Bitcoin has witnessed an impressive surge of more than 110% year-to-date, reviving the ‘Uptober’ trend as it shattered a year-long resistance, touching the $35K threshold. A significant change in market outlook is evident, with major investors now accumulating more BTC in anticipation of the upcoming halving event and the introduction of Bitcoin ETFs. Despite a slight resistance beyond the $35K mark, experts maintain a positive forecast for BTC, suggesting potential further growth if the momentum can sustain above $31,900.

Bitcoin Hits 2023’s Highest Open Interest

In recent days, a significant wave of FOMO (Fear of Missing Out) swept through the markets, prompting an influx of buying activity. With BTC price climbing over 30% in October, the cryptocurrency garnered half of the trading volume, sending its price to soar past the $35,000 mark. However, those traders who initially rushed to buy in a FOMO-induced spree seem to be engaging in ‘panic selling’ now above $35K.

However, CryptoQuant maintains a positive outlook on BTC’s potential for further growth, noting its recent ascent past a significant milestone. Information indicates that Bitcoin has reclaimed the crucial $31,900 resistance level after a 17-month period.

This specific threshold was responsible for tipping Bitcoin into a bearish zone in May of the previous year. CryptoQuant advises that for additional purchasing momentum to materialize, buyers must sustain the price above $31.9K, potentially steering it to reach new highs in 2023.

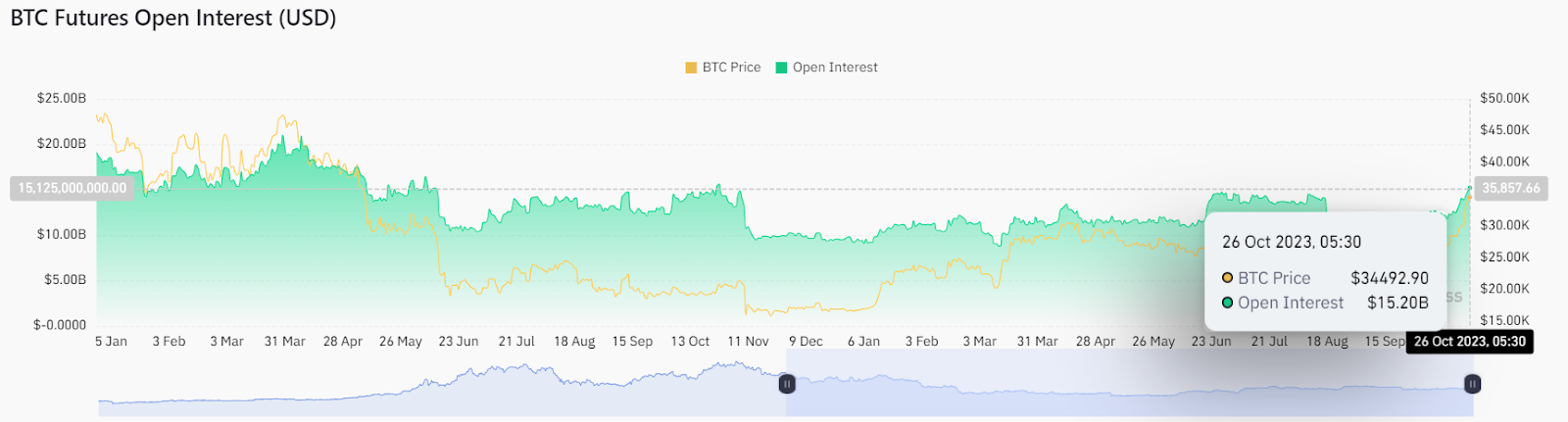

Interestingly, Bitcoin’s Open Interest has reached new highs recently as the metric touched a high of $15.2 billion. Both rising prices and rising open interest generally signal a bull market strengthening. This is because the simultaneous increase indicates that new money is coming in, and more participants are becoming active in the market. The consistent entry of new long positions shows an expectation among investors that the uptrend will continue.

While increasing open interest can indicate a strengthening trend, it also may signal that a reversal could be forthcoming if the market becomes overextended.

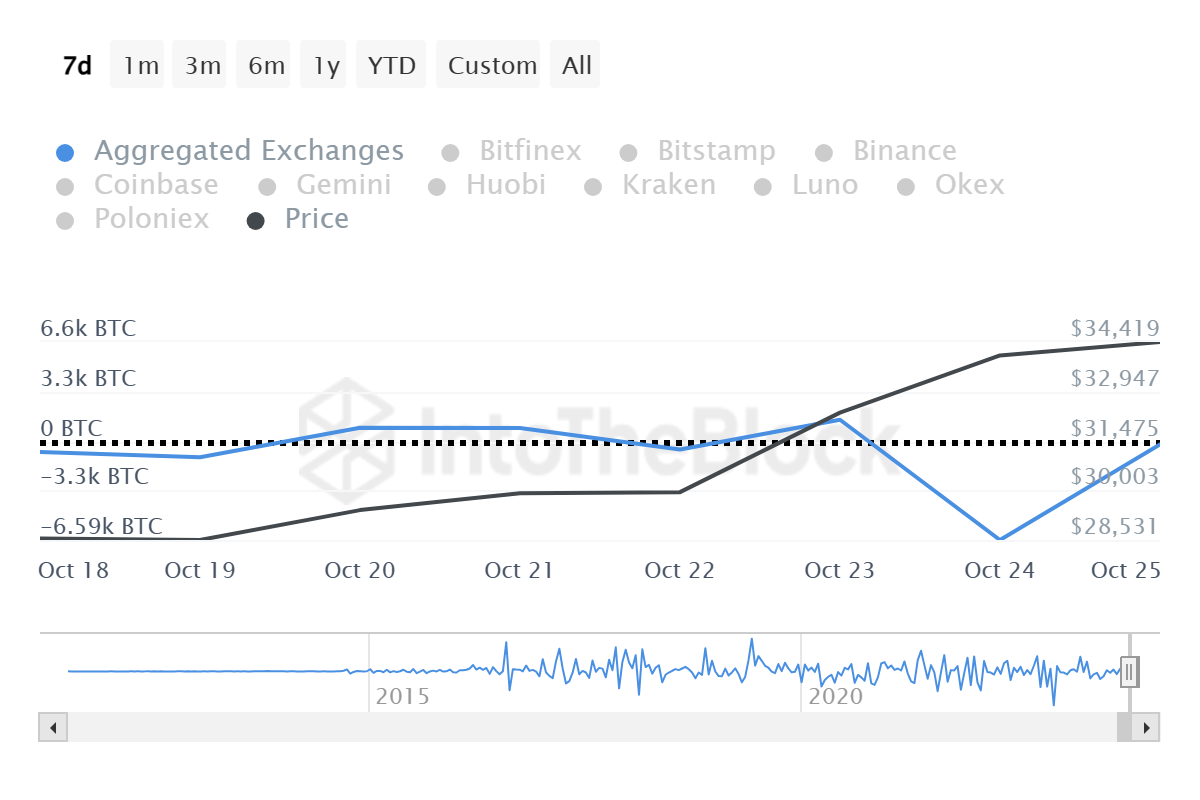

Exchange Netflow Remains Negative

Data from IntoTheBlock reveals a steep drop in the netflow indicator, which is a bullish sign. Following Bitcoin’s surge above $34K, the netflow declined heavily and hit the low of -6.59K BTC. Negative netflow refers to the situation when more Bitcoin is moving out of exchanges than is coming in.

Essentially, it indicates that holders of Bitcoin are transferring their holdings out of exchange wallets, possibly to personal wallets (often referred to as “cold storage”) or other forms of storage. This activity is often interpreted in several ways, many of which can have a bullish impact on Bitcoin’s price.

When large amounts of Bitcoin are moved off exchanges, it often suggests that investors are not looking to sell in the near term. With fewer Bitcoins available on exchanges, there’s less available liquidity to be sold into the market, which can decrease selling pressure and help drive up the price.

However, the netflow has surged from the previous level but remains negative at -233 BTC, suggesting that holders cashed in their assets in profit during the upward rally.

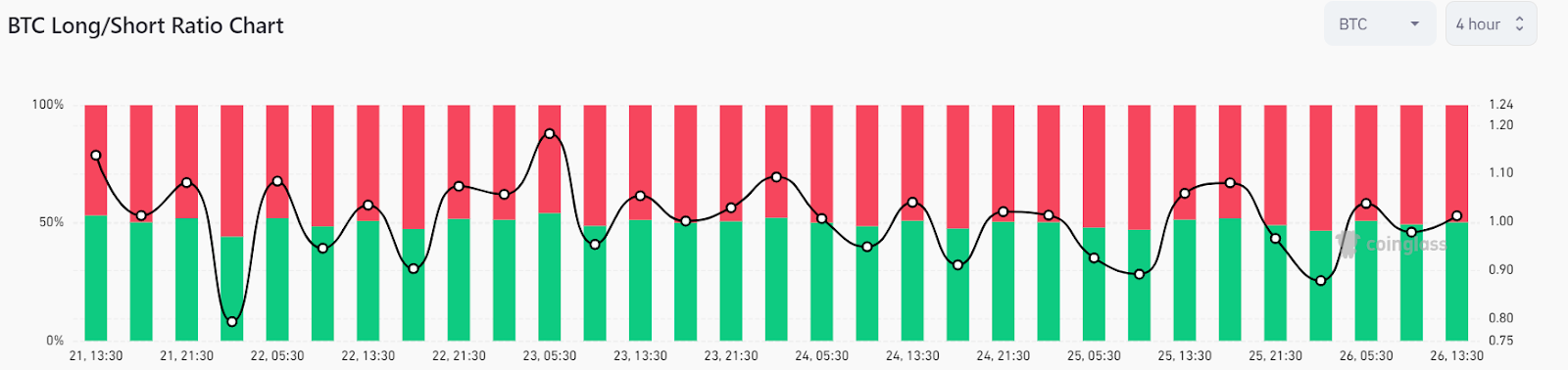

Currently, there’s an intense battle between the bulls and bears below the crucial $35K mark as the long/short ratio hovers at 1.0125. Though buyers are bringing confidence with 50.3% long positions, bears are countering this resistance with 49.7% short positions.

The market sentiment is currently turning bearish as Bitcoin’s funding rate becomes negative. When Bitcoin’s funding rate turns negative, it means that traders holding long positions on Bitcoin (i.e., those betting the price will increase) are paying traders with short positions (those betting the price will decrease). This situation typically arises when the market sentiment is bearish, and the price of futures contracts is trading below the spot price.