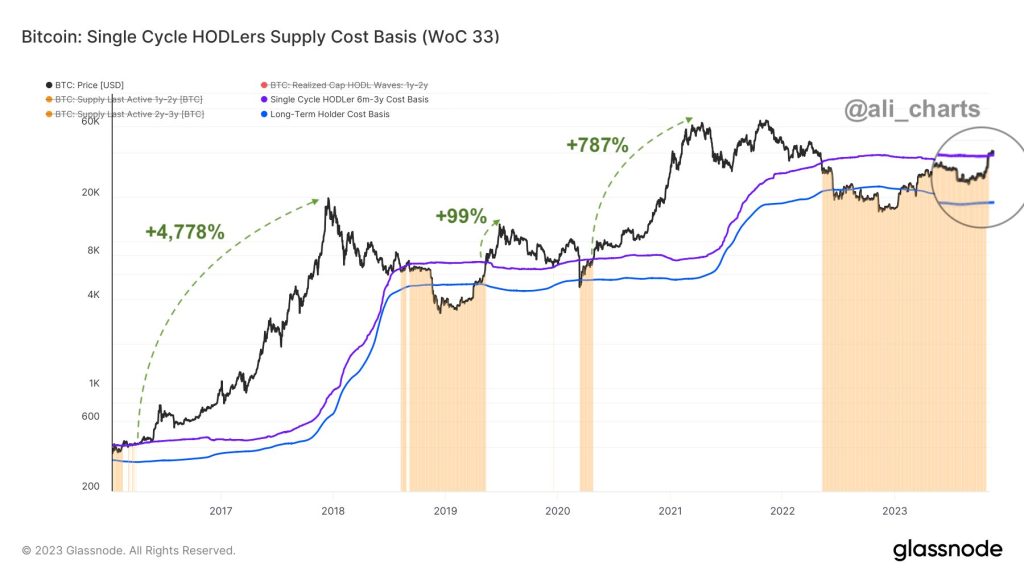

Bitcoin (BTC) recently surpassed the 6-month to 3-year hodler pricing basis, reaching $34,150. Investors and analysts are interested in this achievement because it may herald a market turnaround. If Bitcoin (BTC) stays above this mark, it could help holders of BTC at a lower value recoup profitability.

Bitcoin’s Resilience Shines as Price Sparks Investor Interest

Bitcoin’s exceeding the hodler cost basis within a 6-month to 3-year timeframe has historically triggered important market developments. For comparison, Bitcoin (BTC) rose 4,778%, 99%, and 787% in the three prior instances when it hit this milestone. Historical data gives the crypto community confidence and raises anticipation for a future upturn. These statistics have been pointed out by crypto analyst Ali in his latest tweet.

Bitcoin’s price had been constant for weeks before this incident, but this latest development has piqued investors’ interest. Bitcoin’s resilience and ability to recover from market downturns make it a promising investment and wealth preservation tool.

Academic experts and cryptocurrency enthusiasts are closely monitoring the price level in hopes of a market rebound. Economic data, market sentiment, and world events have continuously affected Bitcoin prices. Given these factors, the cryptocurrency market is dynamic and adaptable, with both internal and external factors having an impact.

Bitcoin prices have fluctuated due to the U.S. nonfarm payrolls (NFP) report, which showed a drop in job growth in October. The figures also showed rising unemployment and slower pay growth. The above economic indicators have led to speculation that the Federal Reserve may not raise interest rates.

Amerdata Director Sees Bright Future for BTC

Amerdata director of derivatives Greg Magadini is optimistic about BTC, citing negative Non-Farm Payroll (NFP) statistics and falling stock market volatility indexes as factors that could boost the cryptocurrency. The Federal Reserve raised interest rates multiple times last year to control inflation.

The decrease in volatility in conventional financial markets, particularly equities and bonds, supports Bitcoin’s optimism. Reduced volatility reduces liquidity strain and creates a more favorable environment for investors and dealers, encouraging riskier international market operations.

The recent achievement of Bitcoin in exceeding hodlers’ cost base over six to three years is a milestone in the cryptocurrency market. The combination of solid economic circumstances and decreasing market volatility has revived market optimism. However, the cryptocurrency market is vulnerable to external causes and global events, making it a flexible asset category for investors and traders.