

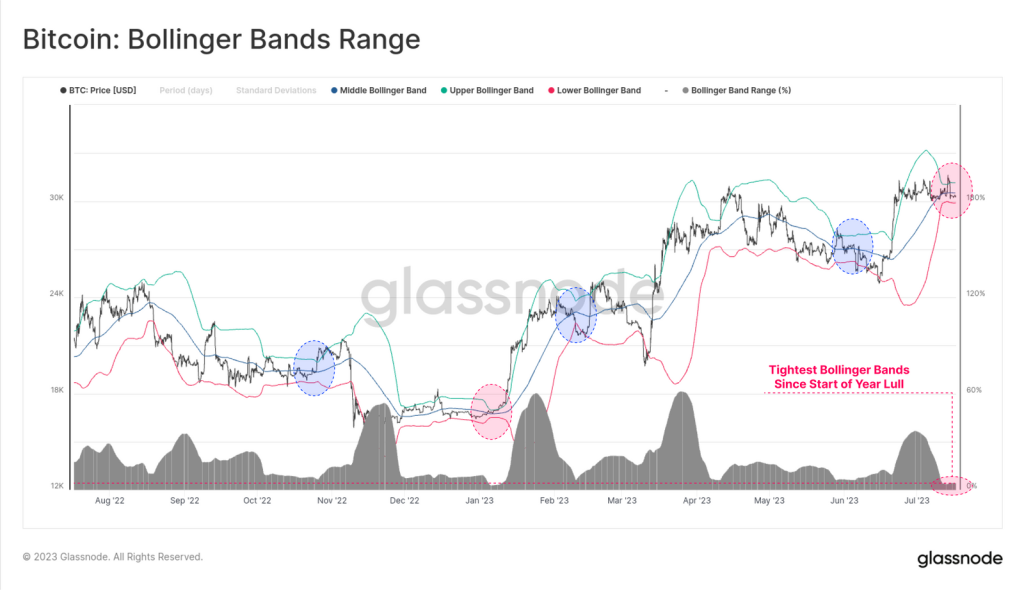

Glassnode, took to Twitter to share the latest position of Bitcoin. On its official web portal, the platform revealed that many metrics point toward a slow and gradual inflow of capital. In addition to this, many indicators resemble the irregular market conditions witnessed in the years 2016, 2019, and 2020. While providing details about this situation, the platform noted that the market of digital assets is continuously witnessing extremely low volatility.

Moreover, the 20-day Bollinger Bands show a huge squeeze. As per Glassnode, Bitcoin’s price rally remained ineffective in sustaining momentum after touching $31.7k a few days back. The respective situation brought the prices of Bitcoin back into the slanting trading range over the $30.0k mark. A range of only 4.2% distinguishes between the lower and upper Bollinger bands.

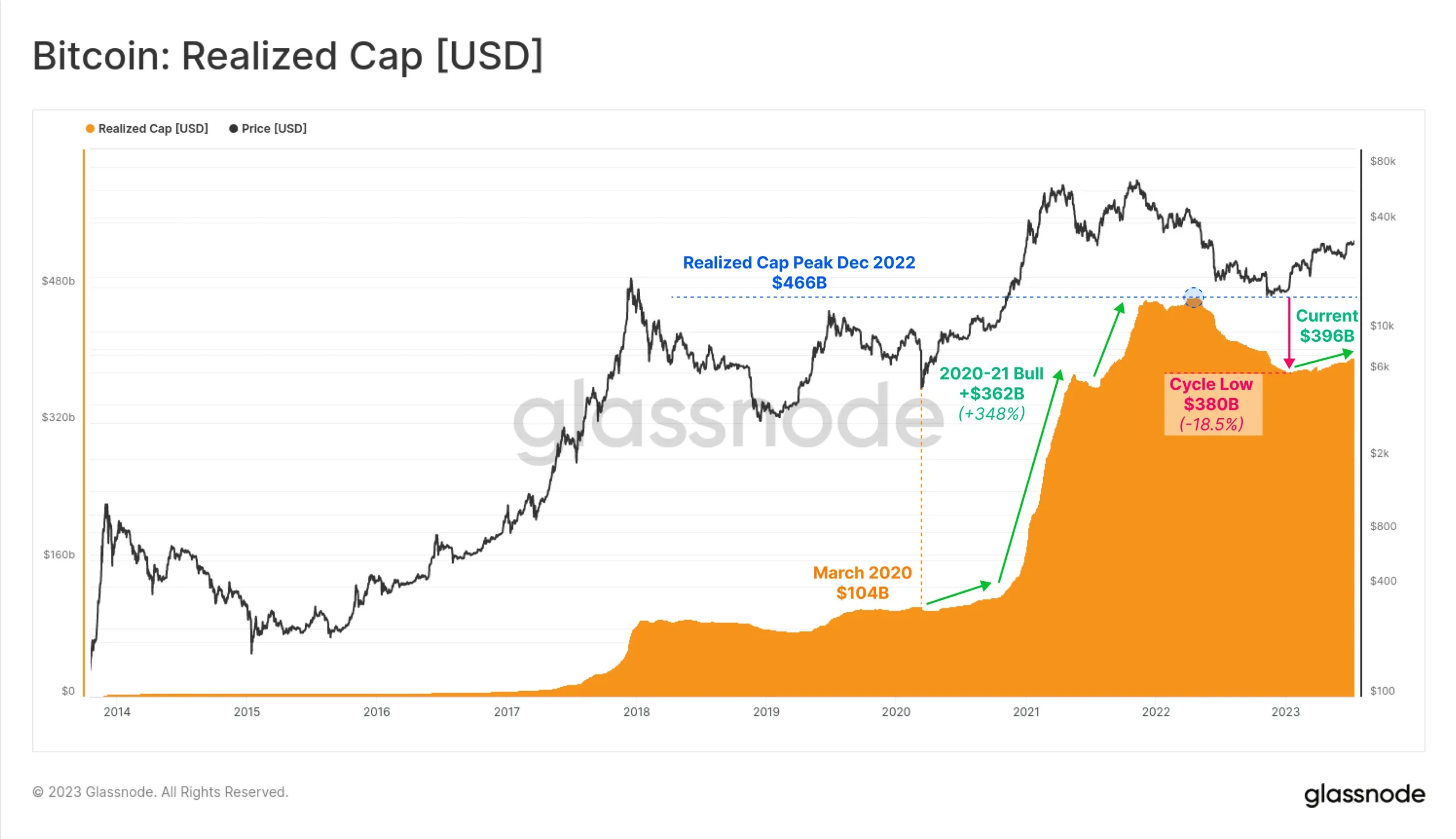

While moving on, the platform discussed the statistics regarding Bitcoin’s realized capitalization. The company asserted that this metric is categorized among the most widely utilized and oldest on-chain metrics. In the case of Bitcoin, the realized capitalization at the moment is placed just near $400B.

This May Result in Additional Demand Inflow, Say Glassnode

Apart from that, it added, this metric signifies that a gradual capital stream is becoming a part of Bitcoin during this year. According to Glassnode, this indicates that the tokens are exchanging at increased prices, leading to a modest spike in additional demand inflow in 2023.