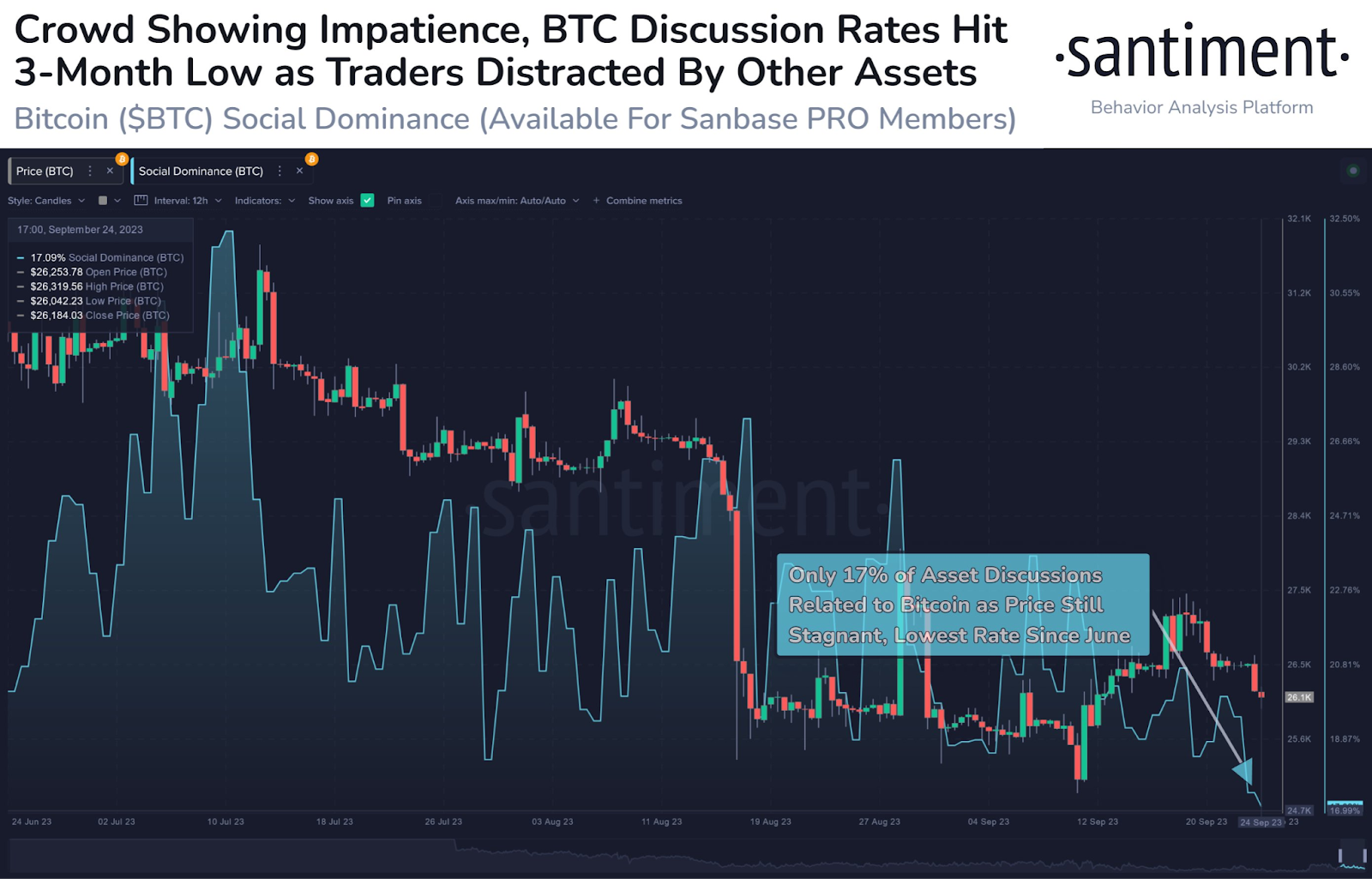

Currently, the crypto market’s spotlight is not shining on leading assets as the community has witnessed a noticeable shift in discussions, with Bitcoin experiencing a significant dip in social chatter. For the first time in three months, the volume of Bitcoin discussions has dipped, making room for a surge in altcoin conversations.

Traders Become Greedy In Altcoins

Bitcoin has maintained a bearish trading range over the past three days amid the S&P 500’s downturn for four consecutive days. This downturn indicates that crypto traders aren’t holding onto their assets currently.

Recent data from Glassnode, highlighted by analyst CryptoCon, reveals an interesting trend: Bitcoin’s short-term holders (STHs) – those who’ve retained their coins for 155 days or less – now possess the smallest share of Bitcoin’s supply in over ten years, suggesting a shift of Bitcoin to more long-term, committed investors.

While Bitcoin has historically dominated the crypto discourse, smaller projects like $LOOM, $CREAM, $LINK, and $SXP are now stealing the limelight. These altcoins have seen a remarkable increase in discussions across various social platforms, signaling a potential shift in trader interest. According to data from Santiment, Bitcoin’s ratio of discussions compared to altcoins has touched a three-month low. Only 17% of discussions are currently related to Bitcoin, the lowest level since June.

One of the primary reasons for this shift could be Bitcoin’s recent price decline toward $26K. For many in the crypto community, a declining Bitcoin price can be synonymous with missed opportunities elsewhere. As a result, traders are increasingly exploring alternative coins that promise higher volatility and, potentially, significant returns.

The Fear of Missing Out (FOMO) is a powerful motivator in the crypto space. As traders and investors witness rapid gains in lesser-known coins, the allure of potential profits can be hard to resist. This FOMO-driven interest often translates into increased social media activity as traders and investors seek to share insights, predictions, and strategies.

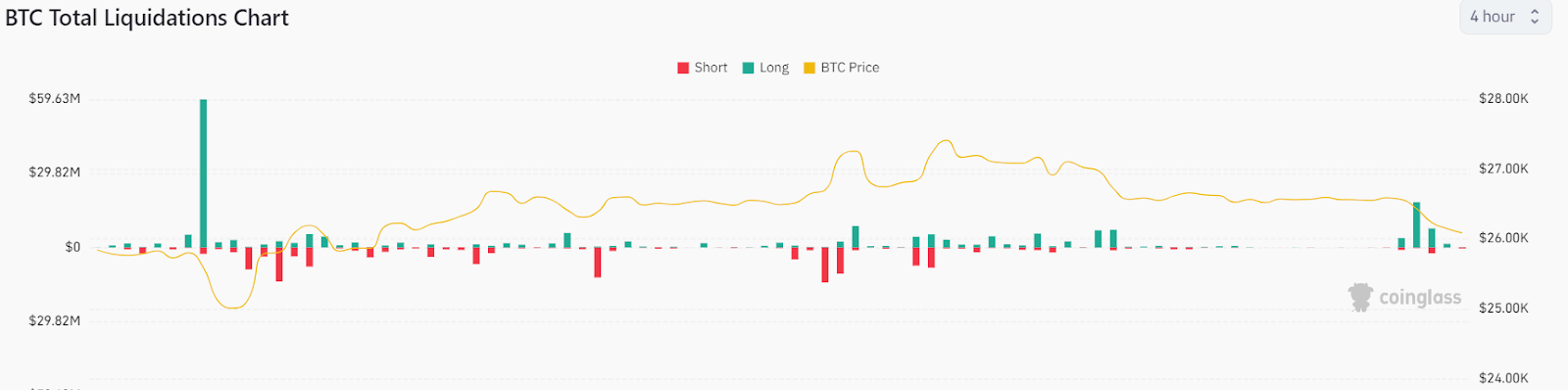

Bitcoin’s Long-Positions Worth $30 Million Liquidated

As BTC price declined from the crucial $26,500 mark recently, traders are increasingly making their bearish moves. The recent downturn triggered a significant increase in long liquidations, raising eyebrows and prompting us to ask: Are the bears starting to dominate the market?

Bitcoin struggled to stay around the $26,500 mark, leading to a downward trajectory. A clear indication of this bearish trend was the surge in long liquidations. Coinglass data shows a massive $30 million in long positions eliminated in just a few hours.

This extensive liquidation highlights the growing sell-off pressure, particularly as Bitcoin couldn’t sustain its buying momentum. For those unfamiliar, long-liquidation is when traders, expecting a price increase, are compelled to exit their positions, often at a loss, due to unexpected downward movements.

While there’s a brief pause in trading due to the current unpredictability of Bitcoin’s next move, this has led to a calm in the price movements of many major altcoins. Yet, this is just a momentary lull. In fact, there’s a bullish hope as several altcoins are already gearing up for a promising rebound in the near future.

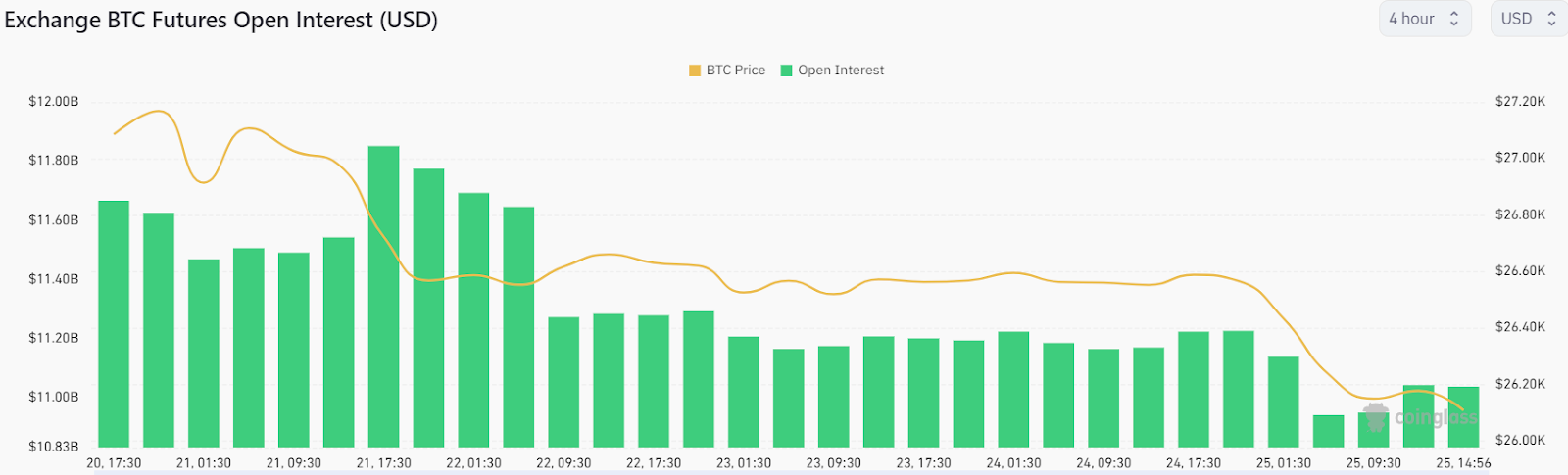

Coinglass reveals a steep decline in the open interest metric (OI) as the indicator has dropped by over $800 million over the last four days. A substantial decline in open interest can deeply influence Bitcoin’s price. Traditionally, a dip in OI might suggest declining trading interest, which can lead to diminished liquidity.

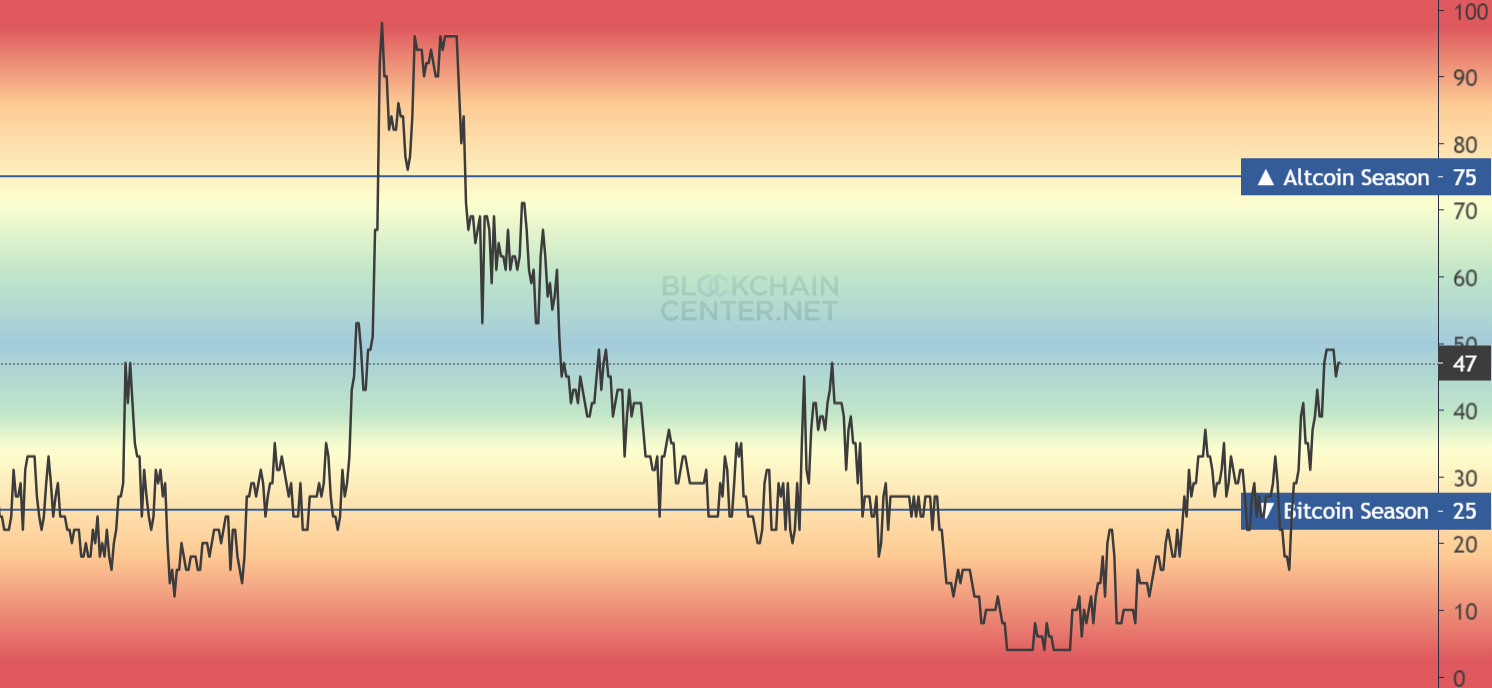

However, data from Blockchain Center reveals an uptick in the altcoin season index. The metric has surpassed Bitcoin season recently and is currently aiming to trade above 75, which will begin an altcoin season by the end of 2023.