Over the past 24 hours, the price of Chainlink (LINK) has been facing heavy downward pressure as it drops below $13. There’s a surge in selling pressure as LINK continues to hover below critical support lines. The fear/greed index has declined, now showing a fear sentiment at level 23. Meanwhile, Chainlink’s trading volume has dropped by 20.3% in the last 24 hours, reaching $497 million.

Looking at the longer trend, LINK’s price has been declining since mid-December, dropping from a high of $31 to about $15 on 3 February. In recent weeks, LINK price has been facing intense downward volatility as it aims for a hold below $15. In the last 24 hours, its market capitalization has dropped by 2.5%, hitting $8.21 billion.

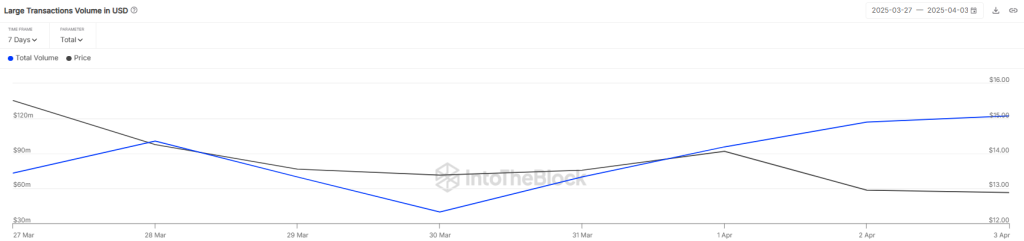

LINK’s Large Transaction Volume Skyrockets

Chainlink (LINK) has been facing rising bearish momentum as sellers aim for a hold below $14. Amid this intense selloff, whales have come forward to accumulate LINK at a discounted price. Data from IntoTheBlock shows that the large transaction volume for Chainlink surged from the low of $39.8 million to $122 million, suggesting rising whale pressure.

As whales continue to accumulate more LINK around the price dip, we might see a strong support level and potential for a rebound as buying pressure surges.

Additionally, recent data from Coinglass shows that about $1.33 million worth of LINK positions were liquidated yesterday. This had a big impact on long traders, who lost nearly $1.02 million from their positions. Meanwhile, $307K worth of short positions were also liquidated, showing the rising pressure on bullish positions.

Additionally, the interest in trading Chainlink has declined. The total volume of unresolved trading positions, known as open interest, has dropped by 2.85%, landing at $448 million. The funding rate has also risen to a positive rate at +0.0057%, suggesting that buyers are preparing for a comeback.

Chainlink Price Prediction: Technical Analysis

Chainlink (LINK) has been losing value recently, falling below the important $13 mark. Currently, LINK’s price is at $12.51, having dropped by more than 2.5% in the past day. The Relative Strength Index (RSI), which is at 40, suggests that more people are selling, possibly indicating a future drop in price.

If buyers start buying more and drive the price above $13, LINK could potentially rise towards the next resistance level. If it breaks through this level, it could boost confidence in the market and possibly push the price up to $16.

However, if LINK cannot stay above $13, it might continue to fall, possibly reaching a key support level at about $11.70. If the price falls below this level, it could lead to further declines and a negative outlook for Chainlink.

LINK Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, LINK price might aim for a recovery toward $13. If the price surges above $13, we might see $16. On the downside, $11.7 is the range.

Long-term: According to Coincodex’s current Chainlink price prediction, the price of Chainlink is expected to increase by 23.27%, reaching $17.46 by April 28, 2025. Based on their technical indicators, the overall market sentiment is currently bearish, while the Fear & Greed Index stands at 26, indicating a state of fear. Over the past 30 days, Chainlink has experienced 16 green days out of 30 (53%) with a price volatility of 6.87%. Given this outlook, Coincodex suggests that now may not be an ideal time to buy Chainlink.

Investment Risks for Chainlink

Investing in LINK price can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.

Frequently Asked Questions

How much is the LINK price today?

LINK price is trading at $12.6 at the time of writing. The LINK price has dropped by over 2.5% in the last 24 hours.

What is the Chainlink price prediction for April 4?

Throughout the day, the LINK price might aim for a recovery toward $13. If the price surges above $13, we might see $16. On the downside, $11.7 is the range.

Is LINK a Good Buy Now?

According to long-term forecasts, the Chainlink price might reach $17.46 by April 28. This makes LINK price a good investment considering its monthly yield.