The digital asset market is experiencing a notable surge, with investment products seeing record weekly inflows of $2.7 billion. This brings the total year-to-date inflows to an impressive $10.3 billion, closely nearing the record $10.6 billion seen throughout the entirety of 2021. A significant rise in weekly trading turnover has also been observed, skyrocketing to $43 billion for the week, vastly outperforming the previous week’s record of $30 billion.

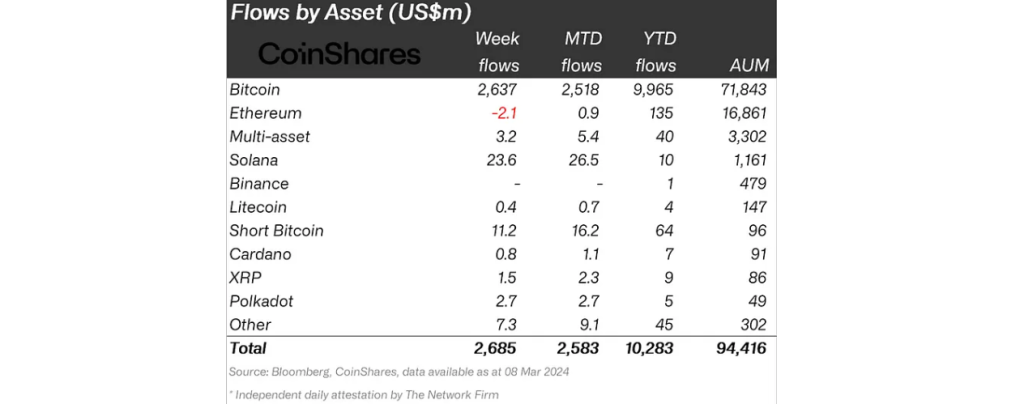

This influx has not only revitalized the market but has also propelled the total assets under management (AuM) to an all-time high of $94.4 billion. The AuM has seen a remarkable 14% increase over the last week alone, with a total rise of 88% since the beginning of the year.

Region-wise, the United States leads the pack with a substantial $2.8 billion in inflows. Switzerland and Brazil follow, with inflows of $21 million and $18 million, respectively. However, not all regions are experiencing net inflows; Canada, Germany, and Switzerland reported outflows totaling $35 million, $77 million, and $39 million, respectively.

Digital Asset Investment Surges

Bitcoin continues to be at the forefront of investor interest, witnessing $2.6 billion in inflows. These figures bring its year-to-date inflows to represent 14% of the total AuM. Despite recent hikes in its price, the market has observed continuous inflows into short Bitcoin positions, with an additional $11 million last week.

In contrast to Bitcoin’s steady dominance, *SOL* has witnessed a positive turnaround after facing a period of negative sentiment, with inflows reaching $24 million last week. Meanwhile, Ethereum, despite having a stronger year-to-date performance compared to Solana, experienced minor outflows of $2.1 million.

Other digital assets have also been on the receiving end of investor favoritism. Notably, *DOT*, Fantom, Chainlink, and Uniswap have seen inflows of $2.7 million, $2 million, $2 million, and $1.6 million, respectively, indicating a broadening interest across different cryptocurrencies.

On the other hand, blockchain equities have faced a slight downturn, with total outflows amounting to $2.5 million. This indicates a shifting focus among investors, possibly tilting towards direct digital asset investments over blockchain-related stocks.

The recent trends underscore a growing confidence and interest in digital assets, signaling a potentially transformative period for the market. As institutional and retail investors alike continue to navigate this evolving landscape, the digital asset sector appears poised for further growth and diversification.