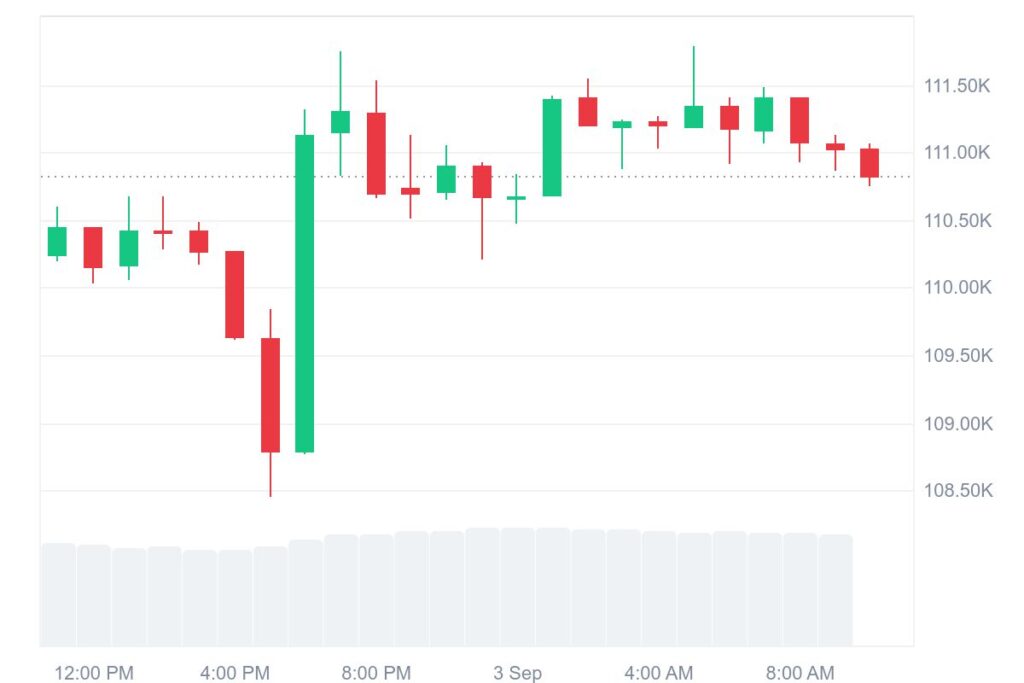

Bitcoin ($BTC), the leading cryptocurrency, is going through upside volatility when compared with gold. As the exclusive market data suggests, Bitcoin ($BTC) is moving toward the $112K mark, while gold has reached its new all-time highs above $3,500 per ounce at the start of September 2025.

In this respect, the gold’s remarkable price rally is leading toward a significant shift from the top crypto assets like Bitcoin ($BTC) to the precious metal. Additionally, amid the wider political and economic uncertainties, the crypto traders are investing their funds into gold.

Gold Surges Above $3,500, Fueling Bitcoin’s Jump Toward $112K

Based on the new market statistics, Bitcoin ($BTC) is spiking toward $!12,000, parallel to gold’s surge above $3,500 per ounce. Hence, gold’s market rally is driving Bitcoin’s upward volatility. Keeping this in view, the investors are tending toward gold amid the market-wide optimism around the precious metal.

On the other hand, despite the gradual upward trajectory, Bitcoin ($BTC) still faces the concerns of a notable dip to the psychological $100K mark. Thus, in line with the on-chain data, the increased volatility highlights the potential of robust volatility around the $112K spot. However, gold is making waves with increasing inflows.

Gold ETF Inflows Accelerate Amid Institutional and Retail Optimism

In addition to this, the breakout above $3,500 per ounce is substantially contributing to the unprecedented gold ETF purchases. In this respect, the retail and institutional investors looking for stability are shifting from Bitcoin ($BTC) to gold. Simultaneously, the September effect is also adding to the broader changing behavior in the market.

Overall, amid the volatility witnessed by the emerging projects such as the Trump family-led World Liberty Financial (WLFI) and the notable altcoins like $DOGE, Bitcoin’s ($BTC) is also facing risks. Hence, despite the momentary charge toward $112K, Bitcoin ($BTC) could still plunge to $100K while gold is making new records above $3,500.