Recently, Bitcoin’s price became a focal point as it surged past the $26,800 threshold, only to experience a sharp drop to around $26,300 in the following hours. This intense fluctuation highlighted interesting on-chain patterns, with long-term holders appearing to capitalize on Bitcoin’s increased volatility. Glassnode’s data indicates that the MSOL (Median Spent Output Lifespan) metric has hit a multi-month peak, suggesting a sell-off inclination among Bitcoin’s seasoned investors.

Bitcoin’s Long-Term Holders Turn Bearish

The latest market conditions presented an unforeseen turn for Bitcoin’s price, which saw a surge in volatility around the $26,800 mark. As BTC failed to trade above the $26,800 resistance, long-term holders took the opportunity to secure their profits amidst the rising volatility. This led to a sharp drop in Bitcoin’s value, pushing its price beneath the $26,300 threshold within a matter of hours.

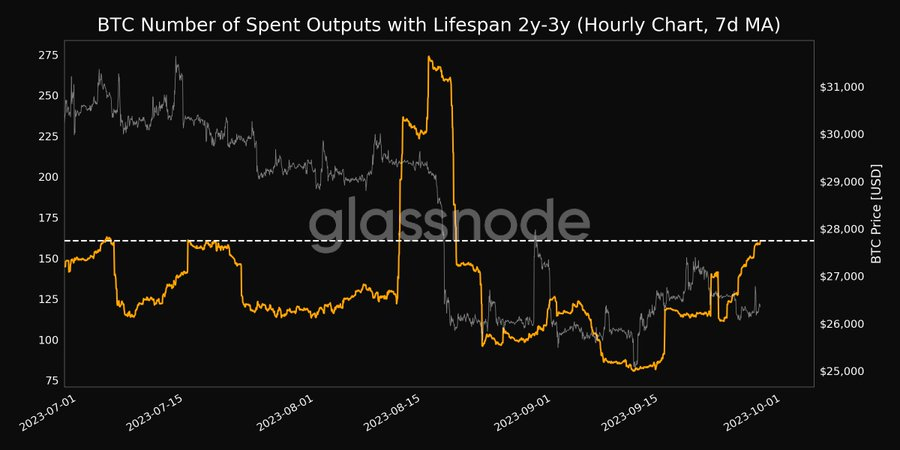

Amid this, Glassnode reveals some crucial on-chain metrics which show long-term holders’ latest move with BTC’s rejection at $26,800. According to data, Bitcoin’s median spent output lifespan (MSOL) (7D MA) has touched an 8-month high of 4.365. MSOL serves as a key metric to monitor shifts in the spending patterns of older coins from the usual daily activity. While MSOL typically remains close to its baseline, significant spikes are observed when a higher percentage of spent outputs have extended lifespans. While a single older spent output might not greatly impact MSOL, the median lifespan tends to rise when a substantial number of such outputs are transacted.

In simpler terms, it offers a glimpse into how long Bitcoin holders are retaining their assets before making a transaction. A rising MSOL suggests that older coins are moving, indicating that long-term holders are either selling or repositioning their holdings.

However, the number of Bitcoin’s spent outputs with a lifespan ranging from 2 to 3 years has hit a one-month peak at 160.726. This implies that coins aged between 2-3 years are now being transacted on-chain, signaling a selling mood among long-standing holders given Bitcoin’s volatility. Such activity could exert a downward force on the asset, establishing robust resistance points on its price chart.

Bitcoin Initiates A Tough War

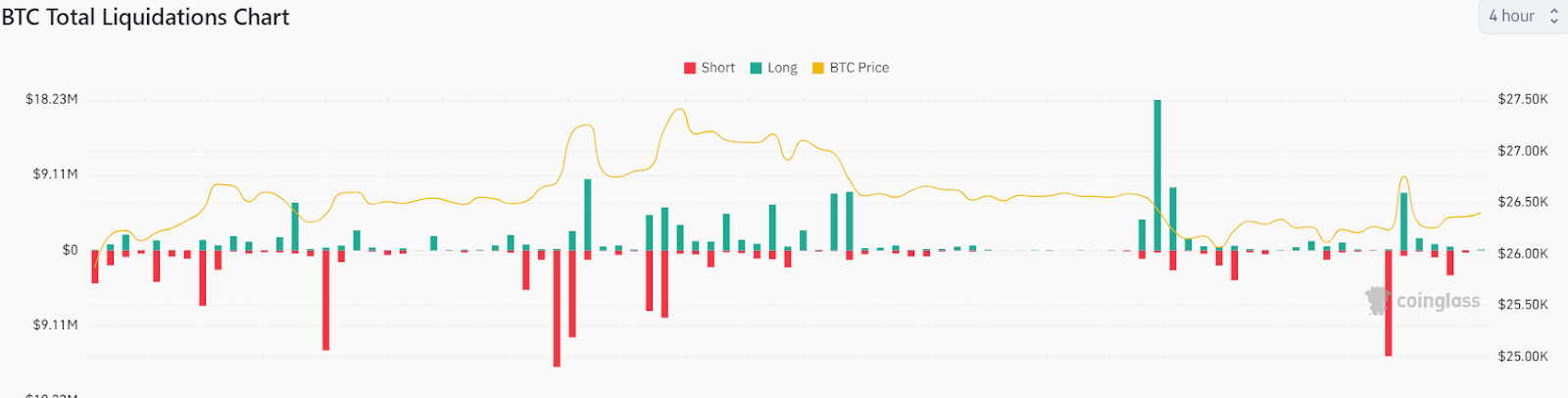

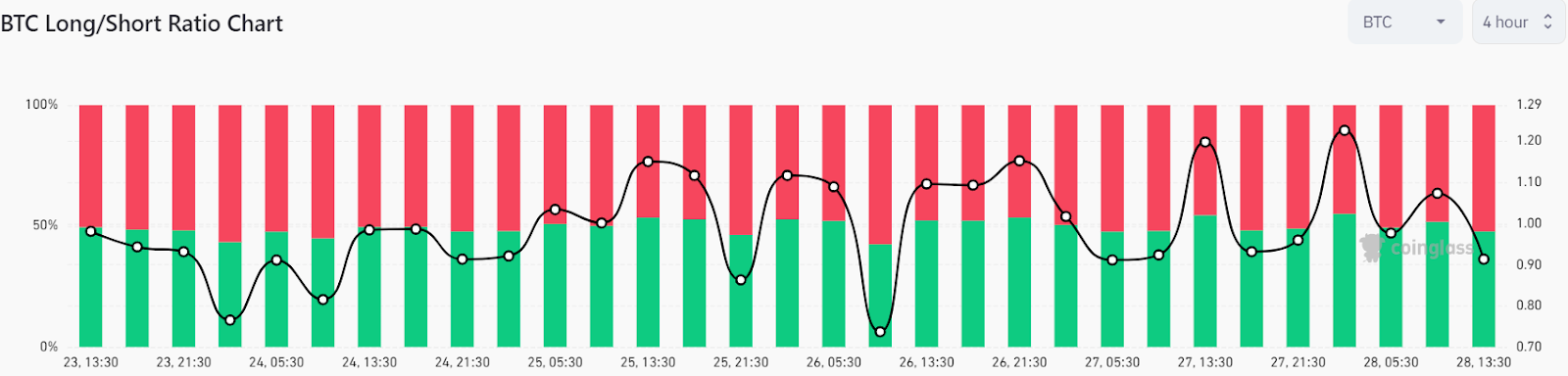

Recent Bitcoin market fluctuations have led to a surge in liquidations for both short and long position holders. Coinglass data shows that short positions amounting to approximately $13 million were liquidated following BTC’s surge towards $26,800. Yet, Bitcoin’s swift drop to $26,300 triggered the liquidation of almost $10 million in long positions, indicating a fierce tug-of-war between bulls and bears. Now, with BTC’s price gearing up for another rise, bearish positions worth over $3 million are facing liquidation.

This significant liquidation highlights the mounting sell-off pressure, particularly as BTC struggled to sustain its buying momentum around the $27K mark. Moreover, this suggests a ‘buy low sell high’ moment among traders currently.

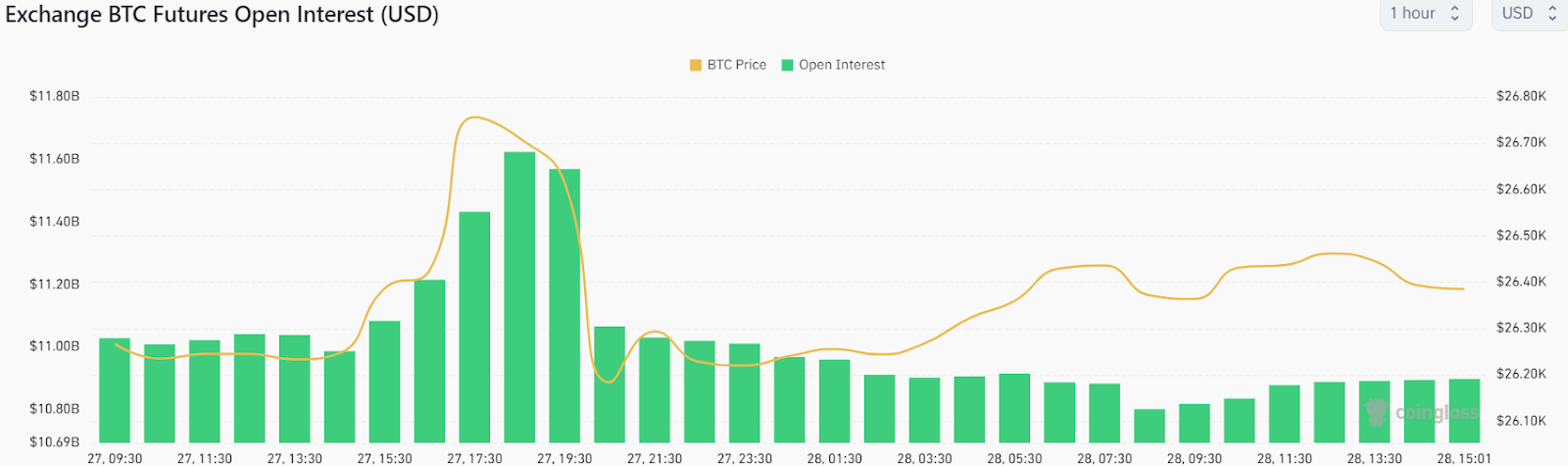

Lately, a trend has emerged with traders quickly closing their future positions in Bitcoin. This shift is backed by data showing a significant dip in Bitcoin’s open interest (OI) metric. The figures reveal a whopping $700 million decline in the OI, suggesting traders are facing fear. Their reluctance to initiate new positions mirrors the prevailing ambivalence towards Bitcoin.

A substantial decline in open interest can have a marked effect on Bitcoin’s price. Traditionally, a dip in OI suggests declining trading assurance, which might lead to low liquidity and volatility. In the immediate future, this could cause low price swings. Over an extended period, it might hint at a more conservative perspective, unless balanced out by other upbeat market signals.

At present, Bitcoin’s long-short ratio stands below 1, registering at 0.9139, as short position holders exert influence with a 52.25% dominance. This could intensify pressure around Bitcoin’s resistance levels. As of now, BTC’s price is hovering at $26,385, marking a 0.49% increase in the past 24 hours.