One month after Bitcoin’s fourth halving event, analysts are closely monitoring Bitcoin hashrate as a key indicator of miner sentiment. Recent observations suggest a noteworthy decline in hashrate. This change is prompting discussions about potential miner capitulation and its implications for the broader Bitcoin ecosystem.

Halting Hashrate and Miner Capitulation Post-Bitcoin Halving

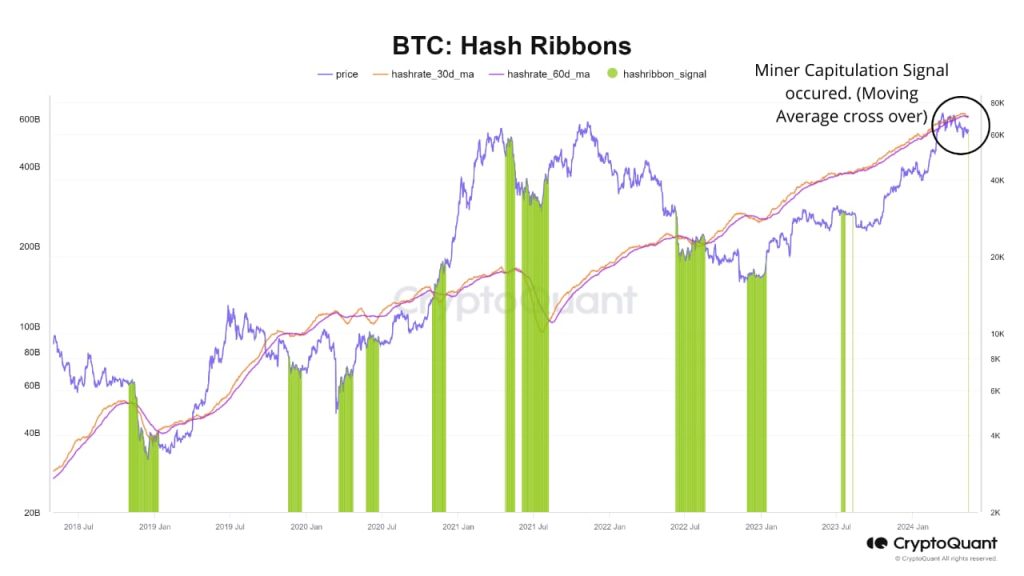

According to insights shared by a CryptoQuant analyst, the 30-day moving average of Bitcoin’s hashrate has seen a decline from its peak of 630 exahashes per second (EH/s) to its current level of 606 EH/s. This shift in hashrate trajectory is particularly significant as it diverges from the typical post-halving pattern, where hashrate tends to increase steadily.

The analyst’s observations are underscored by the Hash Ribbons indicator, which historically correlates miner capitulation with declines in hashrate. The Hash Ribbons methodology operates on the premise that decreased hashrate often signals less efficient miners exiting the market, either by shutting down operations or relocating to more favorable conditions. Additionally, these miners may opt to sell recently mined Bitcoin to cover operational expenses, further impacting market dynamics.

Graphical representations juxtaposing Bitcoin’s price movements with changes in hashrate highlight periods of rapid decline in hashrate, marked in green, which coincide with instances of “miner capitulation.” These events are indicative of a broader trend where less efficient miners relinquish their mining operations, leading to a reduction in overall computational power dedicated to securing the Bitcoin network.

Miner Capitulation and Hash Ribbons Connection

While miner capitulation may initially exert downward pressure on Bitcoin prices, the Hash Ribbons indicator suggests that it often precedes significant price lows, presenting opportunities for strategic investors to capitalize on market dips. However, it’s essential to note that the effects of miner capitulation may not manifest immediately after the initial signal, as the process typically unfolds gradually over subsequent days and weeks.

As stakeholders continue to monitor Bitcoin’s hashrate and market dynamics in the aftermath of the fourth halving, insights from indicators like Hash Ribbons provide valuable context for understanding miner behavior and its impact on price movements. While short-term fluctuations may occur, the broader resilience and long-term prospects of Bitcoin remain positive.