Crypto markets rallied yesterday after U.S. inflation data came in lower than expected, sparking a revival in the buying sentiment. *BTC* soared past $66,000 for the first time since April 24 and has increased by more than 6% in the past 24 hours. As the market recovers from the recent low, there might be a surge in altcoins prices. Analysts believe that Bitcoin’s recent breakout has revived market confidence and investors might soon switch their focus toward altcoins.

BTC Price Sets Eye On ATH

The Bitcoin rally followed the release of April’s U.S. Consumer Price Index (CPI) figures, which showed a slight decrease from March, along with a modestly weak retail sales report. This data relieved investors who had feared that rising inflation and an overheated economy might push the Federal Reserve to reverse its dovish stance and consider interest rate hikes.

“Investors consider this as a bullish regime shift, as it marks the first decrease in CPI inflation over the last three months,” Bitfinex analysts said in a market update. They added that this, along with the Federal Reserve’s earlier announcement of its plan to taper the central bank’s balance sheet run-off, “is viewed as a positive development for risk assets.”

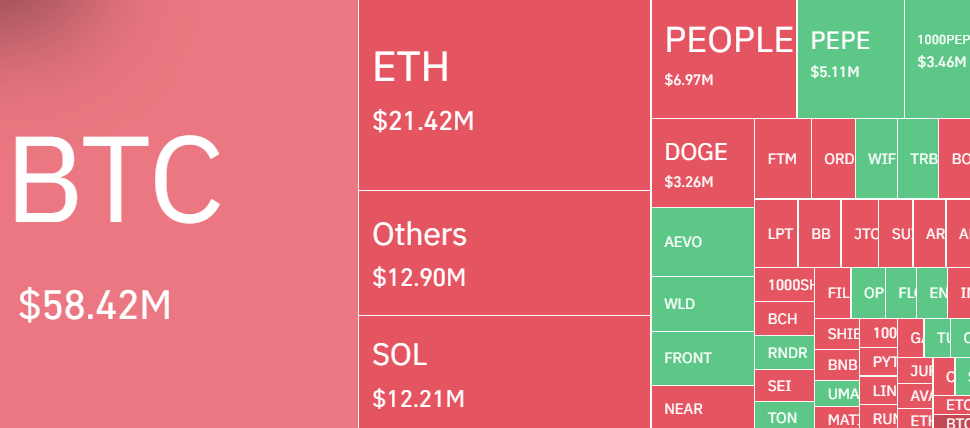

Over the last 24 hours, the Bitcoin market witnessed a surge in total liquidation as it nears $60 million, as of writing. Bearish positions were liquidated most as the amount surpassed $48 million.

Bitcoin (BTC) is likely to rally back to $74,000 in the coming weeks, nearing its all-time high reached in March, driven by three bullish factors, according to crypto trading firm QCP Capital.

QCP Capital analyzed current market conditions on Thursday and predicted a Bitcoin price rally to the highs of $74,000. They expect bullish momentum in Bitcoin in response to macroeconomic developments in the U.S., including a gradual decline in inflation and subsequent interest rate cuts, which should support risk assets. Since this analysis, Bitcoin has traded near the $66,000 level. QCP Capital analysts have noted significant buyers for $100,000 to $120,000 Bitcoin calls for December 2024, reflecting confidence in recent price gains.

Institutional demand for Bitcoin is also on the rise. Large asset managers like Millennium and Schonfeld have invested 3% and 2% of their Assets Under Management (AUM) into the Bitcoin Spot ETF.

Analysts also observe that the breakout in Bitcoin’s price follows increasing sovereign and institutional adoption ahead of the upcoming U.S. elections. Citing the timing, the firm speculates whether this could signal “the resumption of the bull market,” according to a comment on its official Telegram account.

As BTC price now charges ahead, we might see a comeback in altcoin domination during a minor pullback in Bitcoin. This might strengthen the buying sentiment in the market. Michael predicts a comeback in altcoin sentiment with BTC price having a strong support around $60,500.

What’s Next For BTC Price?

Bitcoin climbed past the 20-day exponential moving average ($63,379) on May 16, showing that buyers have taken control. The price has been skyrocketing in recent hours and is aiming to break the $70K barrier. As of writing, BTC price trades at $66,268, surging over 6.5% in the last 24 hours.

If this momentum continues and the price exceeds the immediate resistance line of $67,232, it could lead to a potential rise towards the strong resistance at $73,777. Sellers are expected to put up a strong defense at this level.

To halt this upward movement, sellers need to protect the $67K level and push the price back to the $60K support. Buyers are expected to defend this support vigorously. If this level fails, the BTC/USDT pair might drop to the 61.8% Fibonacci retracement level of $56,600.