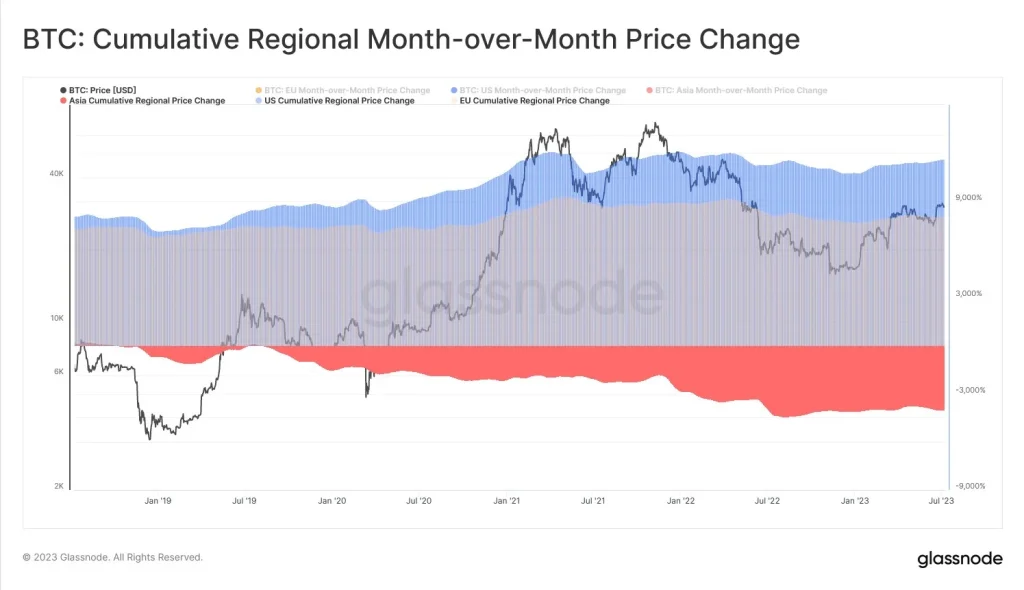

The blockchain data intelligence forum Glassnode has recently shared some exclusive statistics about the top crypto Bitcoin (BTC). The token has been showing quite a positive performance for the recent few months. In this respect, the entities within the United States have particularly shown a significant rise in their traded and held supply of Bitcoin.

Glassnode Says Bitcoin’s Traded and Held Supply at US Firms Increases after Blackrock’s ETF Request

The data provided by Glassnode pointed out that the ETF request of Blackrock has played a significant role in all this. Blackrock is considered to be the largest asset management around the globe. The platform has recently filed an ETF request for Bitcoin. It announced the respective move on the 15th of the previous month.

As a result of that, the well-known crypto token witnessed a great increase in its supply. As per Glassnode, this points toward a likely inflection point in the top crypto coin’s supply dominance. Nonetheless, it added that this would be possible if the respective trend gets sustenance. In addition to this, the on-chain analytics platform brought to the front that the Bitcoin miners traded a great amount of the mined Bitcoin tokens back in June.

Miners Attempt to Capitalize on Bitcoin’s Recent Price Rise

Glassnode mentioned that, on the 20th of June, the exchange flow of Bitcoin miners reached its peak at 4,710 BTC in the previous 5 years. The rest of the days in the month additionally witnessed remarkable spikes, having an average of more than 2000 Bitcoin to exchanges. On the 4th of July, Young Ju (the CEO of CryptoQuant) stated that Bitcoin miners sent more than 54,000 tokens to the well-known crypto exchange Binance in the recent 3 weeks. This signifies that miners intended to capitalize on the recent price rise of Bitcoin.