- 1. Costco: A Quick Introduction

- 2. Costco: Business Expansion

- 3. Costco Share: Price History

- 4. Costco Share Price: Technical Analysis

- 5. Costco Share Price Prediction By Blockchain Reporter

- 5.1. Costco Share Price Prediction 2023

- 5.2. Costco Share Price Prediction 2024

- 5.3. Costco Share Price Prediction 2025

- 5.4. Costco Share Price Prediction 2026

- 5.5. Costco Share Price Prediction 2027

- 5.6. Costco Share Price Prediction 2028

- 5.7. Costco Share Price Prediction 2029

- 5.8. Costco Share Price Prediction 2030

- 6. Costco Share Price: Industry Experts

- 7. Costco Is Set To Report Quarterly Financial Results

- 8. Should You Get a Costco or Sam's Club Membership for Gas?

- 9. Conclusion

- Costco: A Quick Introduction

- Costco: Business Expansion

- Membership And Perks

- Costco Share: Price History

- Costco Share Price: Technical Analysis

- Costco Share Price Prediction By Blockchain Reporter

- Costco Share Price Prediction 2023

- Costco Share Price Prediction 2024

- Costco Share Price Prediction 2025

- Costco Share Price Prediction 2026

- Costco Share Price Prediction 2027

- Costco Share Price Prediction 2028

- Costco Share Price Prediction 2029

- Costco Share Price Prediction 2030

- Costco Share Price: Industry Experts

- Costco Is Set To Report Quarterly Financial Results

- Should You Get a Costco or Sam’s Club Membership for Gas?

- Conclusion

In the US retail market, one name consistently stands out: Costco. Known for its vast warehouses and bulk-buy deals, this retail giant has positioned itself in the hearts and wallets of consumers worldwide. But as we go through the bearish economic landscape of recent times, marked by soaring inflation rates and unpredictable market fluctuations, there’s one aspect of Costco that’s drawing attention more than ever: its gas stations. Amidst the backdrop of rising fuel prices, Costco’s gas offering has emerged as a messiah for budget-conscious drivers. The question on everyone’s mind is, will the allure of cheap Costco gas drive the company’s share price even higher?

The global economy is currently struggling with inflation, a phenomenon where the general price level of goods and services rises, eroding purchasing power. For the average consumer, this means that everyday essentials, from groceries to gasoline, are becoming more expensive. In such trying times, any opportunity to save money is not just welcome but essential. Costco’s gas stations have become a haven for those looking to fill up their tanks without emptying their wallets. Offering fuel prices that often undercut competitors by a significant margin, Costco gas stations have seen a surge in demand.

But how does this relate to the company’s share price? As any investor knows, the stock market is influenced by different factors, from global events to company-specific news. In the case of Costco, the company’s ability to offer cheap gas, even amidst rising wholesale prices, showcases its robust business model and purchasing power. In this article, we’ll explore Costco share price, its future market trajectory with in-depth technical analysis and Costco gas price.

Costco: A Quick Introduction

Costco Wholesale Corporation, often simply referred to as Costco, is a U.S.-based global corporation that runs a series of members-only large retail outlets known as warehouse clubs. By 2022, it stood as the world’s fifth-largest retailer and in 2016, it held the title of the largest global retailer for select items, including choice and prime beef, organic foods, rotisserie chicken, and wine. In terms of revenue, Costco holds the 11th spot on the Fortune 500 list of the largest U.S. corporations.

Located in Issaquah, Washington, a suburb to the east of Seattle, Costco’s global headquarters may be a bit misleading to some, given that its in-house brand, Kirkland Signature, is named after its previous location in Kirkland. The first-ever Costco warehouse began its operations in Seattle in 1983. However, tracing back through mergers, the roots of Costco’s corporate journey can be found in 1976 with the establishment of its then-rival, Price Club, in San Diego, California.

As of July 2023, Costco’s global presence is undeniable, with 858 warehouses spread across the globe. This includes 590 in the U.S., 107 in Canada, 40 in Mexico, 32 in Japan, 29 in the UK, 18 in Korea, 15 in Australia, 14 in Taiwan, four each in Spain and China, two in France, and a single warehouse in countries like Iceland, New Zealand, and Sweden.

Costco: Business Expansion

Price Club, the precursor to Costco, was established in San Diego in 1976 by Sol and Robert Price. This pioneering retail warehouse club targeted small businesses, offering bulk items at discounted rates. By 1986, it had expanded to 24 locations and ventured internationally, opening stores in Montreal and Mexico City.

In 1983, Jim Sinegal and Jeffrey H. Brotman introduced the first Costco warehouse in Seattle. A decade later, in 1993, Costco and Price Club merged to form PriceCostco, streamlining their memberships. By 1997, all outlets were rebranded as Costco.

Costco’s growth trajectory has been impressive. By 2014, it was the third-largest retailer in the U.S., and it expanded to China in 2019 and New Zealand in 2022. As of 2023, Costco boasts 124.7 million members worldwide, reflecting its global retail dominance.

Membership And Perks

Costco has two main membership categories: Gold Star and Executive. Gold Star, priced at $60 annually, grants access to all Costco stores with two membership cards. The Executive tier, at $120 annually, offers a 2% cash-back reward on Costco purchases and additional discounts on services.

For businesses, Costco has the Business and Business Executive memberships. The former, at $60, allows purchase for resale, while the latter, at $120, includes a 2% cash-back reward and other Executive benefits.

Members enjoy a range of services, from gas and pharmacies to car rentals. Business members have access to third-party services like payment processing and bottled water delivery.

Costco’s co-branded credit card with Citi offers cash back on fuel, dining, travel, and other purchases. Unlike Sam’s Club, which has more brand-name items, Costco emphasizes its Kirkland brand, often cheaper yet made by renowned companies. Additionally, Costco typically offers a broader organic produce selection than Sam’s Club.

Costco Share: Price History

Costco’s story began in 1983 with its first warehouse in Seattle. But it wasn’t until 1985 that the company went public. Those initial shares, priced at a modest $4.3, were a glimpse into the potential the company held. Early investors who recognized this potential and took the plunge have been handsomely rewarded. The Costco stock price continued to hover below the $15 mark for several years.

The 1993 merger with Price Club led to the formation of PriceCostco. This merger was a significant milestone, not just in terms of business operations but also for its impact on the stock price. By the end of the 90s, the shares had climbed to an impressive $45.

The early 2000s saw a global shift towards e-commerce and digital retail. While many traditional retailers struggled to adapt, Costco seamlessly integrated online shopping into its model. The Costco stock price surged to the North and reached a high of $67 by the end of 2008. However, due to the global economic downturn, Costco’s price witnessed a heavy selloff among investors, and its price reached the bottom of $38 in early 2009. However, the introduction and expansion of its private label, Kirkland Signature, in the mid-2000s played a pivotal role in boosting Costco’s stock price.

Costco’s price again saw robust buying activity, and by 2015, with the success of Kirkland products, the share price touched $150. Since then, Costco’s price has continued to surge, and it broke above multiple resistance levels, making new highs every month. By 2020, the stock price reached $381, but it failed to continue its upward momentum further as the COVID-19 pandemic plunged the retail market, resulting in a steep drop toward $328 for Costco’s share price.

Despite global challenges like the economic downturn of 2008 and the COVID-19 pandemic, Costco’s stock showed a solid bullish comeback. By 2021, the share price had soared to a remarkable $500, reflecting the company’s robust business model and adaptability.

As of now, Costco’s share price is witnessing minor fluctuations; however, it has successfully maintained its momentum above $550.

Costco Share Price: Technical Analysis

Recently, the Costco share price experienced a solid bearish trend, which has brought more sellers near the immediate resistance levels. The price has been on a steady upward trajectory over the last few weeks. After breaking above the $552-mark, Costco shares sparked an intense buying momentum and surged exponentially. The stock market was previously heavily influenced by rising inflation and the COVID-19 pandemic; however, Costco showed a strong recovery, as seen on the daily price chart, and maintained its price momentum. Despite facing intense bearish pressure in the past, Costco’s share has managed to hold an uptrend and is now well above the bearish territory. A thorough technical analysis of Costco’s share price reveals bullish indicators, which may soon send the price to new resistance levels.

According to TradingView, the Costco share price is currently trading at $558, reflecting an increase of 0.01% in the last 24 hours. Our technical evaluation of Costco’s price indicates that the current bullish momentum may soon fade as bears are attempting to reverse the trend from the upcoming resistance at $570; however, bulls are trying to prevent the price from dropping below the breakout level of $552. Examining the daily price chart, Costco’s share price has found support near the $525 level, from which the price gained bullish momentum and broke above multiple Fib channels. As Costco’s price continues to trade above the EMA20, bulls are gaining confidence to open further long positions and send the stock price to test its upcoming resistance. The Balance of Power (BoP) indicator is currently trading in a negative region zone at 0.13 as sellers are increasing their domination on the price chart.

To thoroughly analyze the price of Costco shares, it is crucial to take a look at the RSI-14 indicator. The RSI indicator recently experienced a decline as Costco’s price failed to hold buyers’ demand. The trend line is currently hovering below the midline as it trades at level 48, hinting that further downward correction is on the horizon. It is anticipated that Costco’s share will soon attempt to break above its 23.6% Fibonacci level to achieve its short-term bullish goals of around $570. If bears fail to plunge below the current 0.038 Fibonacci region, a skyrocketing trend might be on the horizon.

As the SMA-14 continues its downward swing by trading at 48, it trades with the RSI line, potentially holding concerns about the stock’s downward movement on the price chart. If Costco’s shares make a bullish reversal, it can pave the way to resistance at $570. A breakout above will drive the share price toward the upper limit of the Bollinger band at $586.

Conversely, if Costco fails to hold above the critical support level of EMA100, a sudden collapse may occur, resulting in further price declines and causing the Costco shares to trade near the Bollinger Band’s lower limit of $540. If the price fails to continue a trade above, it may trigger a more significant bearish downtrend to $530.

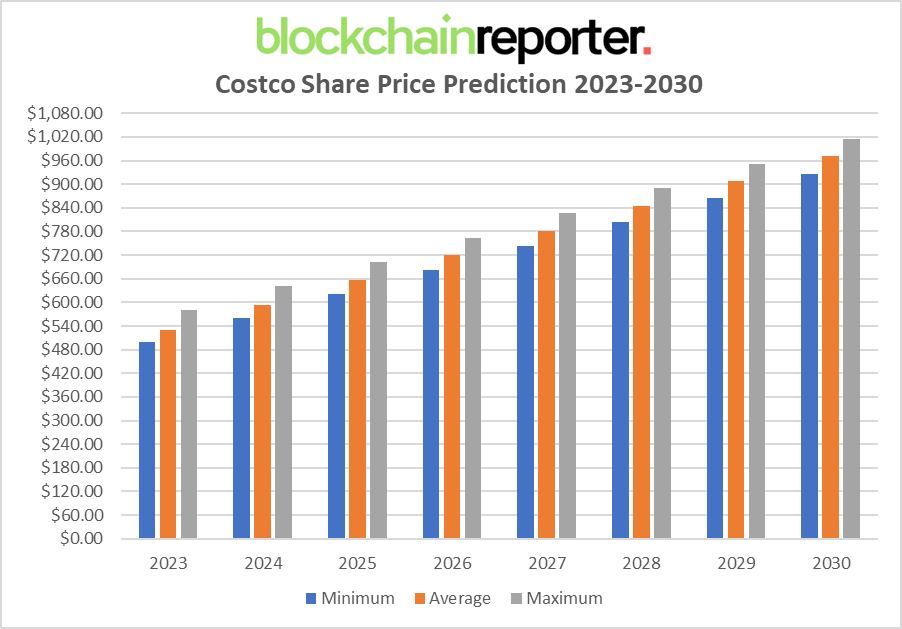

Costco Share Price Prediction By Blockchain Reporter

Costco Share Price Prediction 2023

In 2023, Costco’s share price is projected to maintain an average of around $530. The minimum price is expected to hover around $500, while the maximum could reach up to $580. These estimates are based on Costco’s consistent growth trajectory, its expansion into new markets, and the success of its private label, Kirkland Signature.

Costco Share Price Prediction 2024

Moving into 2024, Costco’s share price is anticipated to experience a positive shift, averaging at about $593. The potential low for this year could be around $561, while the upper limit might touch $641. This forecast is based on the assumption that Costco’s strategic initiatives, such as its e-commerce integration and international expansions, will continue to bear fruit and attract more investors.

Costco Share Price Prediction 2025

By 2025, predictions suggest that Costco’s share price will average around $656, with a minimum of $622 and a potential high of $702. The company’s focus on sustainability, digital transformation, and customer-centric initiatives are expected to drive this upward trend.

Costco Share Price Prediction 2026

In 2026, the share price for Costco is projected to have an average of $719, a minimum of $683, and a maximum of $763. The continued growth in membership and potential technological innovations in the retail space is anticipated to accelerate these figures.

Costco Share Price Prediction 2027

In 2027, Costco’s shares are expected to average around $782, with a potential low of $744 and a high of $826. The company’s potential ventures into new business areas and markets, along with its robust supply chain management, are likely to be significant contributors in 2027.

Costco Share Price Prediction 2028

By 2028, the share price for Costco is predicted to hover around an average of $845, with a minimum of $805 and a maximum of $889.

Costco Share Price Prediction 2029

In 2029, projections indicate that Costco’s share price will maintain an average of $908, with lows around $866 and potential highs reaching $952. The company’s strategic partnerships, global expansions, and acquisitions might play a pivotal role in this growth.

Costco Share Price Prediction 2030

Rounding off the decade in 2030, Costco’s share price is anticipated to average around $971, with a minimum of $927 and a maximum soaring up to $1,015. The company’s business model in navigating global challenges and its continuous innovation in the retail space is expected to be key drivers behind these figures.

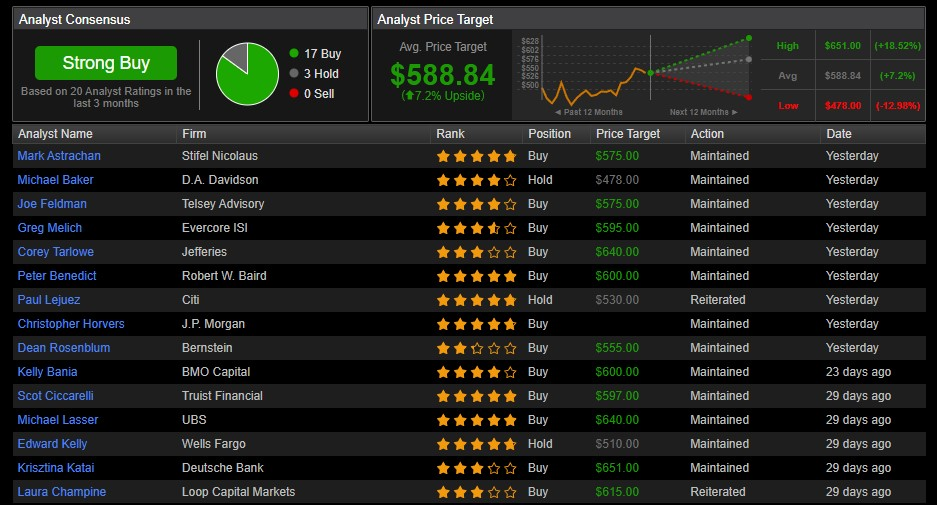

Costco Share Price: Industry Experts

Analysts on TipRanks have shown significant optimism towards the stock, with 17 of the 20 analysts recommending a ‘Buy’ rating in the recent quarter.

The consensus target price over the next year stands at $588, marking a 7% increase from its current trading price of $549. Notably, experts from institutions like Deutsche Bank, Jefferies, and Loop Capital Markets anticipate the stock to surpass the $600 mark.

Following Costco’s announcement of its August sales on August 30, nine analysts reaffirmed their ‘Buy’ or ‘Hold’ ratings on the stock the next day. The company posted net sales of $18.42 billion, marking a 5% growth compared to the same month the previous year. This performance solidified the bullish perspective of many analysts.

Yet, some investors might be wary due to insider trading activities. Since January, six top executives have offloaded Costco shares amounting to $8.8 million, with none making any purchases.

Costco Is Set To Report Quarterly Financial Results

Last quarter, Costco’s (COST) affordable gas prices likely appealed to consumers feeling the pinch of inflation.

The retail behemoth is scheduled to unveil its quarterly figures on Tuesday post-market, shedding light on consumer spending patterns amidst challenges like rising gas costs, student loan repayments, and increased interest rates affecting the average American’s budget.

For the fourth quarter, analysts predict an adjusted earnings per share of $4.76 and revenue nearing $77.6 billion, according to Bloomberg data. A 1.87% increase in same-store sales is also anticipated.

The surge in gas prices during the summer made Costco’s competitively priced fuel a go-to for many. As of now, the average national gas price was $3.38 per gallon, as reported by AAA, marginally below the peak for 2023.

As people head to Costco for fuel, they often end up shopping in-store as well.

Data from Placer.ai revealed that visits to Costco saw an increase of 3% in August, 4.5% in July, and 3.6% in June compared to the previous year. In contrast, overall traffic to wholesale clubs and superstores declined by 1.9% in August and 0.4% in both June and July.

In a note dated Aug. 31, Evercore ISI analyst Greg Melich mentioned, “There’s a continued trend of disinflation in Food/Sundry, and the slight deflation in gas prices (a mere -2%) is noteworthy, especially considering the spike in August.” He further added that rising fuel prices could boost traffic and sales, emphasizing the strength of Costco’s loyalty model.

Should You Get a Costco or Sam’s Club Membership for Gas?

On average, GasBuddy analysis shows that Sam’s Club and Costco members save about $0.15 per gallon. Given that Americans purchase around 489 gallons of fuel yearly for each vehicle, as stated by the American Petroleum Institute, members could pocket an annual saving of roughly $73. If you own multiple vehicles or consume more fuel, the savings increase.

However, actual savings can fluctuate based on local gas prices and discounts. Still, these estimated savings can easily cover the basic membership fees of $50 for Sam’s Club or $60 for Costco, making it a financially savvy choice.

For those keen on amplifying their fuel savings, the Costco Anywhere Visa® Card by Citi offers 4% cash back on gas up to $7,000 annually, then 1% thereafter. Similarly, the Sam’s Club Mastercard provides 5% back on fuel up to $6,000, then 1% after.

In essence, both Sam’s Club and Costco memberships offer valuable gas savings. While the cheaper option might alternate between the two, both are solid choices for budget-friendly fuel.

Conclusion

Costco, a renowned warehouse retailer, is leading the retail landscape. Its business model primarily caters to consumers who prioritize savings by purchasing in large quantities. However, this bulk-buying approach poses challenges in the e-commerce market, as the logistics of delivering hefty items can be intricate.

Furthermore, while Costco offers cost-effective per-unit prices, the nature of bulk shopping means that customers often spend more in a single trip compared to visits to discount retailers like Walmart. This mode of shopping might not be suitable for everyone, especially those with limited storage facilities or tighter budgets. While Costco provides undeniable value, the bulk-buying model requires both space and a more substantial initial outlay, even if it promises savings in the long run.