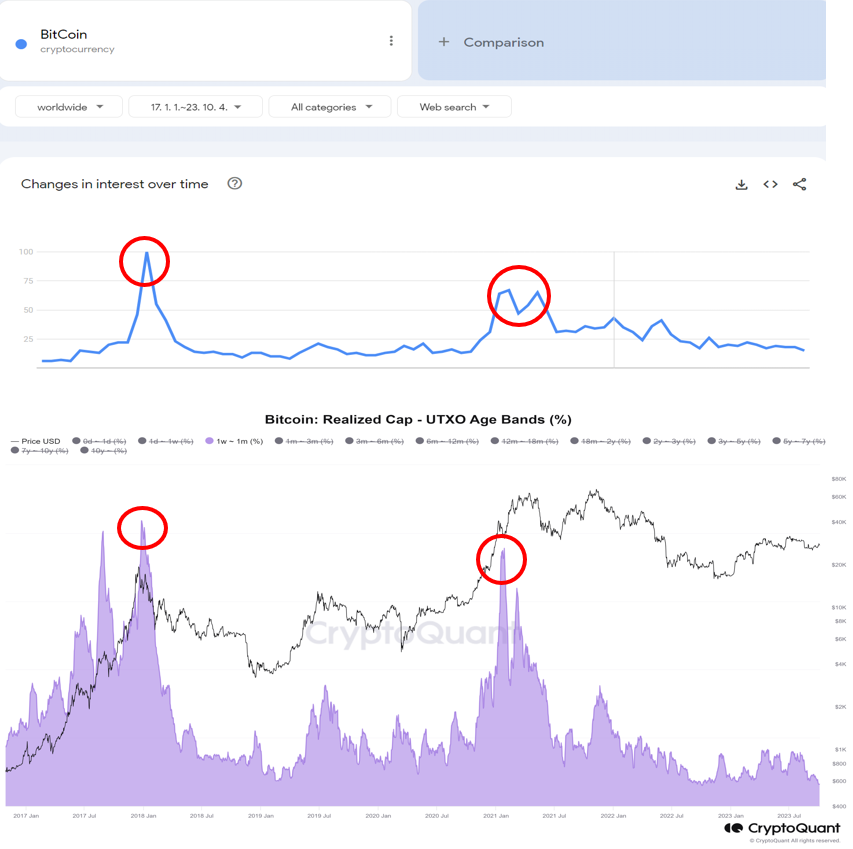

Due to the volatility of the cryptocurrency market, market sentiment and its influence on Bitcoin price are being studied. Recent advances and regulations have complicated the landscape. At this time, public opinion analysis is crucial. The relationship between feelings and cryptocurrency values fascinates analysts and investors. The following CryptoQuant graphic compares Bitcoin’s rank in Google Trends and shows popular interest. It also estimates Bitcoin purchases from one week to one month ago.

Investor Sentiment Shifts Amid Steady Interest in Bitcoin

Investor optimism in the market’s upward trend and favorable media and online news have often been linked to price peaks. Current events show a different picture. Interest is steady, but not at bull market levels. Despite recent price changes, the market is far from its peak. For investors, the current situation makes cost-averaging acquisitions attractive.

One important factor in price changes is the active engagement of “whales,” powerful traders who may influence the market. These cetaceans often sell Bitcoin holdings to individual buyers, lowering market prices. Understanding ordinary investors’ contacts with major market players is essential for market trend forecasting.

Many observers believe Bitcoin’s association with rising interest rates is changing. Historically, rising interest rates have caused Bitcoin price to fall. Bitcoin’s boom-and-bust cycles may remain despite monetary policy changes, even with high interest rates. The anticipation of the April Bitcoin halving event, which has historically influenced cryptocurrency prices, supports this notion.

Market Dynamics, Whales, and Regulatory Changes Impact Bitcoin

Market variables affect Bitcoin performance, but investors remain concerned about regulatory changes. The Bitcoin market is watching the SEC’s careful approach to detecting Bitcoin ETFs.

The recent testimony of SEC Chair Gary Gensler before Congress has added to the unease. The individual expressed concerns about consumer finance management and accused the bitcoin industry of wrongdoing. Given the SEC’s ambiguity on cryptocurrency financial products, potential investors are wary of this domain’s unclear laws.

Market mood, powerful traders, known as “whales,” and regulatory changes affect Bitcoin prices. The cryptocurrency market has been volatile, but it may not have reached its peak, providing a good opportunity to buy at regular intervals to reduce price fluctuations. However, the dynamic link between Bitcoin and interest rates and regulatory monitoring creates market uncertainty. Investors must be vigilant and well-informed to handle these difficult times.