Bitcoin (BTC) soared to $72,000, attracting investors worldwide. This is a turning point in its bull run. This surge has analysts and fans discussing the market’s future in the coming months.

Bitcoin Analyst Willy Woo Forecasts Potential Peak at $337,000

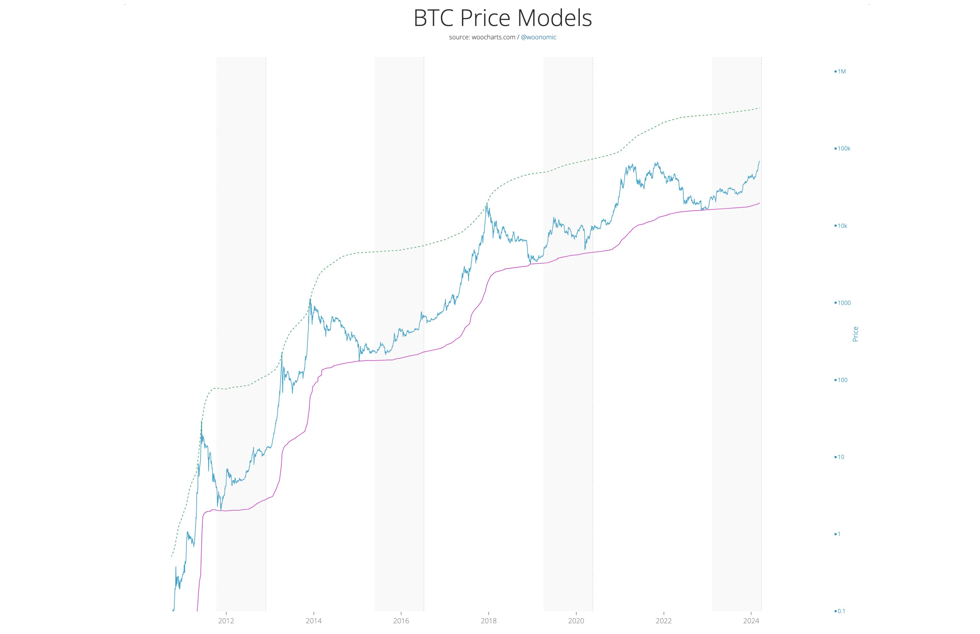

Willy Woo, a prominent Bitcoin analyst, said the bull market is still early. Woo believes Bitcoin’s upper bound model could peak at $337,000. This shows that growth is possible compared to the previous cycle’s peak. Based on this optimistic outlook, Bitcoin’s recent rise may be the start of a larger upward trend.

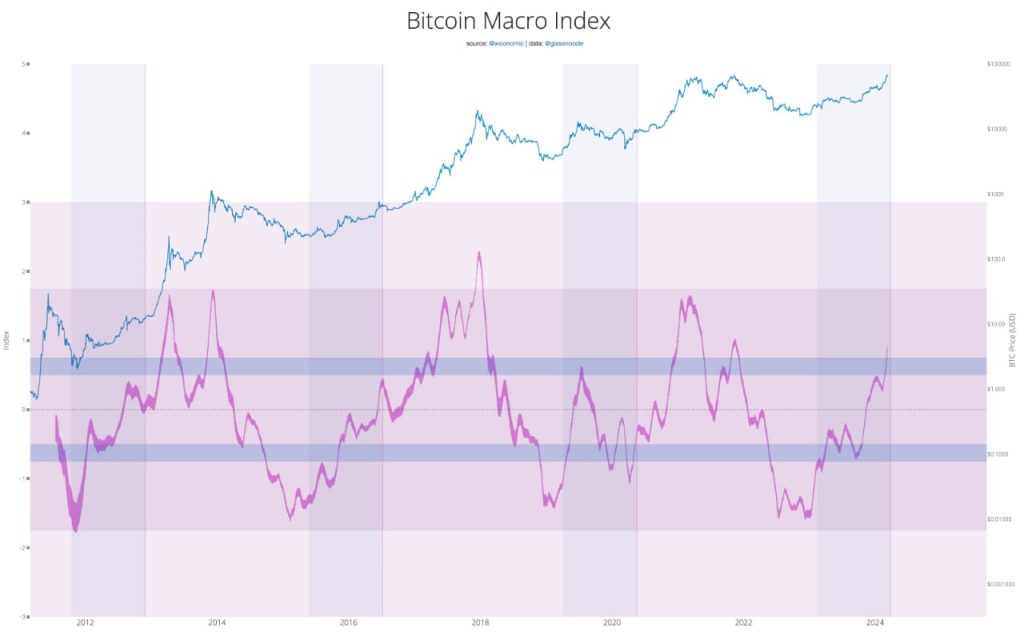

One of the best indicators of Bitcoin market health is the Bitcoin Market Index (BMI). This index includes 17 fundamental and technical macro signals that show market conditions like investor sentiment and mining activity. They are in a full-fledged bull market, according to recent BMI data, driven by strong fundamentals.

The large amount of new *BTC* money has changed the market. The network stores $1.8 billion daily, according to data. This is the third-highest capital ever received. This influx of money shows that more people are trusting and investing in Bitcoin.

On-chain supply liquidity, which tracks highly liquid coins, also shows fewer coins to buy. This suggests that Bitcoin is in more demand than it is available. As investors compete for a limited number of coins, Bitcoin’s price will rise.

Bitcoin’s Rise Solidifies Its Position as Premier Digital Asset

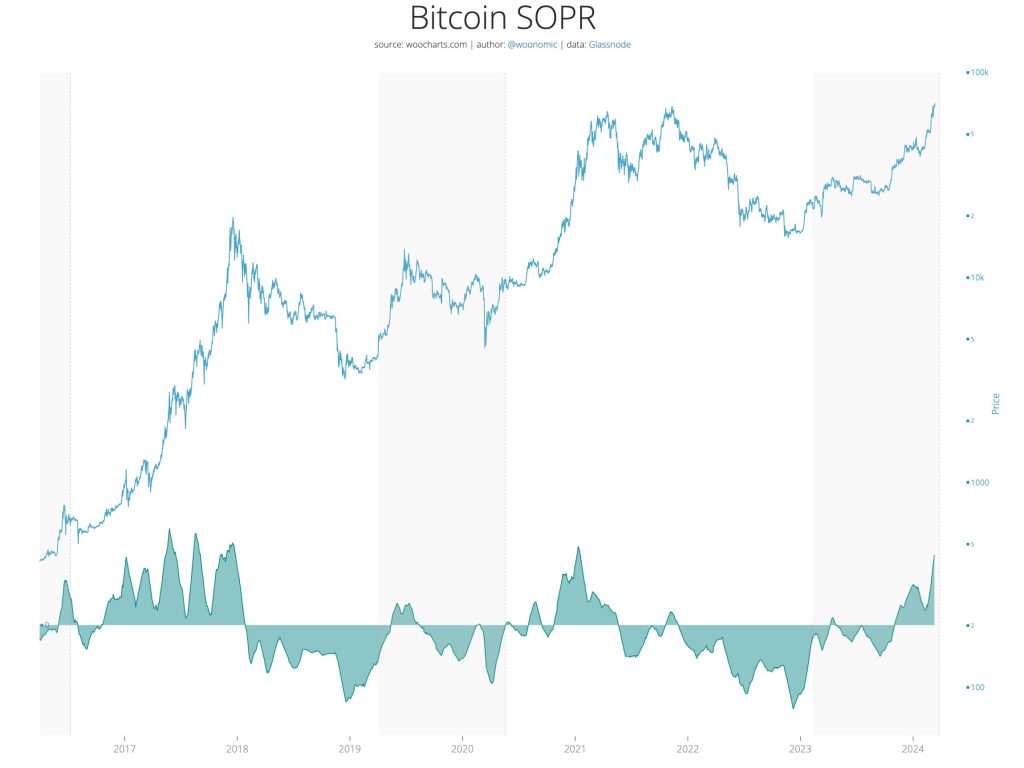

People are optimistic, but there are warning signs. These include the Spent Output Profit Ratio (SOPR). Shows how the network profits. SOPR is nearing its all-time high, so investors may want to sell. When SOPR falls, the market may settle as investors reassess their positions.

Bitcoin’s price rise and bullish momentum excite investors, but they must stay alert and watch key indicators. People know the cryptocurrency market is unstable because prices change quickly and unexpectedly. Thus, investors should be cautious and research their options before investing.

Finally, Bitcoin’s rise to $71,000 and beyond has confirmed its status as a top digital asset and investment. Blockchain metrics like the BMI and supply liquidity indicate a strong market, so Bitcoin’s bullish momentum should continue. However, investors should monitor market risks and adjust their plans as needed. Bitcoin’s price and market will change over the next few months and years as it grows and changes.