The future of Bitcoin’s price remains uncertain amid “sell the news” sentiment, especially in light of the SEC’s pending decision on an ETF. This uncertainty is reflected in the ongoing struggle between buyers and sellers around the $45K mark. Recently, Bitcoin’s price has shown a tendency to favor sellers, with several instances of price rejection and a notable push towards the $40K region, primarily driven by an intense sell-off by big players and miners. This sparks a question: “Do miners know what’s coming for Bitcoin?”

Bitcoin Tests Buyers’ Patience At $40,000

In the last few minutes, the cryptocurrency market experienced a significant liquidation event. Major players initiated a sell-off after selling at the market peak, contributing to Bitcoin’s ongoing difficulty in breaking above the $45K mark. This movement led to impatience among large-scale investors (whales) in the context of the rising “sell the news” sentiment due to the SEC’s ETF decision.

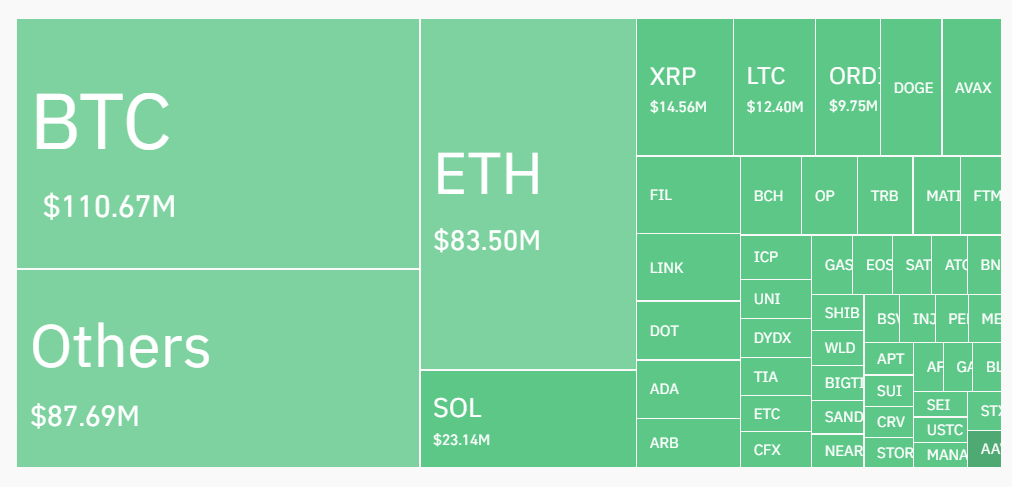

Data from Coinglass reveals that within a single hour, the crypto market witnessed total liquidations nearing $500 million, of which $470 million were from long positions. Bitcoin experienced a sharp drop, hitting the $40K support level, which resulted in over $104 million in liquidations of long positions alone.

However, analysts believe this as a discounted opportunity to accumulate more Bitcoin near the dip. The community sees this as the final correction ahead of the ETF pump. A prominent crypto analyst, PlanB, stated that the recent market crash can be seen as a strategically executed stop-loss hunting.

It appears that leveraged long positions are being targeted for liquidation prior to any potential market boost that could result from the ETF decision. This tactic is not uncommon in trading among big players, where significant price movements are used to trigger stop-loss orders, thereby intensifying market volatility.

As a result, the Bitcoin market rebounded quickly from the $40K low as buyers stepped in with heavy accumulation. Additionally, this can be seen as a “long-squeeze” as BTC struggles near $45K. ‘ In this scenario, investors holding long positions, particularly those using leverage, are forced to sell their assets due to declining prices. This selling pressure further drives down the market, creating a cycle that exacerbates the drop in value.

Miner’s Selling Pressure And Matrixport Trigger Liquidation

Recently, a significant portion of Bitcoin miners’ holdings were transferred to cryptocurrency exchanges, causing concern among market traders. The seven-day moving average of the flow from miners to exchanges surged to its highest level in five months.

According to on-chain data, miners are selling their holdings heavily in recent weeks. The recent decision by a substantial number of miners to sell their holdings, amounting to a staggering $176 million (4000 BTC), has triggered bearish sentiment among investors and market observers.

The miner-led sell-off has added to the existing pressure on Bitcoin, which has been struggling to breach the $45,000 resistance level. As the price hovers closer to $40,000-$42,000, the market is preparing for a potential downturn. This price level is critical; a breach below could further erode confidence and accelerate the downward momentum.

The recent crash might be further triggered by Matrixport’s recent report. Matrixport’s report suggests the SEC may reject all Bitcoin spot ETFs in January, citing SEC Chair Gensler’s cautious crypto stance and the Democratic-led SEC.

Despite ongoing discussions, a key approval criterion remains unmet, with potential compliance by Q2 2024. The report predicts a -20% drop in Bitcoin prices to around $36,000-$38,000 if ETFs are rejected, due to liquidation of assets linked to ETF approval hopes.

However, Matrixport forecasts a Bitcoin price recovery by the end of 2024, following historical trends. This comes as Bitcoin recently rose above $45,000, amid hopes for potential SEC approval.