Following the recent liquidation of $550 million, Bitcoin’s price experienced a sharp drop from its high of $45,000, eventually stabilizing around $41,500. However, this downturn was met with strong buying interest, which helped Bitcoin to initiate a recovery and move out of the fear zone. Analysts point out that there is a critical support level for Bitcoin, and as long as the price remains above this mark, it is considered safeguarded against further significant corrections.

SEC’s Positive Sentiment Sent BTC Above $43K

Bitcoin (BTC) is trading just above $43,000, recovering some losses after a leverage flush sent it down as much as 10% on Wednesday as markets reacted to Matrixport analyst reports.

The report indicated a possible denial by the US Securities and Exchange Commission (SEC) of the highly awaited spot Exchange Traded Funds (ETFs). This led to the second-largest liquidation of long positions seen in the last one year. However, without concrete evidence, analysts swiftly dismissed the report that the decision had been prematurely revealed.

The situation intensified with subsequent submissions from prospective ETF providers. Among these was a securities registration from Fidelity Investments, which rapidly fueled hopes about an approval being granted.

Fox Business reported that SEC staff attorneys from the Division of Trading and Markets held important talks on Wednesday with representatives from key exchanges, including the New York Stock Exchange, Nasdaq, and the Chicago Board Options Exchange, about approving several Bitcoin ETF applications.

This is seen as a hopeful indicator that the SEC might soon approve some or all of the applications from major money managers and crypto firms. An insider hinted that the SEC might start informing issuers about approvals by Friday, with trading potentially commencing next week.

On-chain data provider CryptoQuant anticipates that Bitcoin could fall to around $32,000 in the coming month, especially if a spot ETF gets approved. They note that traders’ unrealized profits are at a point that often leads to a correction, a term in the market usually indicating a drop of 10% or more.

However, an analyst said, “I don’t expect to see a massive sell-the-news event as some have predicted. Rather than falling as low as $32,000, I think that bitcoin will take $50,000 by the end of January and we will see a record print of BTC this year.”

$41,000 Is A Strong Accumulation Point

A noted analyst, Crypto Rover, suggests that Bitcoin has established robust support in the $41,000-$41,500 range. If BTC maintains its position above this level, concerns about a further decline may be unwarranted.

Additionally, despite the recent fluctuations in Bitcoin’s price due to ETF news, long-term investors, particularly those who have weathered the 2019-2022 cycle, appeared unfazed by yesterday’s market movements, according to CryptoQuant.

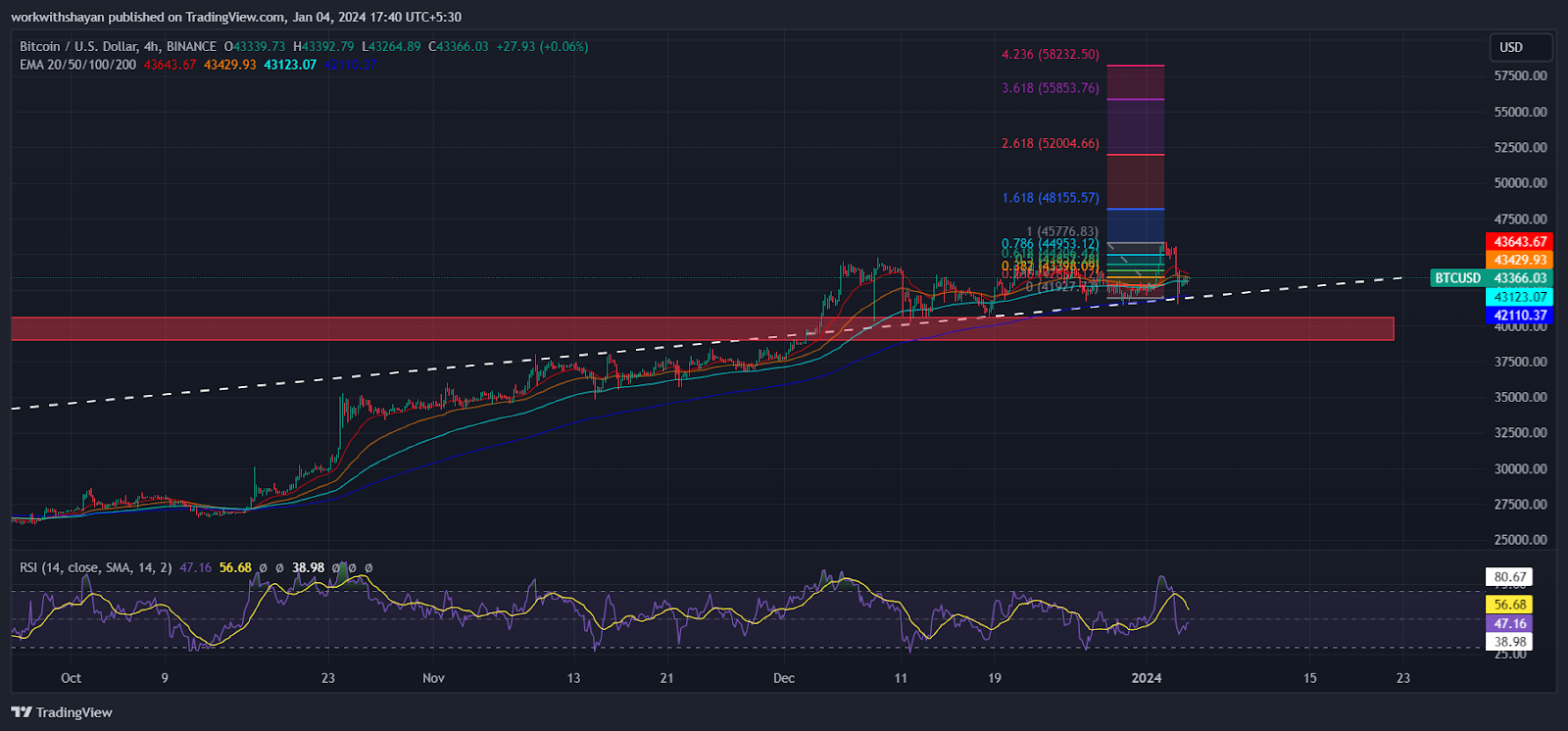

Bitcoin successfully bounced from the ascending support line and gained the $43K level, suggesting aggressive purchases by buyers during the dip. However, sellers are strongly defending a surge above the EMA20 trend line. As of writing, BTC price trades at $43,244, surging over 1.9% from yesterday’s rate.

The leveling off of the 20-day exponential moving average at $43,639 and the relative strength index (RSI) surging toward its midpoint indicate a likelihood of Bitcoin trading within a buying range, potentially setting a recovery above $44K-$45K again in the short term.

However, a fall below the $40,000-$41,000 support level would imply a short-term surrender by the bulls, potentially leading the BTC price down to the significant support at $38K.

Conversely, if buyers manage to push the price above $46,000, it could signal a bullish consolidation with the resistance zone of $48K-$50K.