Bitcoin’s recent price recovery has caught the attention of traders as the price has rebounded above the $71K level following a massive decline last week. Buyers liquidated their positions heavily after the *BTC* price touched the low of $65K. However, as the sentiment cooled down and BTC price experienced an accumulation near the support levels, it has now triggered a robust upward surge toward $72K.

Bitcoin’s Liquidation Jumps Exponentially

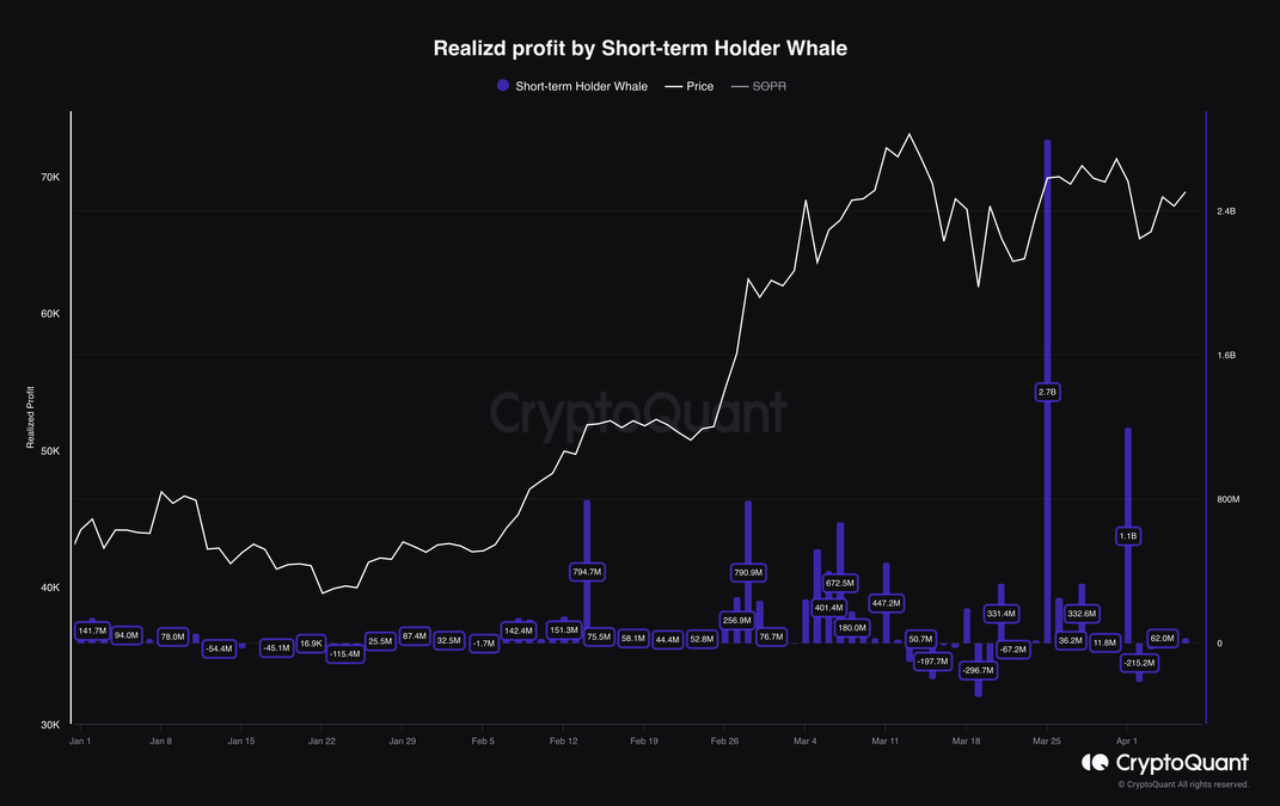

Just three days ago, Bitcoin’s price hovered around the $65.5k mark, sparking conversations about the end of its price correction phase. However, this price level gained buyers’ interest, resulting in a massive accumulation. According to CryptoQuant, the initial spark for this recovery came from the realization of huge profits, amounting to $2.7 billion.

At the same time as people were making profits, there was also less pressure to sell, which really helped keep Bitcoin’s price stable. This happened because people who owned Bitcoin for only a short time stopped selling it at a loss when its price went down. They decided to wait instead, which stopped the price from falling further and let the market stabilize.

Another important reason for Bitcoin getting back on track is the minting of new USDT (Tether). There’s a clear connection between how much USDT is worth and Bitcoin’s price. When more USDT is put into the market, it means there’s more money available for buying things, which usually makes Bitcoin’s price go up.

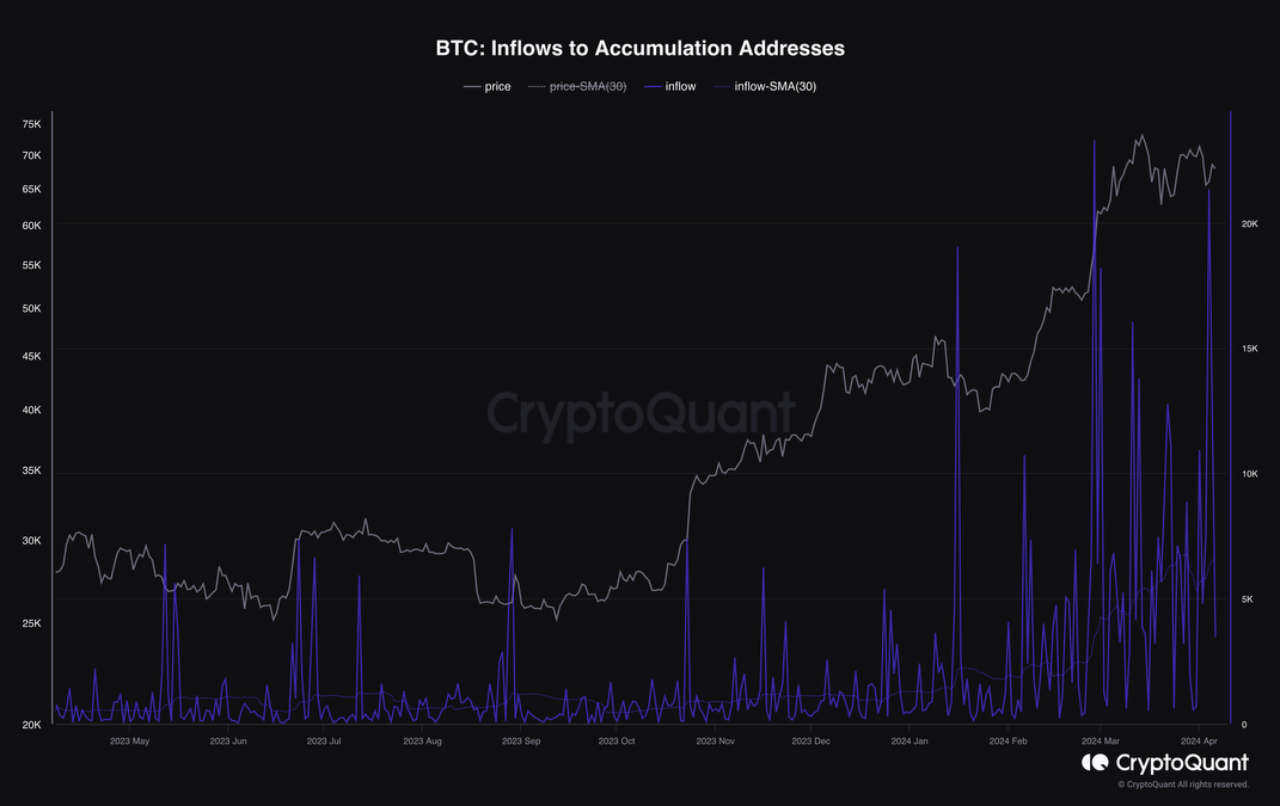

Moreover, the Bitcoin ecosystem witnessed substantial inflows into accumulation addresses, with their reserves hitting an all-time high. This trend indicates a growing confidence among long-term holders and investors, who are increasingly moving their assets to wallets that are known for accumulating and holding onto Bitcoin, rather than engaging in frequent trading. This behavior suggests a bullish outlook on Bitcoin’s long-term value, further contributing to the positive momentum. Over the last 4 hours, BTC price witnessed nearly $29 million worth of liquidations, of which sellers sold $28 million worth BTC contracts.

Lastly, a change in the behavior of long-term investors, particularly in their distribution patterns, has been observed. There’s a noticeable weakening in distribution, meaning long-term holders are selling off their Bitcoin at a slower rate than before. This change is critical because it reduces the amount of Bitcoin available on the market, creating a scarcity that can drive up prices.

Several analysts believe that the upcoming halving event might not have a big impact on BTC price. According to insights, the flow of funds into Bitcoin exchange-traded funds (ETFs) is expected to stay higher leading up to the Bitcoin halving event later this month.

The Bitcoin halving, a significant event occurring quadrennially, is projected to take place on April 20. The daily trading volume of the top seven ETFs has reached $3.19 billion, as reported by Santiment.

The firm also speculated on the potential for a decrease in both ETF and on-chain trading volumes following the event. Additionally, Lucas Kiely from Yield App proposed that acquiring Bitcoin through ETFs might reduce the chances of substantial fluctuations post-halving.

What’s Next For BTC Price?

Bitcoin price has been breaking above the symmetrical triangle formation in recent hours, indicating strong buying momentum from buyers. Buyers have broken above the $72K level, aiming to retest its ATH this week. As of writing, BTC price trades at $72,267, surging over 4.5% in the last 24 hours.

The 20-day exponential moving average (EMA) is steadily climbing, now at $69,167, and a positive relative strength index (RSI) suggests an advantage for the bulls. A decisive breakout above the ATH of $74K will send the price to $80,000.

However, if the price declines from the triangle’s descending trendline and falls below the 20-day EMA, it could mean an extended consolidation within the triangle, hinting at a shift in momentum to the bears. A break below the triangle may trigger a drop to $61,000, and subsequently to the 61.8% Fibonacci retracement level at $59K.