In a striking demonstration of investor confidence, Bitcoin spot Exchange-Traded Funds (ETFs) have recorded a remarkable $146 million in net inflows on February 7, according to financial analytics firm SoSoValue. This marks a continuous streak of inflows for nine days, underscoring a growing interest in cryptocurrency investments despite the volatile nature of digital assets.

The inflow contrasts sharply with the performance of Grayscale’s ETF, GBTC, which experienced a net outflow of $80.78 million on the same day. Excluding Grayscale, the remaining nine ETFs boasted a collective net inflow of $226 million, highlighting a significant shift in investor sentiment.

Notably, the Fidelity ETF, FBTC, alone attracted a single-day net inflow of approximately $130 million, signifying its increasing popularity among investors seeking exposure to Bitcoin through traditional financial instruments. The spotlight, however, shines brightest on BlackRock’s IBIT, which has emerged as a frontrunner in the Bitcoin spot ETF arena.

Surpassing Grayscale with a trading volume of $347.68 million compared to GBTC’s $333.17 million, IBIT demonstrates a nearly $14 million lead, showcasing the intense competition within the sector. This rivalry is a direct result of the U.S. Securities and Exchange Commission’s (SEC) approval of spot BTC ETF applications from leading financial giants including Grayscale, BlackRock, Fidelity Investments, Invesco Galaxy, Bitwise, and several others.

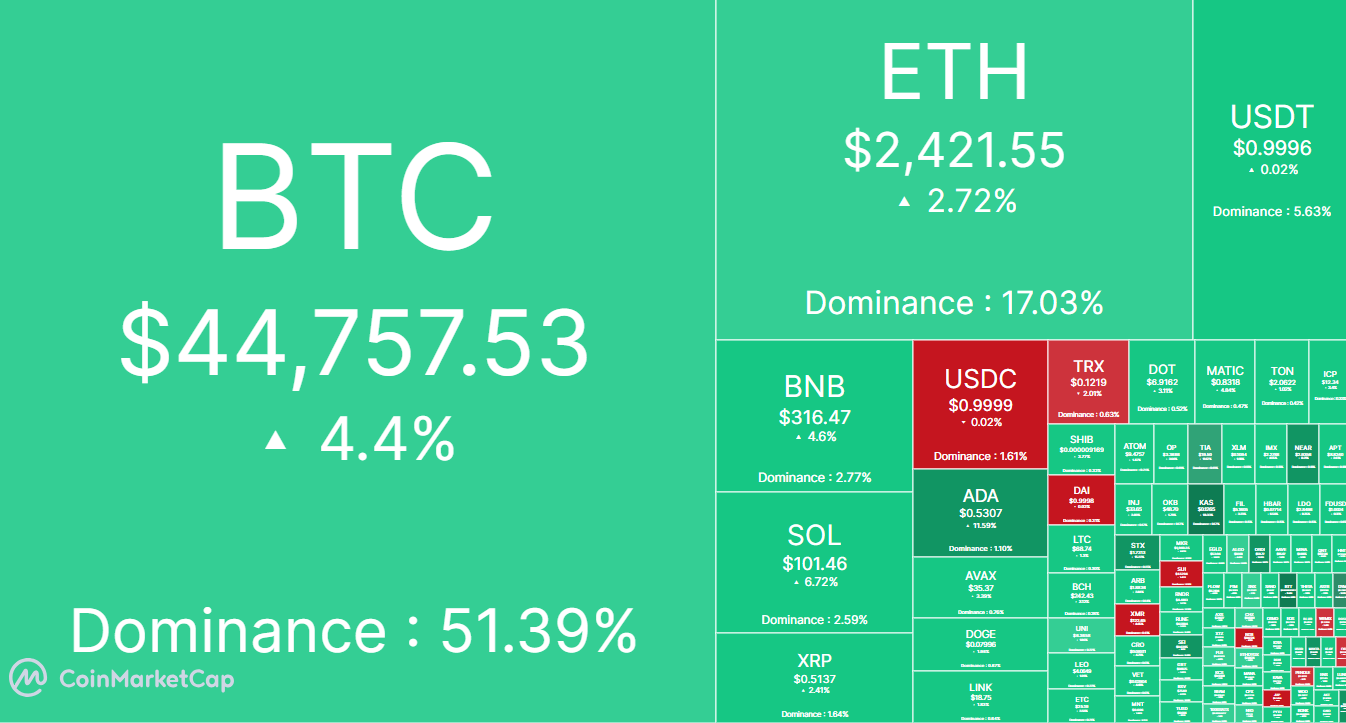

Crypto Market Goes Bullish

The prevailing sentiment in the cryptocurrency market remains notably bullish, with indicators pointing towards a positive trajectory. The global crypto market cap, standing at $1.71 trillion, reflects a robust 3.66% increase over the last day, indicating strong investor confidence and market resilience. *BTC*, the flagship cryptocurrency, has surged to $44,724, marking a substantial 4.28% uptick in the past 24 hours alone.

Moreover, the 24-hour trading volume of Bitcoin has surged impressively by 56.29%, reaching a staggering $25.15 billion. These figures underscore a growing appetite for digital assets among investors, fueled by optimism surrounding Bitcoin’s potential as a hedge against inflation and its increasing integration into mainstream finance.

The increasing inflow into Bitcoin spot ETFs is a clear indicator of the shifting dynamics within the investment landscape, where traditional and digital asset classes begin to converge. Investors are increasingly drawn to the promise of Bitcoin’s potential returns, leveraging the safety and regulatory compliance offered by ETFs. This trend is further fueled by the growing acceptance of cryptocurrencies as a legitimate asset class among institutional investors.

The competition among ETF providers is intensifying, with each seeking to carve out a dominant position in the burgeoning market. The rivalry between Grayscale and BlackRock, in particular, highlights the evolving narrative of digital asset investments, where innovation, regulatory approval, and investor confidence intersect to shape the future of finance.

The sustained inflows signify a maturation of the market, attracting a more diverse investor base and embedding cryptocurrencies more deeply into the fabric of global finance. With each passing day, the integration of digital assets into traditional financial systems becomes increasingly seamless, heralding a new era for both investors and the cryptocurrency industry at large.