Following a promising surge above $27,000, fueling hopes for a bullish resurgence, BTC unexpectedly retreated from its resistance levels. In the past 24 hours, BTC’s price plummeted from the $27K threshold, touching critical support just under $26,500. Yet, recent on-chain data indicates a rise in UTXOs in profit, suggesting a reduced likelihood of a further bearish downturn for Bitcoin at its present value.

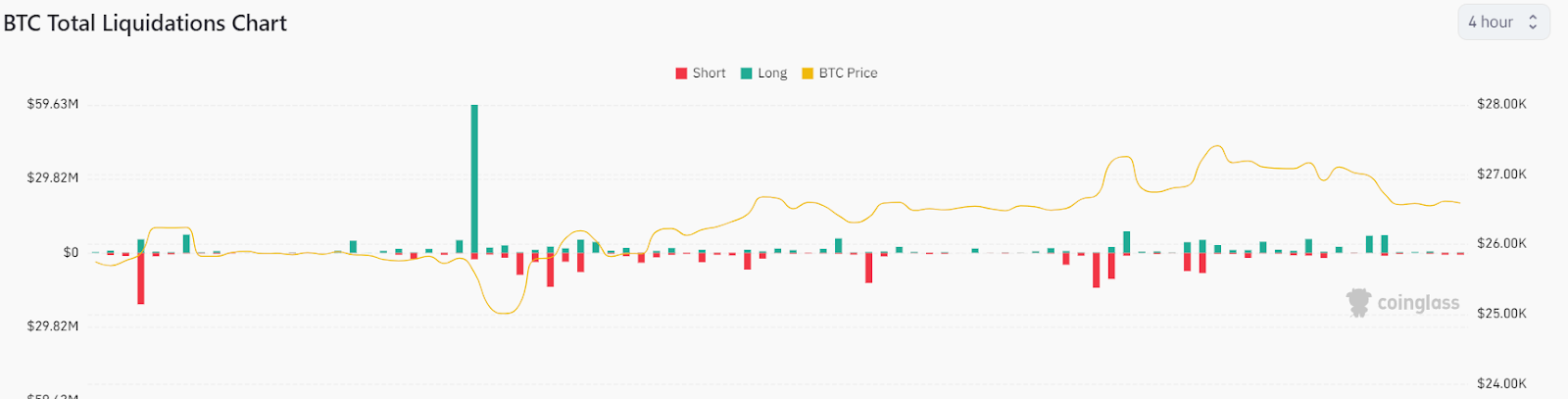

$34 Million Long-Positions Liquidated

The latest market condition presents an unexpected twist: Bitcoin’s value has dipped below the crucial $27,000 mark. This decline, paired with a surge in long-liquidation, sparks curiosity and begs the question: Are bearish traders beginning to take the reins?

After struggling at $27,000, Bitcoin’s value began its decline, marked by a notable bearish sign: a spike in long-liquidations. Data from Coinglass reveals that an astonishing $34 million in long positions were wiped out in just a few hours.

This massive liquidation underscores the increasing selling pressure, especially as the BTC price failed to maintain its buying demand near $27K. For those new to the concept, long-liquidation refers to traders who anticipated a price rise being forced to close their positions, frequently at a deficit, because the price moved contrary to their forecasts.

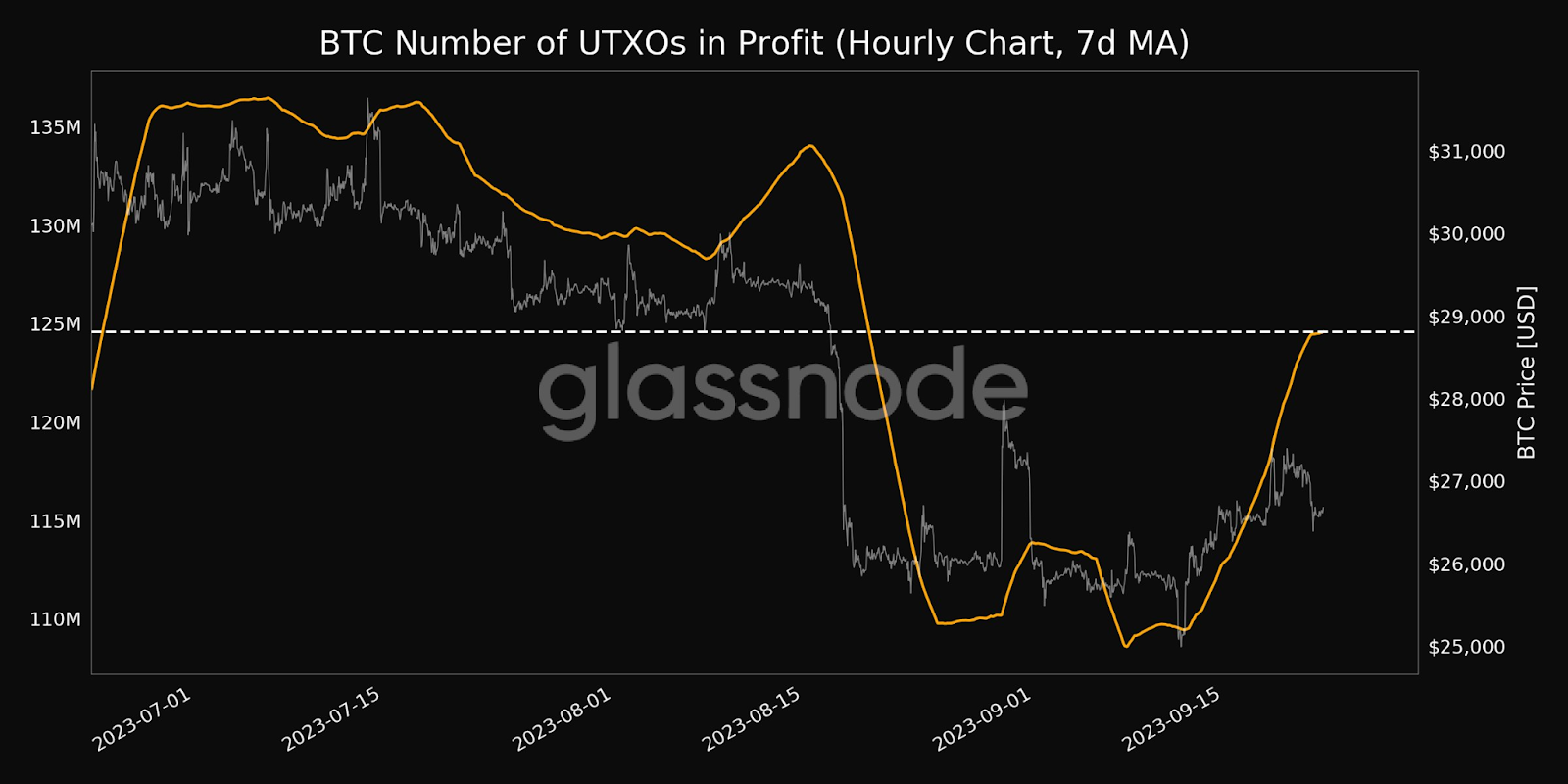

Yet, in the face of increasing selling pressure, a particular on-chain metric is igniting optimism that might counteract BTC’s downward trajectory. Glassnode data reveals that the count of BTC UTXOs in profit has reached a one-month peak of 124,578,285.643.

UTXO refers to the amount of Bitcoin left unspent after a transaction has been executed. When this figure is in profit, it means that the value of these unspent Bitcoins is higher than when they were last moved or spent.

A high UTXO in profit indicates that a large portion of Bitcoin holders are currently in a profitable position. This can act as a psychological boost, reinforcing the belief that Bitcoin remains a viable and profitable investment. When investors are confident, they are less likely to panic sell, leading to a more stable price.

With more holders in a profitable position and less incentive to sell, the chances of a sudden bearish pullback are reduced.

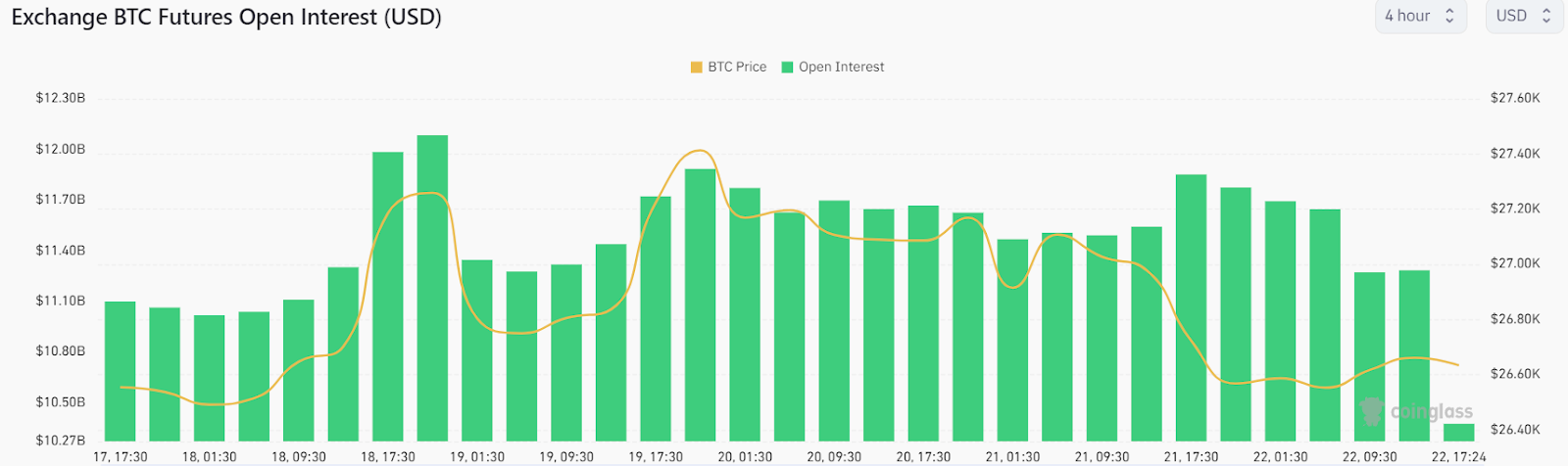

Bitcoin’s Open Interest (OI) Declines Heavily

In recent hours, there’s been a noticeable trend among traders rapidly unwinding their future positions in Bitcoin, driven by data pointing to a sharp decrease in Bitcoin’s open interest (OI) metric. The data indicates a substantial $1 billion drop in the OI, implying that traders are becoming increasingly cautious. This hesitancy to open new positions reflects the current mixed sentiment surrounding Bitcoin.

The impact of such a significant drop in open interest can be profound on Bitcoin’s price. Historically, a decrease in OI can indicate reduced trading enthusiasm or confidence, potentially leading to decreased liquidity and increased volatility. In the short term, this might result in price fluctuations, while in the longer term, it could signal a more cautious or bearish outlook unless countered by other positive market indicators.

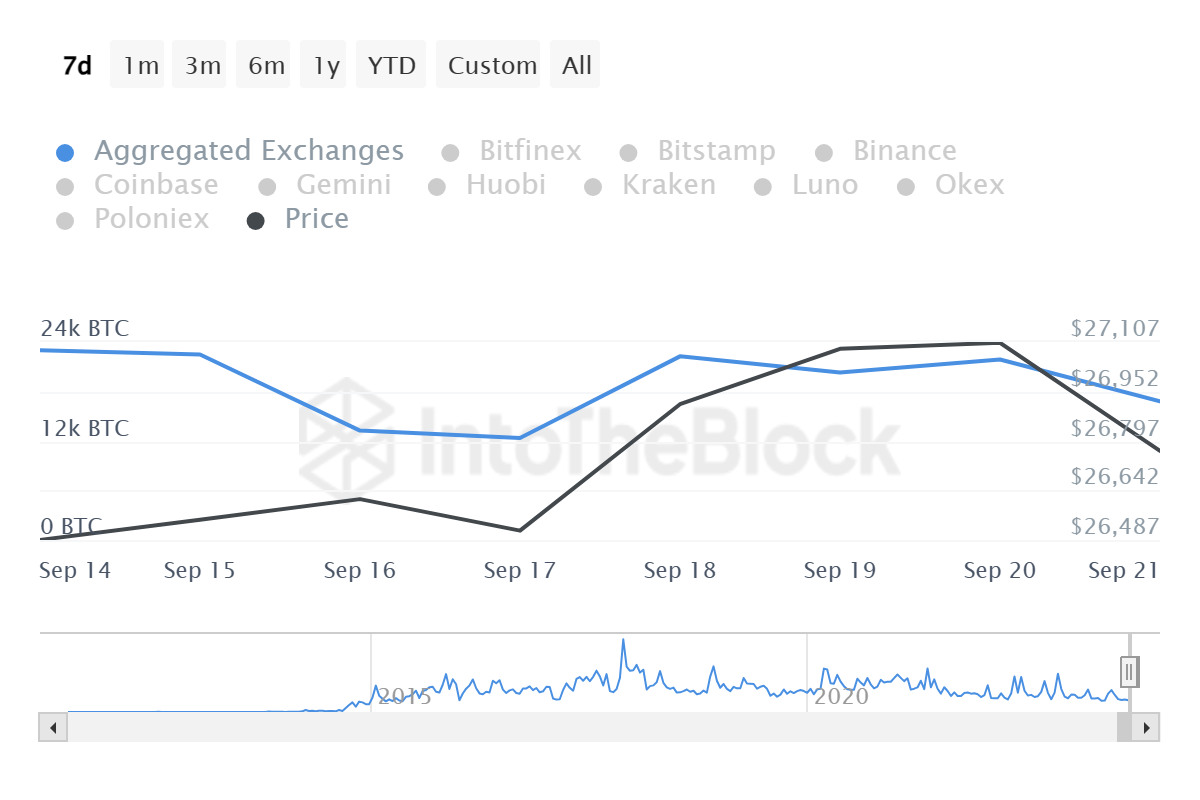

Additionally, data from IntoTheBlock shows a decreasing trend in Bitcoin’s outflow volume. At present, the outflow stands at 16.8K BTC, indicating that fewer Bitcoins are being withdrawn from exchanges for holding. This suggests a bearish outlook for Bitcoin. With a higher number of Bitcoins remaining on exchanges, the likelihood of these BTC being sold rises, potentially exerting further downward pressure on its daily price trajectory.

On the bright side, BTC is experiencing a positive funding rate, a pivotal indicator for derivatives, especially for perpetual futures contracts. The funding rate denotes the fee exchanged between contract participants. When the rate is positive, it means that traders who are long (anticipating a price increase) are compensating those who are short (predicting a price drop).

Such a positive funding rate typically signals a predominant bullish sentiment among traders, reflecting expectations of a price surge. In the short term, this positive rate can serve as a buffer against bearish momentum, indicating sustained faith in Bitcoin’s capacity to rally.