Bitcoin’s price witnessed a heavy selloff in the last 24 hours after failing to hold momentum above the $37,500 level. On November 9, the price of Bitcoin momentarily reached $37,900 before pulling back to $36,880 at the start of Monday. BTC experienced a downward correction, erasing the gains it had made over the weekend, as traders anticipate the release of the US Consumer Price Index (CPI) data.

Bitcoin’s Resistance Is Getting Stronger

In the past few weeks, Bitcoin’s open interest has been on an upward trajectory, touching $16 billion amid whale accumulation. However, there’s a threat for long-position holders as the BTC price struggles to reach the $40K dream due to a notable selloff. So far, in the last 24 hours, over $27 million worth of long-positions have been liquidated.

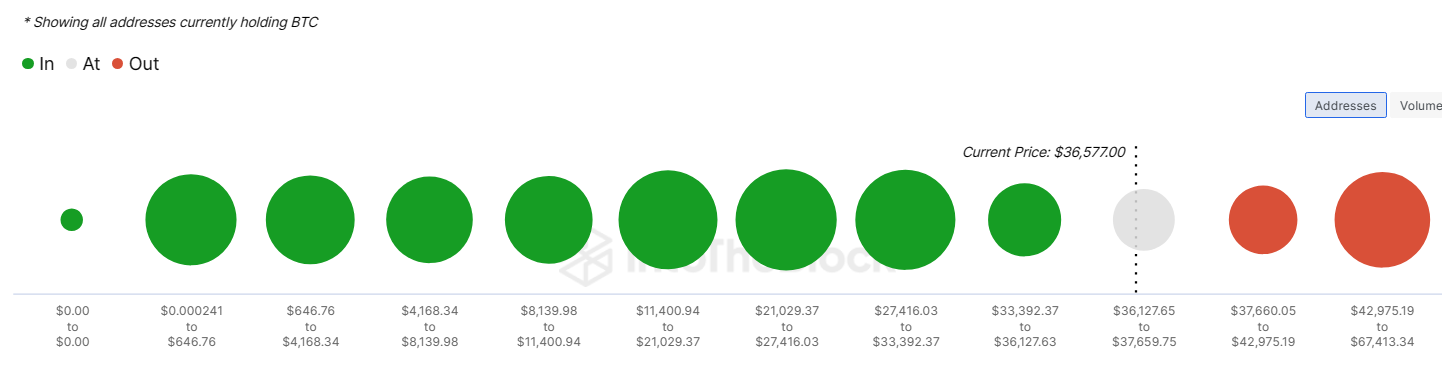

This development has gradually strengthened the resistance levels for the BTC price, making the $40K dream nearly impossible to reach this week. According to insights from IntoTheBlock, close to 81% of Bitcoin holders have now become profitable as BTC slowly heads toward the $40K dream due to ETF hype. This sentiment is bullish, with expectations of a price uptick in anticipation of an upcoming ETF launch. Nevertheless, there is a rising concern over the chances of a considerable liquidation that may still be on the edge.

Around the $37K-$43K zone, 2.2 million addresses are in loss, and a significant portion will become profitable if the BTC price again attempts a surge toward the $40K level next week. As a result, there will be a high chance of a shift in sentiment toward selling at break-even as BTC touches an 18-month high.

Should Bitcoin experience a pullback of $700-$800 upon nearing the $38K threshold, it may trigger an increase in short positions. This could pressure short-term whale holders to sell their positions, potentially leading to a price drop and a revaluation of the $35K support level.

Key BTC Support Levels To Watch Next

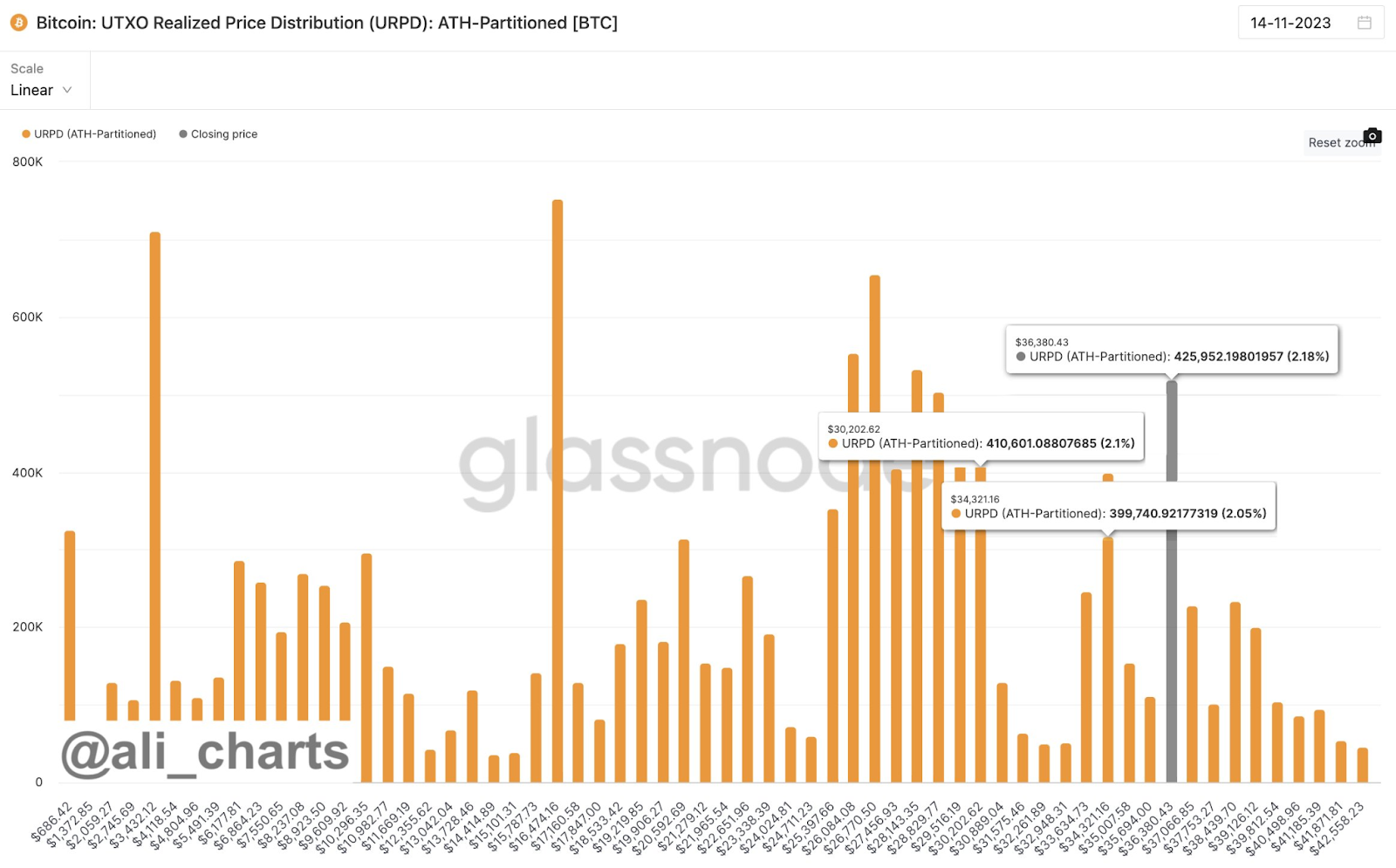

The URPD (UTXO Realized Price Distribution) shows crucial levels for Bitcoin’s price. According to Ali charts, Bitcoin has recently found a stable foothold at around $36,400, sparking interest and speculation among investors and market analysts regarding the next move. At the $36,400-mark, Bitcoin demonstrates stability in the face of fluctuating market conditions.

However, the stability at this level is not guaranteed. The analyst is closely monitoring the situation, acknowledging that if the $36,400 support level breaks, it could lead to a shift in investor sentiment. The next critical demand zones are identified at $34,300 and $30,200. These levels are considered crucial for Bitcoin’s short-term trajectory, as they represent potential turning points for both bullish and bearish trends.

The URPD value at $36,400 is 426K, whereas the $34,300 and $30,200 levels have a URPD value of 400K and 410K. The UTXO Realized Price Distribution (URPD) illustrates the prices at which the existing set of Bitcoin UTXOs (Unspent Transaction Outputs) were formed. In other words, each bar in the URPD represents the quantity of existing bitcoins that were last transacted within a specific price range.

Last week, Bitcoin surged towards the $38,000 mark, a level it hadn’t reached since May 2022. However, the digital currency experienced a decline, falling to $36,880 as traders held their breath for the upcoming release of Tuesday’s CPI data. The Headline Consumer Price Index (CPI), a measure deeply intertwined with changes in living costs, is projected to rise by 0.1% month-over-month in October. This anticipated increase is a notable change from the 0.4% uptick recorded in September.