Bitcoin’s value soared above $44,000 today, marking its highest point since April 2022. This increase is attributed to a growing interest in buying at current prices and a decline in activities by short sellers who were previously betting against the asset. Additionally, factors such as rising open interest and perp delta indicate that BTC is experiencing growing bullish momentum.

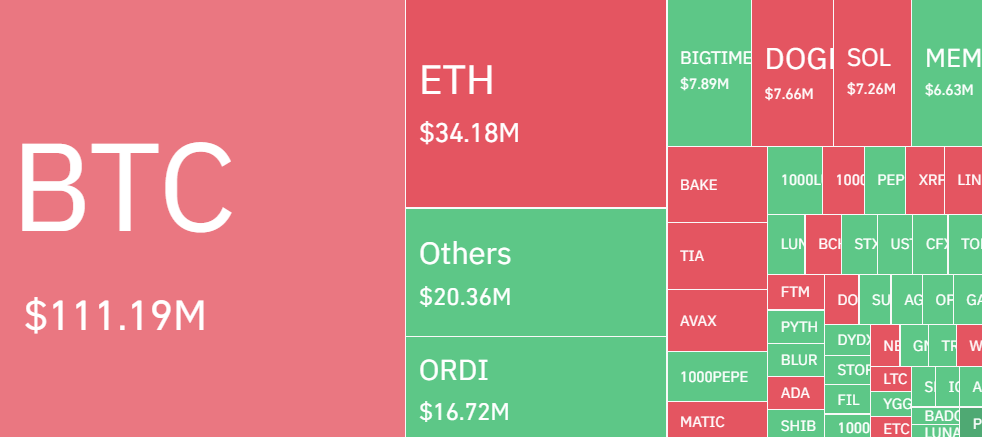

Bitcoin Faces A Total Liquidation Of $111 Million

In the past day, the price of Bitcoin experienced a significant jump, surging from a low of $41,500 to a high of $44.5K. This substantial increase led to the liquidation of positions valued at over $111 million, with sellers bearing the brunt as they liquidated positions worth around $94 million.

Bitcoin is currently in the spotlight once more. The world’s largest cryptocurrency has seen a remarkable 150% growth this year, with its price exceeding $44,000 on Wednesday for the first time in more than a year and a half.

This upward trend in Bitcoin’s value reflects its ongoing positive momentum, supported by various factors. These include decreasing interest rates and rising anticipation surrounding the potential approval of a Bitcoin spot exchange-traded fund (ETF) in the United States by January 10.

Bloomberg’s analysts made a robust forecast about Bitcoin, as it makes significant gains in the market. They suggest that Bitcoin’s climb over $42,000 signifies the beginning of a “crypto supercycle,” rather than merely being a transient high point.

In line with this optimistic outlook, the prediction is that Bitcoin will skyrocket to extraordinary heights, surpassing $500,000.

The recent surge in the market has also led to a revival of activity among “aging whales,” reminiscent of patterns observed during the bullish phase of 2021. CryptoQuant analyst ‘Maartun’ noted a significant transaction on December 5th, involving 1000 bitcoins that had been dormant for over ten years.

This echoes the 2021 bull market trend, where there was a noticeable increase in transactions involving Bitcoins that had been inactive for a decade or more. This suggests that the current market is entering a similar phase of activity.

Futures OI And Perp Delta Are Bullish

The rise in Bitcoin’s value is believed to be partly driven by the closure of short positions, as traders who were betting on a price decline are now cutting their losses. This activity has created a short squeeze, sending the price upwards as short sellers purchase Bitcoin to cover their positions.

Market analysts have been closely monitoring the Open Interest (OI) on Binance Futures, which has shown a positive trajectory. The OI is a key indicator of market sentiment and liquidity, and the current trend suggests an increasing interest in Bitcoin futures contracts. This is a bullish signal, indicating that traders are more optimistic about the future price of Bitcoin.

Additionally, the Perpetual Delta, a metric used to gauge the net difference between perpetual contract buys and sells, has also been trending positively. This metric offers insights into the market’s directional bias and, in this case, points towards a bullish sentiment among traders.

Interestingly, data from CoinGlass reveals that the majority of these liquidations took place on Binance, OKX, and Huobi. Over the past week, trading volumes have seen a 25% increase, and the open interest has risen to $20.2 billion, up from $17.2 billion at the beginning of December.

A group of traders reportedly established a $200 million position in BTC futures over the weekend, signaling strong interest in Bitcoin exposure. This activity coincides with ongoing updates and modifications related to spot ETF applications.

Several market watchers anticipate that Bitcoin prices may surpass the $48,000 mark in the upcoming weeks.