Following an extended bearish consolidation and tumbling investor confidence, Bitcoin has finally met buyers’ demand. Over the last 12 hours, the *BTC* has experienced a notable upswing, climbing from a low of $47,500 to breach the much-anticipated $50,000 mark. This rise can be attributed to considerable investments into Bitcoin ETFs in the last week, boosting market hope. However, despite this uptick, there’s ongoing debate among experts regarding the sustainability of the rally, with concerns over a potential large-scale sell-off by many investors looking to capitalize on their gains. However, there are high chances of further gains before a brief correction.

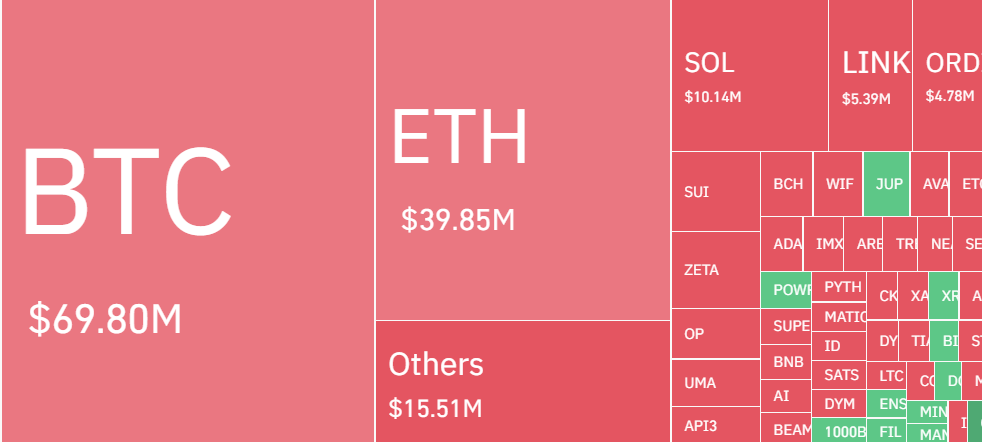

Total Market Liquidation Nears $200 Million

While Bitcoin has yet to reclaim its peak of nearly $69,000 from 2021, its value has been climbing, going through adjustments influenced by ETF transactions. This week, it surpassed the $48,000 and $49,000 levels, achieving levels last witnessed nearly two years ago. Now, having surpassed the highly anticipated $50,000 milestone, Bitcoin sets its sights on reaching its all-time high within the year.

Recently, the crypto market witnessed a notable shakeout, with total liquidations reaching roughly $184.2 million in the past 24 hours. Notably, BTC price witnessed total liquidation of nearly $70 million and sellers liquidated nearly $55 million worth of short-positions.

This recent increase in Bitcoin’s price has been fueled by a substantial injection of capital into spot Bitcoin ETFs last week, attracting more than $1.1 billion in new investments to the market. This influx coincides with a slowdown in outflows from established funds, such as the Grayscale Bitcoin Trust (GBTC) and ProShares’ futures-based ETF.

Market analysts and experts are predicting that Bitcoin’s value could surge above $50,000 and may even hit a new high before the anticipated halving event, which is now slightly more than 65 days away.

According to Ali Charts, Bitcoin investors go through a cycle of emotions tied to market changes. Initially, there’s panic selling, followed by hope as the market starts to recover. This hope then turns into optimism and strong belief in Bitcoin’s potential for growth. However, price drops can lead to anxiety. Recently, Ali Charts’ analysis indicates that the market has moved past this anxiety and entered a new phase of confidence, suggesting the possibility of further increases in Bitcoin’s value.

It is to be noted that analysis from Intotheblock highlights that around 375,000 addresses have acquired about 119.48K Bitcoin, totaling $6 billion, at an average price of $50,227.81. These holders are currently experiencing losses and might contribute to selling pressure as they seek to reach a breakeven point on their investments. This might plunge BTC price toward $48K if it fails to break the $52K mark.

What’s Next For BTC Price?

Bitcoin surged past the January 11 high of $48,970, signaling the beginning of the next upward movement. This resulted in the price breaking above the much-anticipated $50K milestone and is now trying hard to convert that level into a support zone. However, sellers are defending near immediate Fib channels. As of writing, BTC price trades at $50,102, surging over 4.1% in the last 24 hours.

A sustained close above $52,000 would confirm the breakout, paving the way for a potential surge towards further gains. While the $50,000 mark might offer a slight hurdle, it’s expected to be dominated. Strong momentum above $52K could further send the price towards $60,000.

On the flip side, if the BTC price declines and falls below $48,500 again, it would indicate that sellers are active around $50,000, increasing the chances of a drop to $44,500.

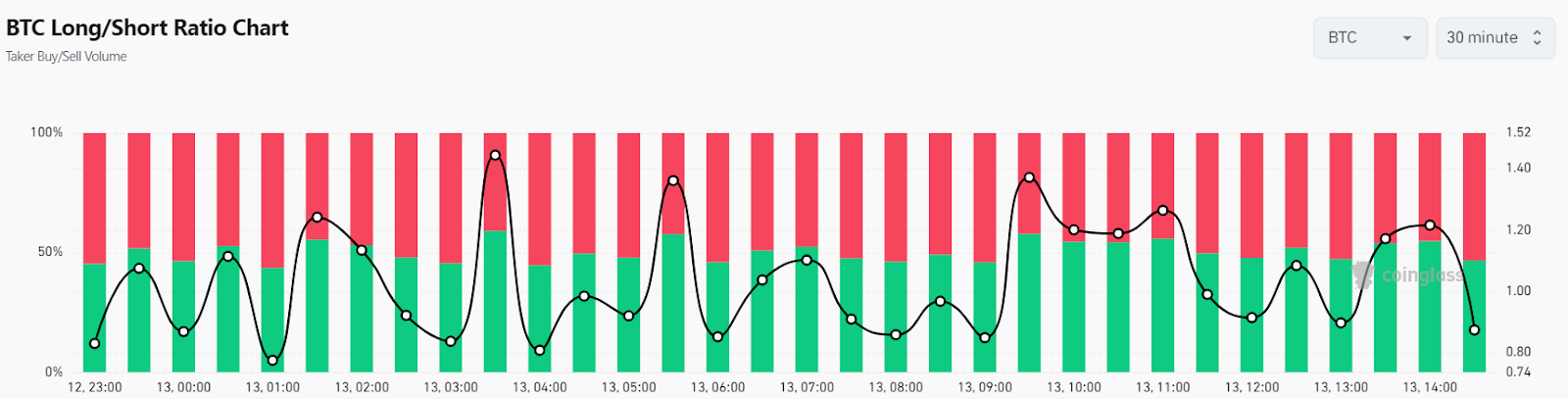

Recently, the Bitcoin (BTC) price experienced a decline in its long/short ratio, dropping to 0.8734, which signifies that the volume of sell orders is exceeding that of buy orders. This trend is due to a higher number of traders opening short positions, expecting a price correction from the $50,000 peak. Currently, 53.4% of all trading positions are predicting a decrease in price, while 46.6% anticipate an increase.