A prominent Bitcoin whale has recently made headlines by purchasing 1,000 BTC, worth approximately $59.65 million, just 55 minutes ago. This substantial acquisition comes as Bitcoin hovers around $60,000, with the whale taking advantage of what appears to be a market dip. The whale now holds a total of 7,559 BTC, valued at approximately $450 million, signaling confidence in Bitcoin’s future price action.

This whale’s recent purchase marks a strategic return to accumulation after a period of significant selling. Between June 27 and July 8, the same whale sold off 7,790 BTC, amounting to roughly $468.3 million at that time. This earlier move to liquidate a substantial portion of holdings came just before Bitcoin experienced a period of volatility, suggesting the whale’s adept market timing and insight.

Technical Analysis: Current Market Dynamics

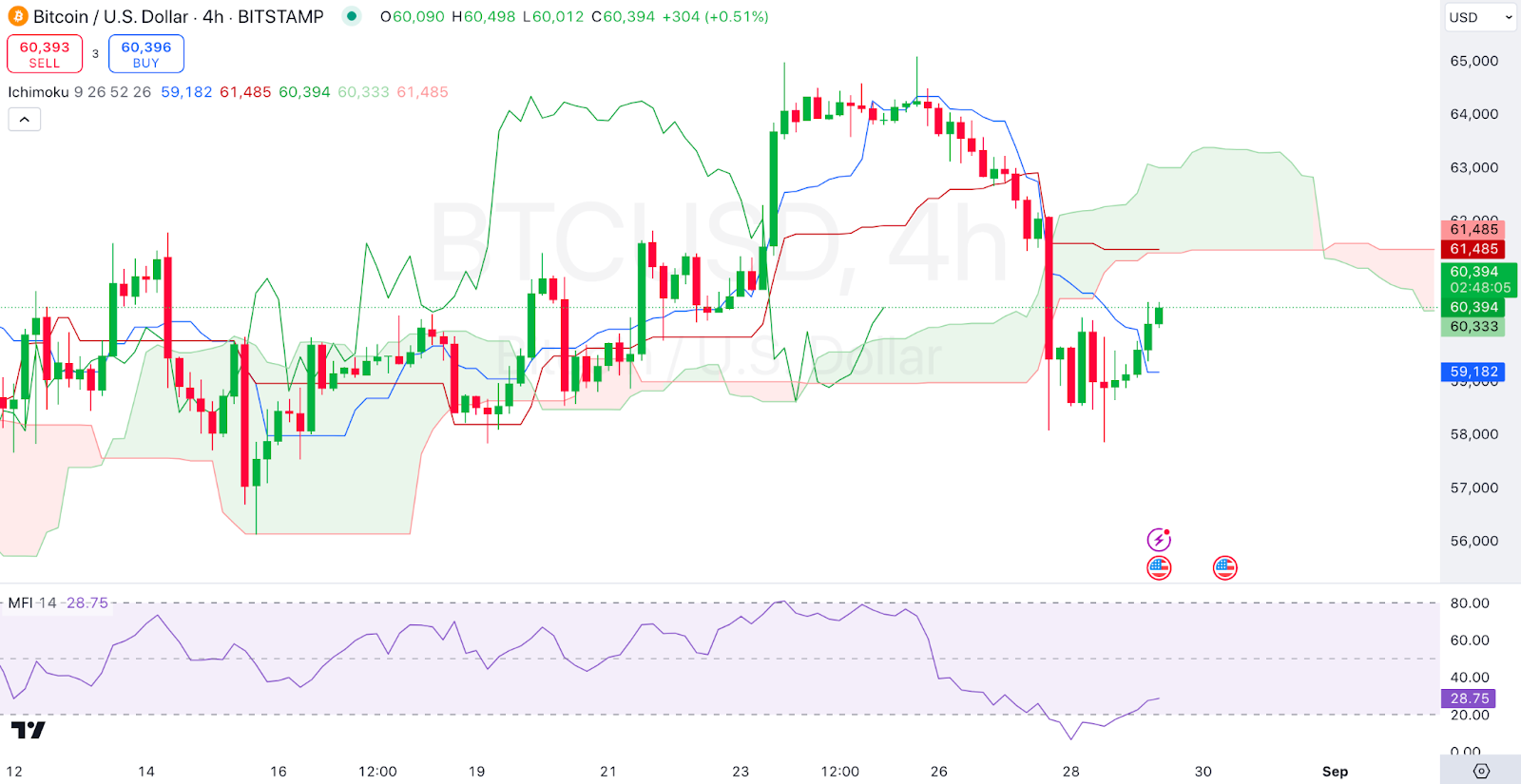

The 4-hour chart of Bitcoin against the U.S. Dollar on Bitstamp provides further context for this whale’s actions. Bitcoin is currently trading at $60,394, showing a modest increase of 0.51%. The Ichimoku Cloud on the chart presents a mixed outlook. Bitcoin is trading just below the cloud, indicating a near-term bearish trend, with the cloud acting as a significant resistance zone. The upper boundary of the cloud, marked by Senkou Span A, is at $61,485, while Senkou Span B is slightly lower at $60,333. For a bullish reversal, Bitcoin would need to break and close above these resistance levels.

4-hour BTC/USD Chart | Source: TradingView

The Money Flow Index (MFI), currently at 28.75, suggests that Bitcoin is in the oversold territory, as values below 30 typically indicate oversold conditions. This reading aligns with the whale’s recent accumulation, hinting at a potential short-term rebound if buying pressure increases. The Conversion Line (Tenkan-Sen) at $60,396 is marginally above the current price, reflecting a near-term bearish stance. However, the Base Line (Kijun-Sen) at $59,182 serves as the immediate support level, suggesting that Bitcoin may test lower levels before any potential upward movement.

This whale’s activity is significant for both market sentiment and retail traders. A purchase of this magnitude often signals strong bullish sentiment among large holders, potentially influencing other market participants to follow suit. If Bitcoin can sustain above the key support levels and break through the resistance indicated by the Ichimoku Cloud, a bullish trend could emerge, validating the whale’s strategic move.