The leading on-chain data and insights provider Glassnode has disclosed some exclusive statistics regarding the top crypto asset Bitcoin (BTC). The platform has noted on its official X account that the market of the top crypto asset has touched a spot of huge exhaustion and apathy. Additionally, the platform disclosed that Bitcoin’s volatility measures and many prominent on-chain indicators had reached their all-time lows.

Glassnode’s Latest Statistics Say On-Chain Indicators of Bitcoin Are at Their All-Time-Lows

Apart from that, it brought to the front that the market has somewhat become very heavy. While providing details in this respect on its official web portal, Glassnode mentioned that the industry of crypto assets is continuously trading within an extremely low volatility zone. In addition to this, the company stated that many metrics signify enormous exhaustion and apathy as Bitcoin’s value hovers around the range of $29k and $30k.

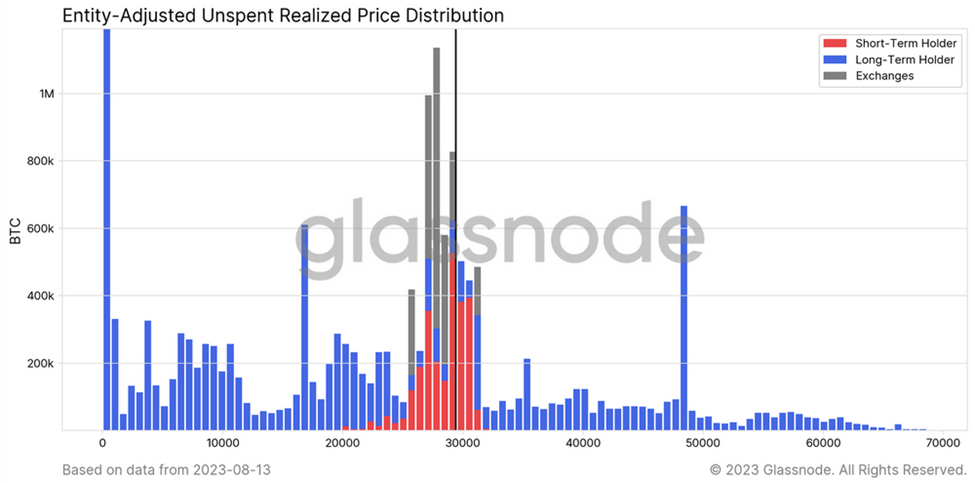

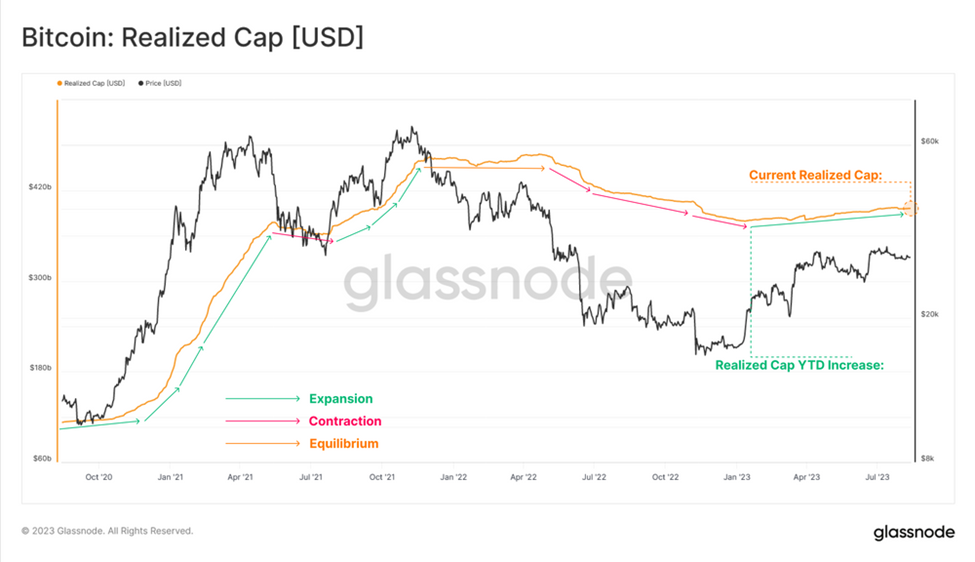

The company also added that a few indicators specify that the market is somehow very heavy. They take into account the Short-Term Holder supply’s concentration and cost basis regarding the present spot price. Moreover, Glassnode pointed toward the limited capital inflows. It added that the most crucial metric is the realized capitalization. In this respect, the gradient and magnitude of the realized capitalization are informative. This represents the inflows of more than $16 billion in value (nearly +4.1%) into Bitcoin year-to-date.

Nonetheless, one can also witness that the jump is very shallow from the vertical elevation that took place between the uptrend of the years 2021 and 2022. This brings to the front that Bitcoin showing a considerably modest pace even though the capital inflows are occurring. While moving further, the company divided the realized capitalization of Bitcoin into short-term and long-term holder components. Both the categories presented a +$22B increase and a -$21B decrease this year.

Several Investors Are Exposed to the Risk of Unrealized Losses

Furthermore, Glassnode also talked about the macro level and revealed that the respective supply dissemination is analogous to the periods during the recoveries of the bear markets in the previous times. Several price-conscious investors are at risk of witnessing unrealized losses.