- 1. Coinbase Global Inc: An Introduction

- 2. Coinbase Stock Price Statistics

- 3. Coinbase Stock Price Prediction: Price History

- 4. Coinbase Stock Price Prediction: Price Analysis

- 5. Coinbase Stock Price Prediction

- 6. Conclusion

- 7. FAQ

- 7.0.1. What is Coinbase Global Inc?

- 7.0.2. When did Coinbase go public?

- 7.0.3. How has Coinbase's stock price performed since its IPO?

- 7.0.4. What was Coinbase's defining moment in 2022?

- 7.0.5. How is Coinbase diversifying its revenue streams?

- 7.0.6. What is the Coinbase stock price prediction for 2023?

- 7.0.7. What is the Coinbase stock price prediction for 2025?

- 7.0.8. What is the Coinbase stock price prediction for 2030?

- Coinbase Global Inc: An Introduction

- Coinbase Stock Price Statistics

- A Brief History

- Platform’s Gradual Advancement with Time

- The Regulatory Scenario

- Coinbase Stock Price Prediction: Price History

- Coinbase Stock Price Prediction: Price Analysis

- Coinbase Stock Price Prediction

- Coinbase Stock Price Prediction 2023

- Coinbase Stock Price Prediction 2025

- Coinbase Price Prediction 2030

- Conclusion

- FAQ

Coinbase Global Inc: An Introduction

Coinbase Global, Inc. is known as a financial technology platform that offers end-to-end financial technology and infrastructure for the crypto economy. It provides fundamental financial accounts to its clients for the crypto economy. In addition to this, the platform also offers a marketplace as well as a liquidity pool to carry out crypto transactions. The developers are offered services and technology to be capable of developing crypto-based applications. It also enables them to accept payments in crypto assets.

Keeping in view the boom in blockchain technology and the crypto space, Coinbase also develops services and products related to financial infrastructure and technology. With this, it intends to assist businesses and individuals to transact and discover diverse crypto assets as well as decentralized applications (dApps). The company offers an all-inclusive platform letting them trade, store, stake, spend, borrow, earn, as well as utilize the crypto assets in their possession. It offers a Web3-based wallet, Coinbase Prime, and Coinbase Wallet.

Coinbase Stock Price Statistics

| Coinbase Stock Price: | $69.81 |

| Coinbase Stock Market Cap: | $18,309,429,000 |

| Coinbase Stock Trading Volume: | $12,883,365 |

| Coinbase Stock 24h High: | $71.6985 |

| Coinbase Stock 24h Low: | $67.87 |

A Brief History

On the 14th of this month, the crypto community celebrated Coinbase Global’s 2nd anniversary of its initial public offering (IPO). Back in 2021, it went public during the time and witnessed the most-hyped moments by securing a prominent position within the crypto market. That was the time when it saw one of the highest booms ever. After that, nonetheless, several challenges have been experienced by it.

At present, Coinbase is trading around up to $69.89. This shows a significant decline from the huge value of Coinbase IPO at nearly $381. Several people dismiss Coinbase while saying that it is being overhyped and overvalued. Nonetheless, many other smart investors are also present – taking into account Cathie Wood (Ark Invest’s CEO) – who are still focused on accumulating Coinbase without any decrease in their pace.

Back in 2021’s April, analysts were of the view that a vital role was being played by retail investors to embellish Coinbase’s future. Nevertheless, several of the top Wall Street-based banking institutions were still flippant about crypto assets. In this way, it seemed that mainstream organizational investors would never accept the concept of using crypto in the form of an asset class in terms of investment.

As a consequence of that, it appeared adequate to value the platform in line with the metrics like per-month trading volume and per-month active users. More investors utilizing Coinbase would make the platform more beneficial with a higher value. It was brought to the front that the big organizational investors might be significant for the future of Coinbase rather than the minor retail investors. The Wall Street banks, that initially mocked the idea of crypto, are at present adopting the respective technology. In addition to this, those organizational investors who at first ridiculed Bitcoin, are currently endeavouring to purchase it.

August 2022 was the month when Coinbase saw its defining moment. At that time, it declared a well-known collaboration with BlackRock (the biggest asset management platform). In line with the terms of the contract, Coinbase would permit BlackRock’s organizational investors (pursuing getting access to the crypto assets) to avail of the services related to crypto trading.

Platform’s Gradual Advancement with Time

A couple of years back, the majority of people were of the view that the charges implemented on trading crypto would be chiefly profitable for Coinbase. This assumption is somehow sensible if one considers Coinbase a crypto exchange that offers services to retail investors. The platform has gained a considerable position among the top cryptocurrency exchanges. Nevertheless, the decline experienced last year compelled Coinbase to discover completely exclusive sources to generate revenue for its survival. Such endeavours are assisting the platform to diversify the whole revenue stream thereof.

In this respect, staking of cryptocurrency – which was once seen as an insignificant portion of the revenue generated by Coinbase – currently equals up to 10% of the platform’s entire revenue. Apart from that, Coinbase has discovered several other sources to make revenue, taking into account subscription charges. The platform additionally has an arrangement for revenue sharing with Circle (the payment company that is based in Boston and issues USD Coin).

The Regulatory Scenario

When the IPO of Coinbase occurred, everyone was in knowledge of the regulatory risk associated with the platform. However, no one could have thought how severe the regulatory scenario would become. For instance, the Securities and Exchange Commission (SEC) of the United States has targeted Coinbase. The US securities regulator has accused the platform of having been involved in several supposed violations.

The respective infringements take into account offering trading services for the trading of those digital assets that the regulatory agency thinks to be securities. The most recent contention is being done over the case of crypto staking. In the eyes of the SEC, such services come under the category of securities offering. Adding to this, the Coinbase investors were also not thinking a couple of years back that the platform would find it this much difficult to confront each of the claims made by the SEC.

Sometimes it seems that Coinbase is following an updated 21st-century-based approach in the case of cryptocurrency while the regulatory organizations depend on obsolete regulations. Nevertheless, Coinbase is getting ready to take this regulatory brawl a step further with the recent introduction of Crypto435. It is a lobbying endeavour to advise and inform the 435 Congress members. This would likely influence the crypto-focused regulatory agenda in the future.

Another important thing is that Coinbase is continuously innovating. A few of the efforts made by it have been effective, including its increasing belief in crypto staking to create revenue. On the other hand, the rest of them to enhance the Coinbase revenue projections were not successful. One such initiative was the release of a marketplace for non-fungible tokens (NFTs) last year. At that moment, it was thought that the fees implemented on the NFT trading might offer a required patch during the uncertain periods in the market of cryptocurrency.

Coinbase Stock Price Prediction: Price History

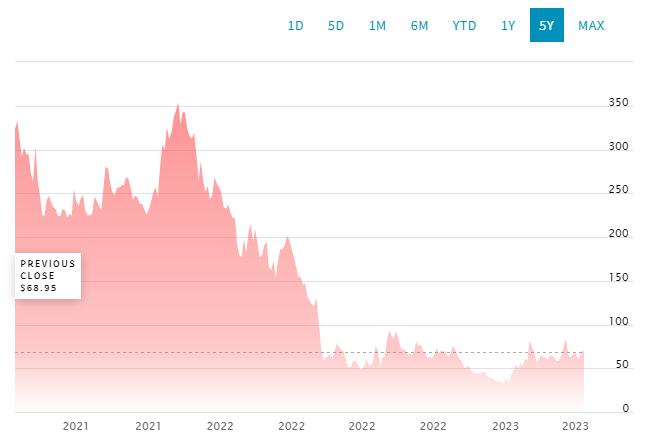

Looking at the price history is inevitable to be aware of the likely future performance. In this scenario, the cryptocurrency market trends have been influencing Coinbase financial performance. Bitcoin price movements have significantly contributed to this. Trading volumes on Coinbase have also been impacted by Ethereum price movements. Overall, Coinbase stock has been witnessing a continuous downfall for the last 4 years.

The stock price history of Coinbase stock brings to the front that, following the start of trading its stocks back in 2021, Coinbase witnessed a downfall in price. Consecutive price dips kept on lowering its value to a great extent. As a result of this, in June 2021, the price dropped to $220.66. Nonetheless, after that, the stocks began witnessing an uptrend. At the end of that month, the price regained the $254.90 mark. In the next couple of months, the price kept on fluctuating around the respective figure.

Then, at the start of September, the price reached the $265.90 mark. The respective price rally did not stop there and the Coinbase stocks further jumped to the high of $278.44 on the 3rd of the same month. The rest of the days in that month again saw a gradual price slump. Nonetheless, October 2021 proved to be a remarkable month in terms of price growth. At the denouement of that month, Coinbase stocks touched the $319.42 spot.

November 2021 beheld further increase in the prices and a figure of $357.39 was achieved by Coinbase stocks on the 9th. However, after that until the end of the year, they remained at around $250 with some fluctuations. The year 2022 started with a further decline in the prices of Coinbase stocks. The decline was sharp and dumped the price level to just $190.15 by the end of January 2022.

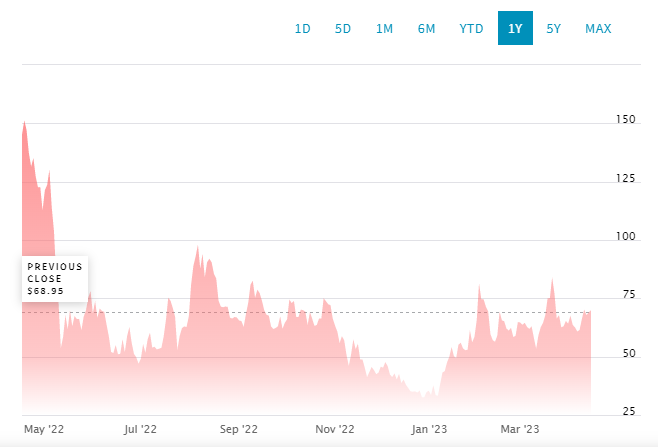

While moving forward, the stock prices continued to dip except for a few minor increases until June 2022. At the end of that month, Coinbase stocks stood at just $47.02. Despite some fluctuations, the year 2022 saw Coinbase stocks priced at nearly $35.39 at its end. Nonetheless, the current year has been slightly positive in this respect as – after some fluctuations – the stocks have reached the present price of $69.89.

Coinbase Stock Price Prediction: Price Analysis

The stock market analysis includes price analysis as its crucial part. This helps understand the overall stock market trends as well as the performance of the trading platforms. Along with this, considerable knowledge about the market sentiment, stock market volatility, as well as market liquidity is also gained in this way.

The fundamental analysis of Coinbase stock points out that the current price is $69.89. The trading volume of Coinbase stocks is $12,883,365. The market capitalization of Coinbase stocks stands at $18,309,429,000. Coinbase stocks have a recent 24-hour high of nearly $71.6985 and $67.87 is its low for the recent 24 hours.

The technical analysis has a significant portion called sentiment analysis which says that currently a bullish momentum is being witnessed by Coinbase stocks. The fear and greed index is placed at 39, indicating “Fear.” Moreover, the recent thirty days witnessed 14 days of positive price development, showing 47% of optimistic price movement. During the respective 30 days, the price volatility of the Coinbase stocks was almost 8.76%. The data analysis and visualization specify that a decrease of -54.8% has been witnessed by Coinbase stocks in the recent year.

Coinbase Stock Price Prediction

Price discovery mechanisms and the Artificial Intelligence (AI) and machine learning techniques for price prediction depend a lot on the price history and analysis. Coinbase’s business model has been effective in the raging competition in the cryptocurrency industry. Nevertheless, the economic indicators affecting Coinbase’s performance have made it challenging for the platform to make enormous performance.

Coinbase Stock Price Prediction 2023

The valuation metrics and financial forecasting signify that the position of the crypto industry will improve with time. Macroeconomic indicators are expected to become supportive of cryptocurrency adoption on a wide scale. Along with this, the regulations affecting Coinbase are also being taken into consideration by the platform. Keeping this in view, the Coinbase stock price will rise in the future. It is anticipated to reach the maximum price of nearly $122.62 during the current year.

Coinbase Stock Price Prediction 2025

In line with the recent positive development in the price of Coinbase stocks, the expectations for the coming years are promising. In this way, the platform has also been endeavoring to push the boundaries of the crypto sector. The broad-ranged adoption of cryptocurrency will be beneficial for Coinbase and the entire industry. If all goes according to the plan, the year 2025 will probably see a great upsurge in the value of Coinbase stocks. It is anticipated that $231.23 will be Coinbase stock’s likely maximum value.

Coinbase Price Prediction 2030

The next 5 years after 2025 will probably see a great trend of crypto adoption. The ever-increasing interest in this sector is expected to boost the stock prices of Coinbase. The platform will likely make some exclusive advancements with the launch of cutting-edge services and products. This will also be advantageous for the overall reputation of the platform. According to the price prediction, Coinbase stocks will surpass the price level of $1000 by 2030. The predicted price of Coinbase stocks for 2030 is $1181.38.

Conclusion

Despite the recently posed difficulties, Coinbase Global, Inc. has considerable potential to grow further in the future and the aforementioned statistics and analysis clarify it. There is a possibility that the ongoing improvements in the crypto sector may pave the way for more growth in the stock prices of Coinbase.

However, stock market volatility should be kept in mind. The investors should be prepared to carry out adequate risk management before making any investment-related decision. By doing proper research in line with the financial needs thereof, they should have a clear idea about the market before moving toward investment. Furthermore, they should also follow suitable investment strategies while remaining up to date by keeping an eye on the latest news.

FAQ

What is Coinbase Global Inc?

Coinbase Global Inc is a financial technology platform that offers end-to-end financial technology and infrastructure for the crypto economy. It provides financial accounts to clients, a marketplace for crypto transactions, and services to developers for developing crypto-based applications and accepting payments in crypto assets.

When did Coinbase go public?

Coinbase went public on April 14, 2021, through an initial public offering (IPO).

How has Coinbase’s stock price performed since its IPO?

Coinbase’s stock price has experienced significant fluctuations since its IPO, with its current price around $69.89, which is a decline from its IPO value of nearly $381.

What was Coinbase’s defining moment in 2022?

Coinbase’s defining moment in 2022 was the announcement of a collaboration with BlackRock, the largest asset management platform. Coinbase agreed to allow BlackRock’s institutional investors access to crypto trading services.

How is Coinbase diversifying its revenue streams?

Coinbase is diversifying its revenue streams by exploring various sources like staking of cryptocurrency, which now accounts for 10% of its total revenue, subscription charges, and revenue sharing with Circle, a Boston-based payment company that issues USD Coin.

What is the Coinbase stock price prediction for 2023?

According to the valuation metrics and financial forecasting, the maximum price for Coinbase stock is anticipated to reach nearly $122.62 in 2023.

What is the Coinbase stock price prediction for 2025?

Based on recent positive developments and industry growth, Coinbase’s stock price is expected to reach a maximum value of $231.23 in 2025.

What is the Coinbase stock price prediction for 2030?

With the increasing trend of crypto adoption, cutting-edge services, and product offerings, the predicted price of Coinbase stocks for 2030 is $1181.38.

READ MORE:

Baby Doge Coin (BABYDOGE) Price Prediction

Lucid Stock Price Prediction 2025: Can LCID Stock Recover Amid Bearish Sentiment?

EverGrow Coin Price Prediction: Will EGC Skyrocket to $1 Soon?

MANA Price Prediction $100 In 2022-2030: Will Decentraland Rise to $100?

Rivian Stock Price Prediction 2025 & 2030: What Lies Ahead for RIVN Stock Price?