On Monday, Bitcoin (BTC) soared above $47,000 for the first time since April 2022, fueled by rising excitement over the potential approval of a pioneering spot-based BTC exchange-traded fund (ETF) in the United States. The cryptocurrency experienced a sharp uptick, climbing from $43,200 to reach an impressive 19-month peak of $47,192. Amid this surge, there was a noticeable change in the on-chain metrics of Bitcoin as a 2-year high net unrealized profit might trigger short-term holders to exit.

Bears Get Trapped Near $45K

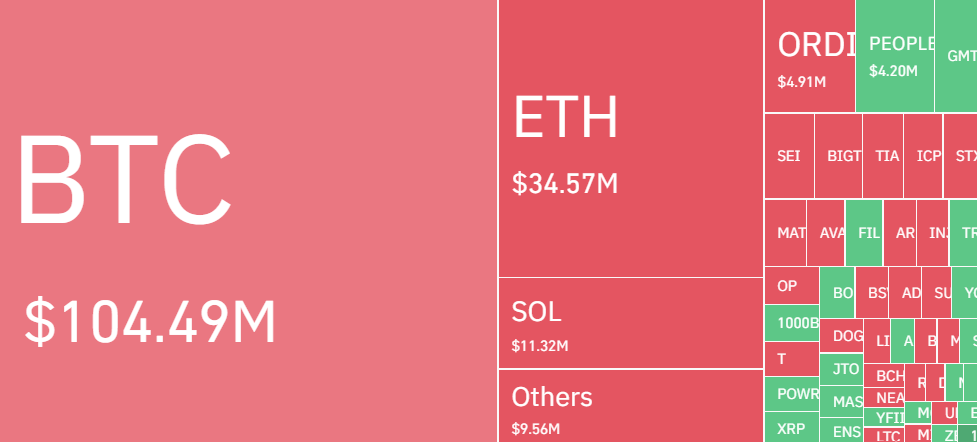

Over the last 24 hours, investors witnessed a robust liquidation in the market after crypto prices surged following Bitcoin’s climb above the $47,000. Data from Coinglass reveals that the total crypto market liquidation in the last 24 hours surpassed $205 million. Notably, Bitcoin price witnessed a total liquidation of $104 million, out of which sellers liquidated $87 million worth of short-positions as the price went against their bearish bets.

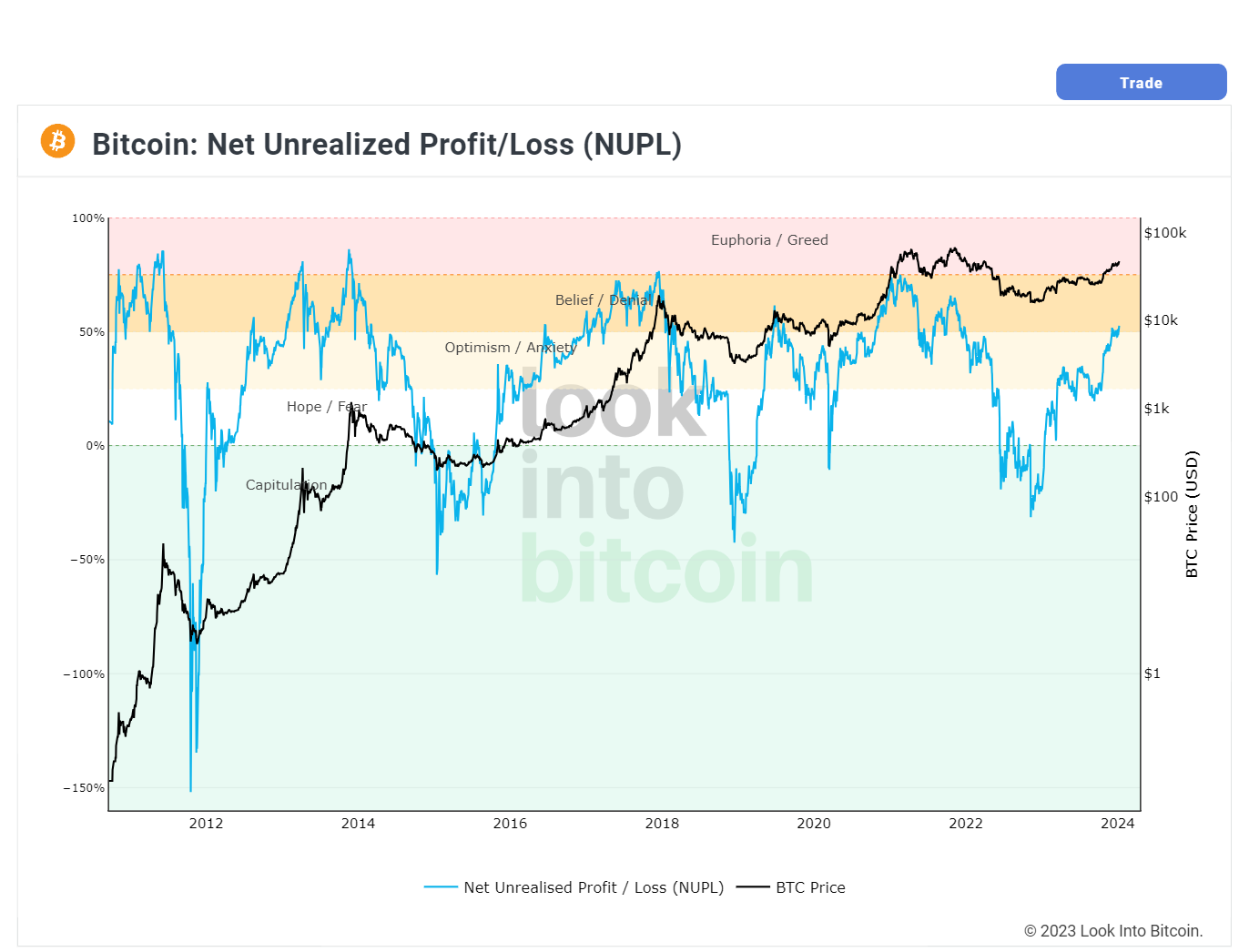

Interestingly, Bitcoin’s recent surge has pushed several on-chain metrics toward new highs and they signal a potential exit of short-term holders. The Net Unrealized Profit/Loss (NUPL), a critical on-chain metric, recently surged to a 2-year high, currently trading at 52.62%. This suggests that a significant portion of Bitcoin holders are experiencing a state of profit, a scenario that typically incites positive market sentiment. However, this has triggered a market correction for Bitcoin historically.

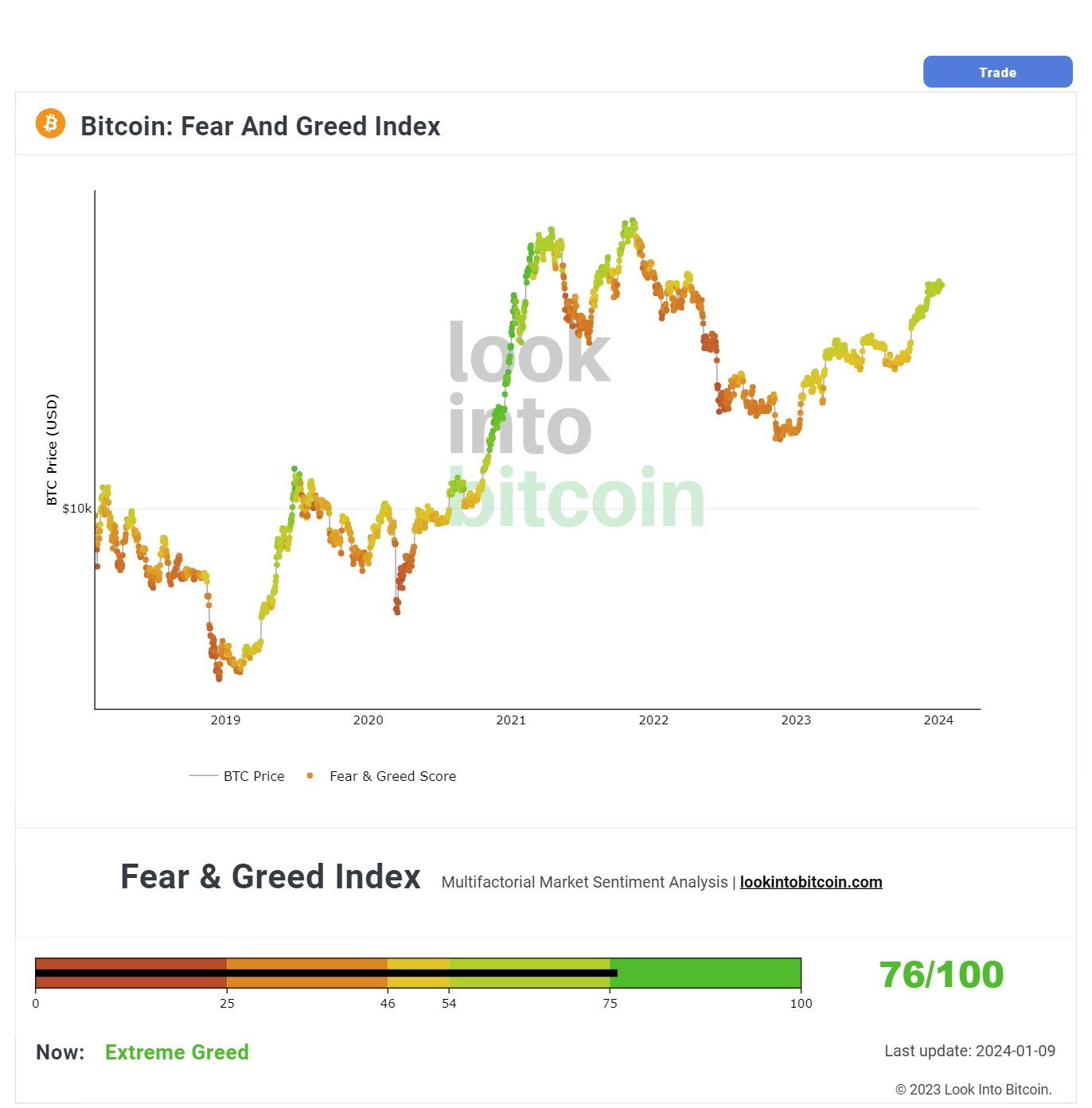

Bitcoin price faced a rejection near $47.3K recently as the fear/greed index surged to extreme greed. In the crypto market, while in-depth analyses inform traders’ decisions, emotions like fear and greed often drive investors’ actions.

Asset price fluctuations are influenced by shifts in these sentiments. High demand, driven by greed, increases asset value, whereas fear leads to less demand and lower prices, offering buying opportunities. The Crypto Fear and Greed Index measures these market emotions. It scores from 0 (extreme fear, indicating selling trends and decreasing value) to 100 (extreme greed, denoting buying trends).

Presently, the Bitcoin fear/greed index has surged to the ‘extreme greed’ category, with a current rating of 76. This could lead to a stabilization around the $47K level. However, growing anticipation for the approval of a spot Bitcoin ETF by the SEC could send BTC prices above $50K with positive news.

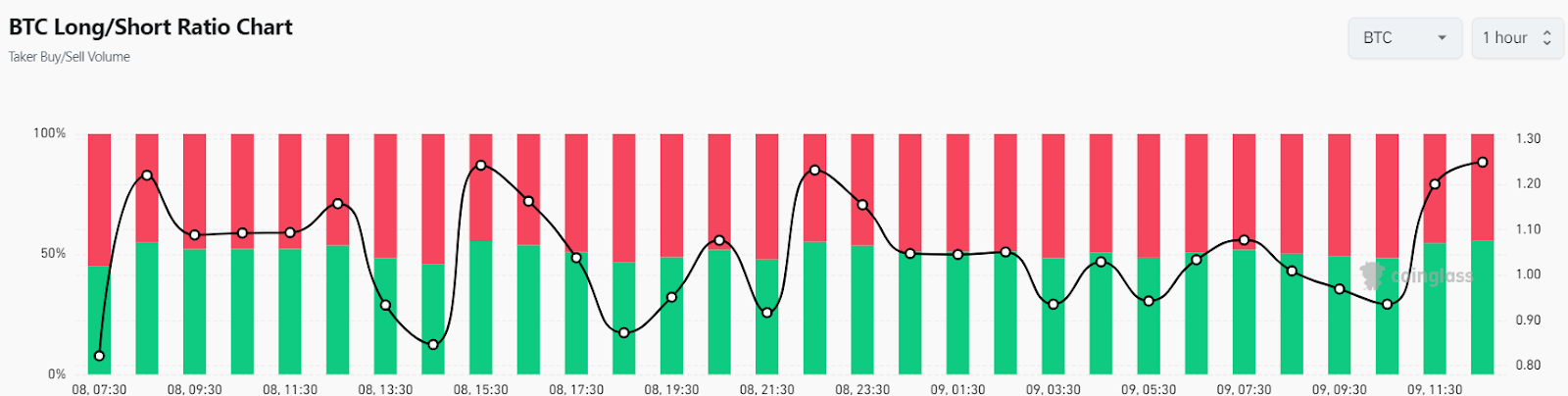

The market’s long/short ratio is also showing a significant upward trend, surpassing the 1 mark and indicating increasing bullish sentiment. The ratio stands at 1.2492, with about 55.5% of positions predicting a rise in price, while 44.5% are short positions.

What’s Next For BTC Price?

Bitcoin’s price surged past $46,000, with buyers aiming to transform the $45,000 level, previously a strong resistance, into a support base. However, the price faced a rejection near $47,330 as sellers were active near that level. As of writing, BTC price trades at $46,752, surging over 6.1% from yesterday’s rate.

The rising 20-day EMA at $45,000 and the positive territory RSI indicate a slight advantage for the bulls. However, as the RSI reaches the overbought region, there’s a concern of a correction. A close above $47,500-$48,100 would complete a bullish ascending triangle pattern for the BTC price, potentially leading to a rise towards the pattern’s target of $50,000, and possibly extending to $52,000.

However, this bullish scenario could be negated if the price reverses and falls below the channel’s support line. Under such circumstances, the price might test the $40K resistance and hover around $38K. This scenario might be triggered if the SEC comes up with bearish news regarding the ETF approval, bringing a “sell the news” event for Bitcoin.