After experiencing a notable drop recently, Cardano’s ADA is showing signs of recovery. Investors have been actively accumulating ADA around its recent low at $0.34, indicating a growing interest in the altcoin. As the ADA price successfully goes past several resistance levels that have persisted for months, anticipation is building for new highs. A leading analyst is forecasting a rise to $0.45 in December, followed by a potential increase to $0.75 by the end of the year.

ADA Witnesses $1.2 Million Worth Short-Liquidation

Since ADA’s price bounced back from its low at $0.34, a considerable number of short positions have been liquidated. Recently, the market exhibited unexpected bearish behavior following the release of the Consumer Price Index (CPI) data, which was less alarming than anticipated. Nonetheless, with the market’s recent recovery, short positions amounting to nearly $1.2 million have been closed out.

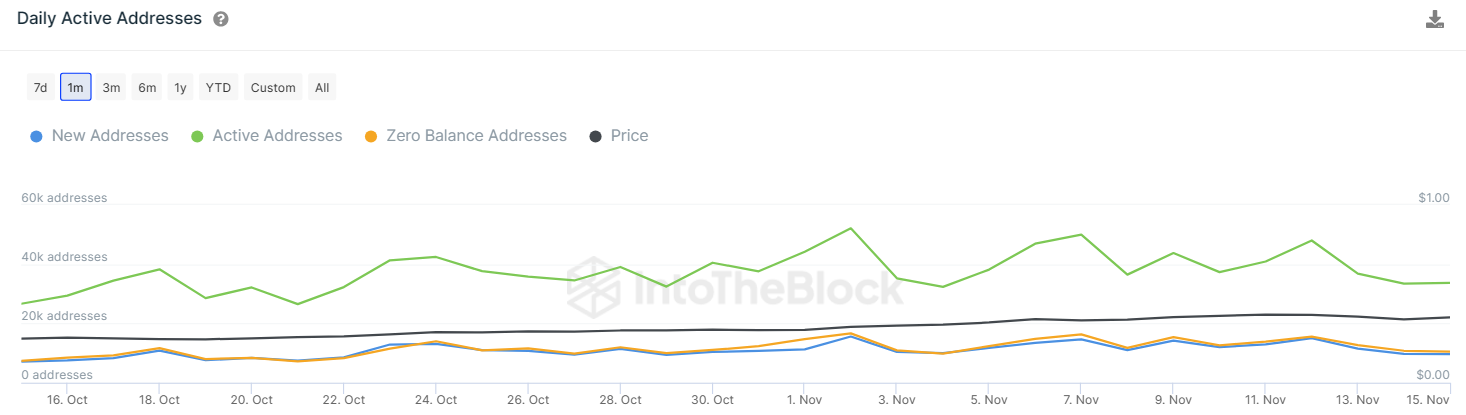

Understanding the trajectory of Cardano’s price can be enhanced by looking into on-chain metrics. Indicators such as the number of Active Addresses and the Market Value to Realized Value (MVRV) ratio provide clear insights into whether the market sentiment is leaning bullish or bearish.

In the case of Cardano, although the ADA price saw an increase from the beginning of November, there was a noticeable decrease in both Active and New Addresses during this period. Data from IntoTheBlock reveals that the active address count declined from a peak of 52K to a low of 33K. This scenario represents a bearish divergence, as illustrated in the chart below.

The Market Value to Realized Value (MVRV) ratio, an on-chain metric used to assess the average profit or loss of investors who bought ADA in the last month, reached a local high of 0.768. As of November 16, the MVRV stands at 7.17. This suggests that ADA traders who purchased the asset in the past thirty days have likely sold and taken their profits. Consequently, this trend supports a bearish perspective for the future price of Cardano.

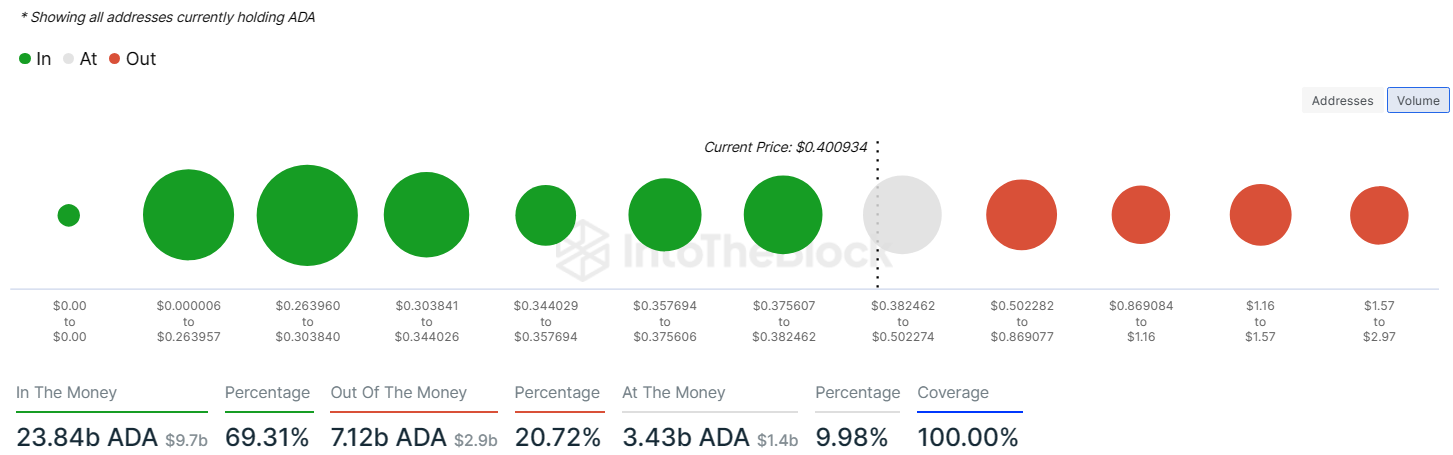

Data from IntoTheBlock’s Global In/Out of the Money (GIOM) indicator, which shows the distribution of buyers across different price levels, reveals that 69.3% of addresses, holding a total of 23.84 billion ADA tokens, are currently in a profitable position.

The Cardano price is anticipated to find strong support in the range of $0.34 to $0.36. This is where 169,000 addresses have collectively purchased 1.65 billion ADA tokens.

Regarding resistance, ADA price might face a hurdle in the $0.5 range. Overcoming and converting the $0.5 mark into a support zone will be crucial. Beyond this, the next level of resistance lies between $0.8 and $1. This upper resistance band is where 422K addresses hold 1.4 billion ADA tokens, as depicted in the accompanying chart.

ADA Sets Its Final Targets

According to a prominent crypto analyst, Ali Charts, Cardano (ADA) is currently experiencing a consolidation phase that closely resembles the pattern observed between 2018 and 2020. However, this time, the scenario is showing without the influence of a COVID-19 style crash.

According to him, investors are closely watching ADA’s performance, particularly as it approaches the $0.45 resistance level. Resistance levels are like psychological barriers in trading, where selling pressure tends to increase, making it harder for the price to rise further. If ADA successfully breaks through this level, it could signal the start of a significant upward trend.

The most bullish scenario suggests that once ADA crosses the $0.45 mark, there’s potential for a steady climb. Projections indicate that ADA could reach as high as $0.75 by the end of December.