Bitcoin is gearing up for a monumental surge towards the $48,000 mark, following a remarkable achievement of an $800 billion market capitalization. The market kicked off this week with a bullish vibe, with BTC price breaking above its psychological mark of $40K, marking a new 2023 high. However, as the year comes to a close, investors are wondering how long Bitcoin price can go ahead of the upcoming spot ETF approval.

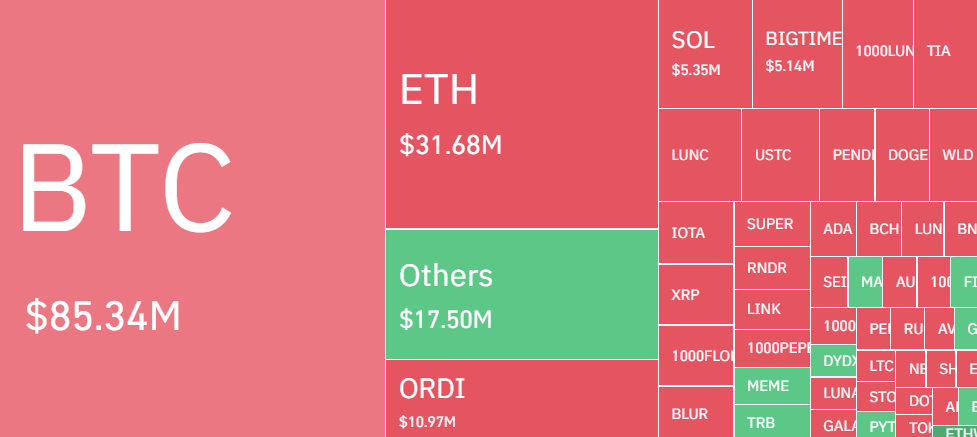

Bitcoin Triggers $85 Million Worth Of Liquidation

In the last 24 hours, Bitcoin has experienced a notable price increase, initially surpassing the $39K mark before steadily ascending past $40K, recently reaching a peak of nearly $42K. This uptrend has led to substantial market liquidations, according to information from Coinglass. The data indicates that during this price movement, Bitcoin saw total liquidations close to $85 million, with approximately $75 million of that amount coming from the liquidation of bearish short positions.

The market is experiencing its strongest performance since May 2022, highlighted by Bitcoin and Ethereum breaking through the $41,000 and $2,200 thresholds, respectively. This surge has pushed the total market capitalization to $1.55 trillion, marking a peak for 2023. Analysts are bullish due to the growing anticipation of the US Federal Reserve reducing interest rates in 2024 and the potential approval of a Bitcoin ETF by Jan 10. Such developments are expected to significantly boost the value of Bitcoin.

According to a prominent crypto analyst, Carl, Bitcoin price has created a CME gap. The ‘CME Gap’ is a term familiar to traders, referring to the price gap that appears on the Chicago Mercantile Exchange (CME) Bitcoin Futures chart when the price of Bitcoin moves after the CME futures market is closed for trading. Historically, these gaps tend to get filled, and in this instance, the gap suggests an upward trajectory for Bitcoin’s price.

Moreover, Bitcoin’s market cap reached a record high of $800 billion. This achievement strengthens its position, attracting more institutional investors. This increased market confidence is a key factor driving the anticipated price surge. Top of Form

Bitcoin’s $100K Target In 2024

Markus Thielen, the head of research at Matrixport, has forecasted that Bitcoin’s value could surpass $60,000 by April of next year and reach $125,000 by the end of 2024.

Thielen’s prediction is based on historical patterns observed in the market. He noted that the past three crypto bear markets were followed by three-year bull cycles. His analysis suggests that we are currently entering another three-year bullish phase, with 2023 marking its commencement.

Thielen highlighted that the years coinciding with Bitcoin mining reward halvings have traditionally been bullish. The next halving event, where mining rewards will be reduced by 50%, is anticipated around mid-April 2024. According to Thielen, miners typically accumulate Bitcoin in anticipation of these halvings, historically leading to a price increase of over 200%. This trend supports his projection of Bitcoin reaching $125,000.

Previously, Standard Chartered Bank forecasted that Bitcoin might reach $120,000 by the end of 2024. Currently, there are 13 applications for a spot Bitcoin ETF in the U.S., with the latest submission coming from Swiss asset manager Pando Asset on November 29. If approved by Jan 10, Bitcoin price might head toward its $100K goal in 2024.

Despite this bullish projection, skepticism about this asset class persists among some, including the renowned investor Warren Buffett. At the 2022 Berkshire Hathaway annual meeting, Buffett expressed his reservations about the cryptocurrency, famously remarking that even if he were offered all the Bitcoin in the world for $25, he would decline, questioning the practical utility of the digital asset by asking, “What would I do with it?”