In a surprising turn of events, Bitcoin has managed to climb above the $26,500 mark, defying the traditional strategy that correlates high trading prices with robust transaction volumes. This unexpected surge has left investors and analysts scratching their heads, as on-chain data reveals a contrasting story of low transaction activity.

Bitcoin’s Average Transaction Volume Touches 4-Year Low

In the wake of FTX’s cryptocurrency liquidation and the U.S. Federal Reserve’s interest rate announcement, Bitcoin has demonstrated strong buying support at key levels, as evidenced by its daily price chart. Despite low transaction volume, BTC has maintained its upward momentum, comfortably staying above the $26.5K mark and now eyeing a push towards the $27K threshold.

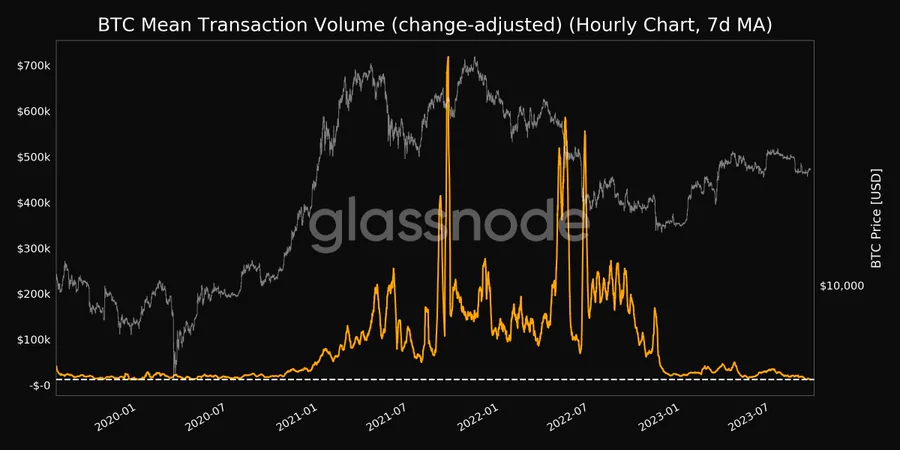

Per Glassnode’s on-chain analytics, Bitcoin’s average transaction volume has plummeted to a four-year low, hitting $12,234. The last time it dipped this low was on January 2, 2020, when it touched $12,341. Additionally, Bitcoin’s median transaction volume touched a 3-month low of $67.43.

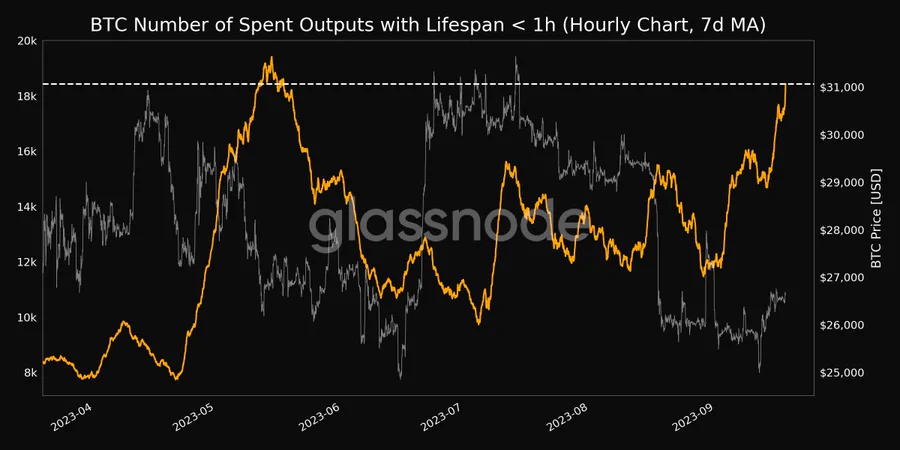

As Bitcoin shows signs of recovery, short-term investors are taking the opportunity to unload their holdings and capitalize on minor price surges. The short-term SOPR metric, which measures holdings of less than one hour, has soared to a four-month peak of $18,432. This indicates that Bitcoin’s recent price volatility has been lucrative for those holding the asset for under an hour. However, this could pose a challenge to Bitcoin’s price trajectory, as increased selling pressure may potentially lead to a downturn in its value.

Bitcoin’s scalability issues are well-known, and with competitors offering faster and cheaper transactions, users might be migrating to alternative platforms for their transaction needs. The recent data presents a mixed bag for Bitcoin. While strong buying support and upward price momentum are positive signs, the low transaction volume and increased short-term selling pressure add layers of selling pressure.

Bitcoin Sees A Spike In Adoption

Bitcoin’s recent push towards the $27K mark is backed by compelling on-chain metrics. According to Glassnode, the number of new Bitcoin addresses has been on an upward trend for the last five years, recently hitting a five-year peak at 26,808. This indicates heightened investor enthusiasm for acquiring Bitcoin. Furthermore, Bitcoin’s transaction count has seen a significant uptick, reaching a four-month high of 23,724.

The rise in the number of new Bitcoin addresses to a 5-year high suggests that investor interest in Bitcoin is stronger than ever. New addresses typically indicate new entrants into the market, which could mean increased demand for Bitcoin. A consistent increase in new addresses could lead to higher demand and, consequently, a long-term bullish trend for Bitcoin. This could make Bitcoin a more attractive investment option, potentially driving its price even higher in the long run.

Moreover, an exponentially rising number of transactions could indicate that Bitcoin is not just being hoarded but is also being actively used for various purposes. This could lead to greater adoption, making Bitcoin more mainstream and potentially driving up its long-term value.

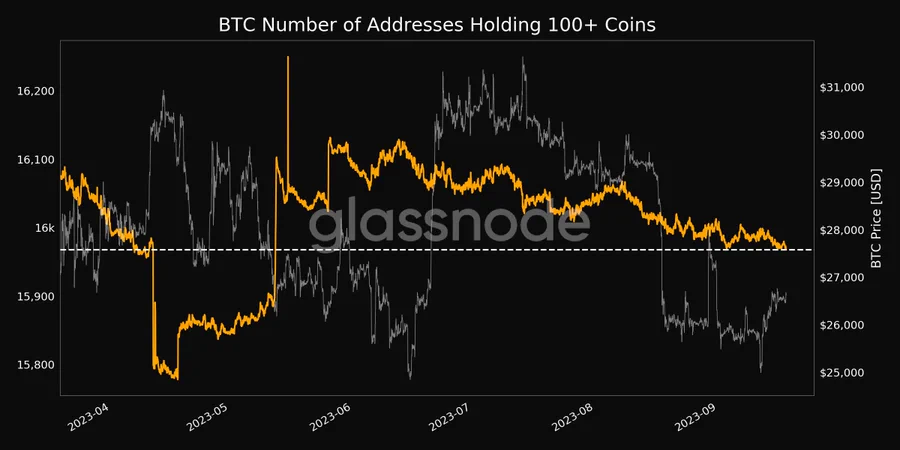

Nonetheless, whale activity, often a key driver of Bitcoin’s volatility, appears to be declining, according to on-chain data. The statistics indicate that the number of addresses holding more than 100 Bitcoins has dipped to a four-month low, standing at 15,968.

A decrease in the number of large holders could potentially lead to lower liquidity, making it more challenging to execute large trades without impacting the market price. Lower liquidity could deter institutional investors who might be looking to enter or exit the market with large positions. This could limit Bitcoin’s upward price potential in the short term.

Nonetheless, as the SEC gears up to rule on Bitcoin ETFs on October 17, Bitcoin’s price appears to be in a phase of accumulation, laying the potential for explosive gains.