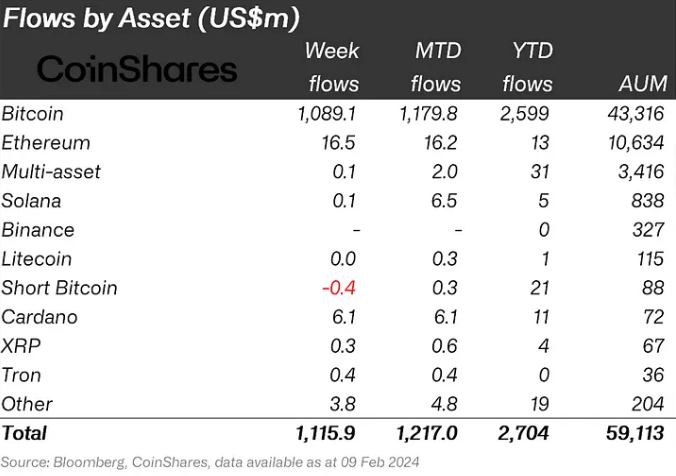

In an unprecedented rally reminiscent of the digital asset boom of previous years, digital investments have reached a new pinnacle with total assets under management (AuM) soaring to $59 billion, the highest figure recorded since early 2022. This resurgence is largely attributed to the significant inflows into digital asset investment products, which have seen a cumulative addition of $1.1 billion recently, bringing the year-to-date inflows to a robust $2.7 billion.

The latest report from CoinShares, a leading digital asset investment firm, highlights the renewed vigor within the cryptocurrency market, with Bitcoin at the forefront of this remarkable growth. The report underscores the pivotal role of the newly issued spot-based Bitcoin Exchange-Traded Funds (ETFs) in the United States, which have captivated investors’ attention and capital.

Since their launch on January 11, these ETFs have amassed an impressive $1.1 billion in net inflows in just the past week, culminating in total inflows of $2.8 billion. Despite the enthusiastic reception of Bitcoin ETFs in the U.S., the situation has been mixed in other regions. Canada and Germany experienced minor outflows, totaling $17 million and $10 million, respectively. Conversely, Switzerland has emerged as a beacon of positive momentum, with inflows reaching $35 million last week alone.

Bitcoin has dominated the inflow charts, accounting for nearly 98% of the total, further buoyed by price appreciations that have also lifted the spirits of Ethereum and Cardano investors. These latter assets witnessed inflows of $16 million and $6 million, respectively. Meanwhile, smaller cryptocurrencies like Avalanche, Polygon, and Tron saw modest inflows.

However, not all segments of the digital asset sphere have enjoyed positive trends. Blockchain equities experienced outflows, notably from one issuer to the tune of $67 million, although this was partially offset by inflows totaling $19 million from other issuers. The CoinShares report also pointed to potential market risks, such as the possible sale of Genesis holdings worth $1.6 billion, which could trigger further outflows in the months ahead.

Bitcoin’s Bullish Divergence

On the market front, Bitcoin has once again demonstrated its resilience and potential for substantial growth. The digital currency witnessed a notable surge in its price, illustrating the dynamic and volatile nature of the cryptocurrency market. This recent upward trajectory has captivated investors and traders alike, as Bitcoin breached significant resistance levels to achieve a new multi-week high.

The rally commenced with Bitcoin’s price ascending beyond the $45,500 mark, a critical resistance zone that had previously capped its upward movement. This breakthrough was a significant indicator of the bullish momentum building within the market. Following this initial success, Bitcoin confidently navigated through additional hurdles near the $46,000 and $47,200 levels. Each of these milestones represented a test of the cryptocurrency’s strength and the market’s willingness to support higher valuations.

As the bullish sentiment intensified, Bitcoin’s price managed to surpass the $48,000 resistance level, showcasing the sustained buying pressure and investor confidence. This momentum propelled the cryptocurrency to test the $48,800 zone, eventually peaking at a new multi-week high near $48,775. This peak not only symbolizes a significant achievement for Bitcoin but also serves as a testament to the robust interest and optimism circulating within the digital asset community.

Following its remarkable ascent, Bitcoin has entered a phase of consolidation, where it is currently stabilizing its gains. Currently, the price of Bitcoin stands at $47,954, experiencing a slight decrease of 0.39% over the past 24 hours, yet it has seen a significant increase of 10.38% in the last 7 days. This period of consolidation is crucial for establishing a solid foundation for potential future advances, allowing the market to absorb the recent gains and prepare for the next wave of buying activity.

The recent resurgence in digital asset investments and Bitcoin’s price signals a revitalized interest and confidence in the cryptocurrency market, marking a significant turn from the cautious stance observed over the previous years. With Bitcoin leading the charge, the digital asset sector is poised for potentially more groundbreaking developments as it continues to navigate the complexities and volatilities of the global financial landscape.