Bitcoin’s recent descent to levels below $62,000 has prompted discussions and speculations among investors and analysts alike. The rapid decline has pushed the Relative Strength Index (RSI) into what is traditionally considered ‘oversold’ territory. Historically, such signals have often been precursors to significant price rebounds, presenting what some analysts view as potential buying opportunities.

Prominent crypto analyst Ali Martinez has highlighted this phenomenon, pointing out the historical rebounds Bitcoin has experienced following similar conditions. According to Martinez, the past instances where *BTC* daily RSI reached these levels resulted in impressive surges of 60%, 63%, and an astonishing 198%.

These statistics have not gone unnoticed, with the current market conditions stirring discussions about the potential for another significant price recovery.

Market Impact and Trader Sentiments

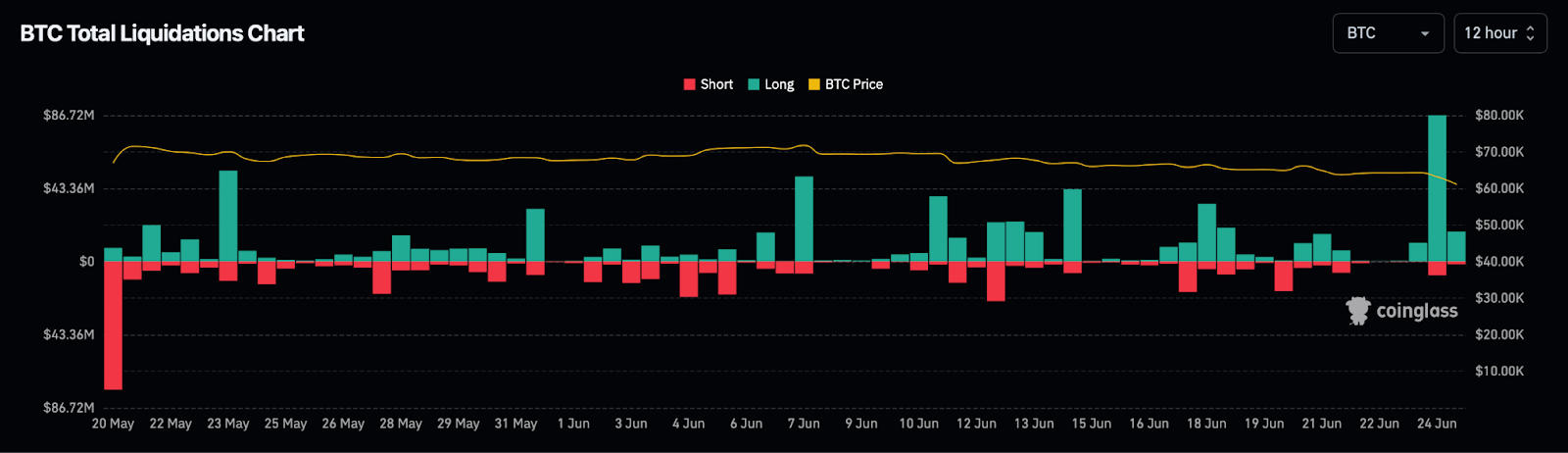

As Bitcoin grapples with these low prices, the impact resonates across the broader cryptocurrency market, affecting altcoins and influencing trader strategies. The recent price dip has not only seen a sharp decrease in value but also led to significant trader liquidations.

Data provided by Coinglass data shows that on average 89,025 traders were liquidated over a span of 24 hours leading to a total of $314.86mn liquidations spectacles. A large sum of these market moves was felt by Bitcoin traders who lost $128.56 million as a result.

Source: Coinglass

Of course, this phase of the market understandably has led to a mixed sentiment by investors. For some, this oversold status will look like a golden opportunity to “buy the dip.”

But for others, it will be way too soon to come back into the market with more declines on sight. This cautious optimism is shared by analysts who recognize the cyclical nature of Bitcoin’s market movements, suggesting that while the potential for gains is significant, so too is the risk involved.