In a significant development for the cryptocurrency market, Bitcoin (BTC) has surged beyond the $47,000 threshold, accompanied by a notable increase in open interest. Analysts and enthusiasts are closely monitoring these developments, with widespread anticipation that the U.S. Securities and Exchange Commission (SEC) could grant regulatory approval for U.S.-based spot Bitcoin exchange-traded funds (ETFs) this week.

As of the latest market data, Bitcoin is currently priced at $47,015, reflecting a robust 6.19% uptick in the past 24 hours. The swift upward movement triggered a series of liquidations, particularly of leveraged positions on centralized exchanges. Within the last hour alone, liquidations surpassed $2.5 million in Bitcoin positions, with shorts accounting for a significant portion at $1.98 million.

The broader cryptocurrency market experienced an influx of volatility, resulting in over $2.79 million in liquidated short positions. This contributed to an aggregate figure of approximately $3.99 million in liquidations across various centralized exchanges, according to comprehensive data provided by CoinGlass.

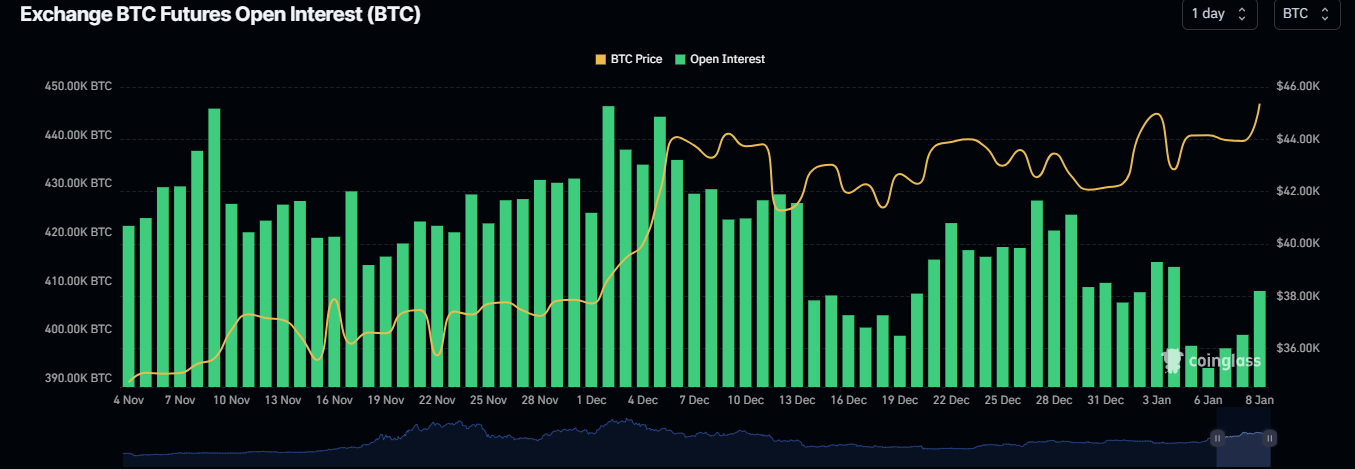

Adding to the fervor, Bitcoin futures open interest witnessed a substantial increase, reaching 407,400 BTC. According to data from CoinGlass, this surge represents a daily uptick of more than 8,000 BTC, highlighting the heightened interest and activity in the futures market of the leading cryptocurrency.

Spot Bitcoin ETF Buzz

The prevailing optimism in the market is largely fueled by expectations that the SEC could greenlight multiple spot Bitcoin ETFs in the near term. A recent report from Fox Business indicates that BlackRock, the world’s largest asset manager and a key contender in the race for a spot Bitcoin ETF, is optimistic about the approval of its application, with an expected decision date this Wednesday.

BlackRock is just one of several firms that recently submitted updated 19b-4 filings last Friday for proposed spot Bitcoin ETFs. Other prominent players in this race include Grayscale Investments, Valkyrie, ARK 21Shares, and Invesco. As part of the preparatory process, these firms have also filed amended S-1 forms today, providing insights into their prospective fee structures.

The broader crypto community is holding its breath as the SEC’s potential approval of spot Bitcoin ETFs is viewed as a transformative event. Analysts believe this move could inject billions of dollars in fresh capital into the cryptocurrency sector, attracting institutional investors and solidifying Bitcoin’s status as a mainstream investment asset.

With the market hanging in suspense, all eyes are now on the SEC, as the impending decision could shape the future trajectory of Bitcoin and have far-reaching implications for the wider digital asset market. As stakeholders eagerly await this pivotal verdict, the cryptocurrency landscape stands at the precipice of a potentially groundbreaking development.