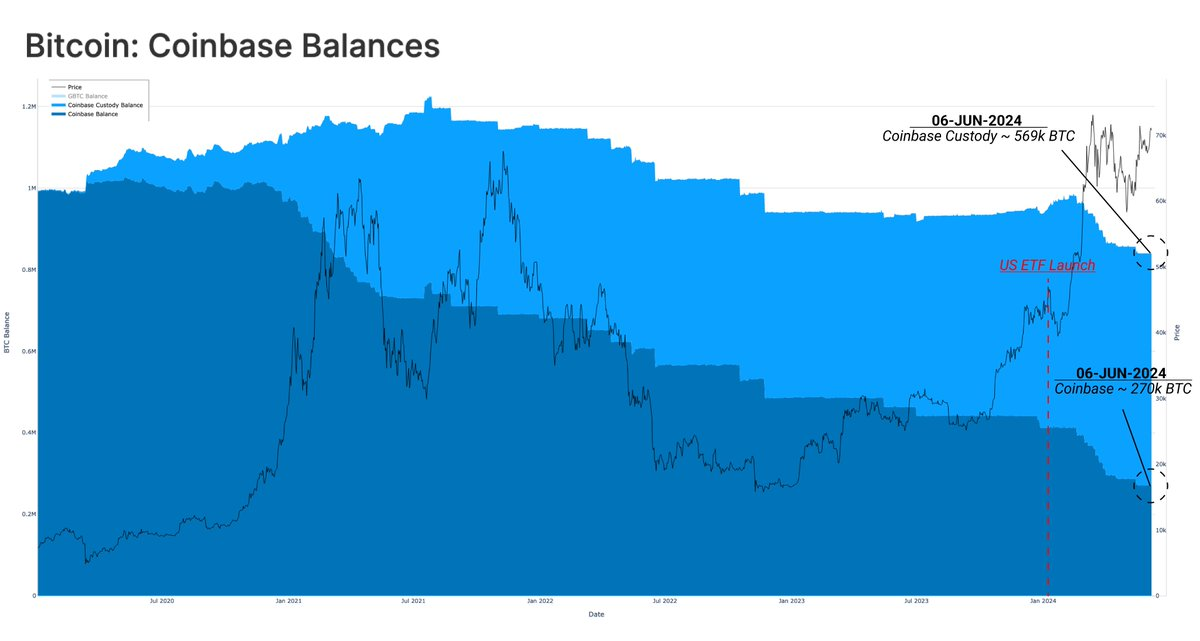

In a new report from Glassnode, a leading market intelligence platform, analysis shows that Coinbase is the kingpin of the *BTC* market. Such a platform holds massive amounts of Bitcoin, and it has two operational segments, Coinbase Exchange and Coinbase Custody.

The report states that Coinbase and Coinbase Custody together hold approximately 270,000 BTC and 569,000 BTC, respectively. A significant investment in the company highlights Coinbase’s role in the cryptocurrency ecosystem as both a storage and trading platform.

Source: Glassnode

Major exchanges like Coinbase are increasingly at the center of the evolving cryptocurrency landscape. Coinbase has significant influence over market liquidity with its huge coin holdings, and also, given its size, it has a very real effect on the general regulatory mindset.

Coinbase is the largest custodian by a significant margin as a result, and its role as an exchange and a private spot ETF provider highlights the degree to which it is infrastructure as much as a mere market actor.

Market Dynamics and Bitcoin prospects

While Coinbase secures its position as a major player, the broader market dynamics offer a mixed picture. Despite being the second-largest spot cryptocurrency exchange after Binance, Coinbase’s market activity shows unique trends. In the last 24 hours, Coinbase recorded a trading volume of approximately $1.45 billion.

However, in terms of site visits, there’s a stark contrast between Coinbase and its top competitor, Binance. Coinbase attracted around 66,913 weekly visits, significantly fewer than Binance’s 14 million, reflecting varying user engagement levels across platforms.

Bitcoin’s market performance continues to face challenges. The leading cryptocurrency has experienced a decline of 2.7% in the past day and 5.5% over the past week, bringing its current trading price to approximately $65,228. This downward trend in Bitcoin’s price further complicates the market outlook, impacting investor sentiment and broader market stability.